Artificial intelligence is transforming business operations with breathtaking speed. But as innovation accelerates, so too does exploitation. In 2025, companies find themselves battling not just economic uncertainty but an AI arms race – where the same technology enhancing operations is also being weaponised against them.

Fraud is evolving. Gone are the days of obvious phishing emails and fake invoices with typos. Today, finance teams face hyper-realistic deepfake scams, voice clones, and generative AI tools that can convincingly mimic C-suite executives. According to new research from Signicat, deepfake-enabled fraud attempts have surged by an astounding 2,137% over the past three years – it’s no longer a niche concern – it’s a systemic crisis.

The scale of the threat is staggering. Deloitte estimates that generative AI could drive U.S. fraud losses to $40 billion by 2027. Meanwhile, our own Medius Financial Census 2024 paints an equally alarming picture: nearly half of finance teams (44%) have been targeted by invoice fraud, and 43% have fallen victim to business email compromise (BEC) scams. Deepfakes are no longer edge cases – 53% of finance professionals say their organisation has been targeted, and 43% admit they’ve fallen for an attack.

It’s not something I’m pleased to admit, but these deepfake attacks are becoming extremely sophisticated, and objectively good at misleading the majority of people.

The risk from within

The risk is amplified by internal vulnerabilities. More than half (57%) of financial professionals can approve payments without secondary approval. And 87% say they would comply if “called” by someone claiming to be the CFO or CEO – something now easily faked with AI voice cloning. These are not hypotheticals – they are access points for millions in potential losses.

Compounding the issue is employee burnout. Finance teams are overwhelmed and overstretched. The average team member spends six hours a week just responding to vendor emails, handling an average of 28 messages per day. It’s no wonder that 71% of UK and 58% of US finance professionals are actively job hunting, with 55% citing burnout as the reason.

The result? A distracted, disillusioned workforce – precisely what fraudsters count on. But the very technology being used against us can also be our best defence.

The solution

To counteract these rising threats, businesses must adopt a multifaceted approach to security. One essential defense is the implementation of multi-factor authentication (MFA). By requiring employees to confirm their identities through multiple channels – such as authentication apps or one-time codes – organisations can reduce the risk of unauthorised access to payment systems and sensitive data. In cases where a fraudster attempts to impersonate an executive, MFA introduces a verification step that can halt the deception in its tracks.

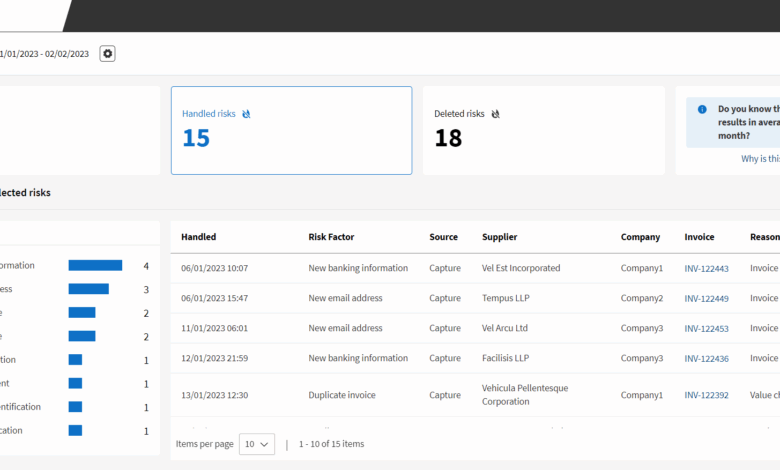

Equally important is the integration of Accounts Payable (AP) automation. Manual financial processes are not only inefficient but also leave businesses vulnerable to error and exploitation. By automating tasks like invoice approvals and vendor validations, companies distribute financial control across teams and reduce the likelihood of fraud slipping through unnoticed. Platforms like Medius have demonstrated how AI can enhance AP workflows by flagging anomalies, preventing duplicate payments, and identifying suspicious patterns in real time.

Training and awareness are also vital components of an effective anti-fraud strategy. As AI-generated scams grow increasingly convincing, even well-informed employees can be misled. Regular fraud awareness programmes, combined with simulated phishing exercises and AI literacy training, can significantly improve an organisation’s ability to detect and respond to threats early.

Looking beyond fraud detection

Beyond fraud detection, AI is also vital for retention and productivity. In our research, 94% of finance professionals were happy with AI adoption in their workflows. Automation frees them from monotonous tasks and allows them to focus on strategic, value-added work. In fact, 54% of those who’ve adopted automation say they now have more time to innovate, meaning these are not abstract benefits, they’re a direct path to both fraud prevention and employee satisfaction.

Yet, the challenge is cultural as much as technical. Research shows that 56% of finance professionals have suspected internal fraud, but four out of five stayed silent, often due to fear of retaliation. If we are to combat white-collar crime effectively, we must empower employees not just with tools but with confidence. AI can help here, too, offering the data and traceability that build a solid case for whistleblowing and compliance.

Let’s be clear: The future of finance will be autonomous. With AI handling routine tasks and detecting risks in real time, finance professionals can focus on steering the business – not patching holes in outdated systems. Our goal is to replace anxiety with assurance, giving teams full visibility over what’s paid, what’s pending, and what needs attention – so finance can lead from the front, not fight from the shadows.

The fraudsters are innovating. It’s time we do the same – and at an even faster pace.