Drift isn’t randomness. It’s regulatory risk. Deterministic frameworks like Decision Physics prove that AI can be made auditable, reproducible, and safe for finance.

The Compliance Blind Spot in AI

Imagine submitting the same loan application twice and receiving two different outcomes. For a consumer it is confusing. For a bank it is a compliance breach.

This is the blind spot in how most artificial intelligence operates. Modern AI systems use probabilistic models that depend on random sampling. The same input can produce different outputs because the model is exploring a space of possibilities rather than executing a fixed decision path.

In creative settings this unpredictability feels novel. In financial environments it is an operational hazard. Regulation is written on the premise of determinism: the idea that identical data should always yield identical results. That principle anchors how we audit, explain, and assign responsibility.

When a probabilistic system breaks that link, accountability collapses. No regulator can approve a system that cannot explain itself twice in the same way.

The Thirty Percent Problem

Across testing environments we observed that probabilistic drift accounts for roughly thirty per cent inefficiency in applied models. That means one in three outputs is inconsistent with its own logic.

The cost is not limited to technical performance. It becomes a matter of market confidence. When credit scoring or risk assessment models produce variable decisions, entire portfolios can shift in value. A mispriced decision at scale becomes a systemic threat.

In financial markets the smallest variance compounds. Over time it translates into trillions in misallocated capital and unquantified exposure.

The Regulatory Gap

Financial regulation assumes systems behave predictably. The Basel III framework, the Financial Conduct Authority’s AI guidance, and GDPR transparency requirements all rely on the same core principle: a decision must be explainable and repeatable.

Probabilistic AI breaks that assumption. Its architecture is designed for probability distributions, not for proof. Even the most advanced compliance tools cannot audit stochastic systems with complete accuracy.

Regulators face a paradox. They require documentation that demonstrates reproducibility, yet the underlying model changes with every inference. A system that cannot reproduce its own reasoning cannot satisfy the principle of fairness or equality before the law.

The result is a widening gap between what regulators assume and what AI systems can deliver.

Introducing Decision Physics

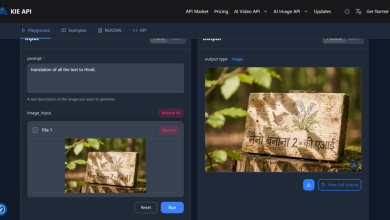

Decision Physics was built to close that gap. It is a deterministic framework that converts decisions into measurable, auditable processes.

In a deterministic model, the same input always produces the same output. There is no random sampling, only precise computation. When tested across one thousand identical queries, Decision Physics produced one thousand identical results. Each result generated a lineage receipt showing the exact reasoning path, data source, and outcome.

This approach transforms AI from a probability engine into a verified function. Every decision can be traced, audited, and reconstructed without approximation. It brings scientific repeatability back into computation.

Practical Applications

For regulators and financial institutions, determinism restores what has been lost: trust through evidence.

When a risk model operates deterministically, an auditor can verify that identical data produces identical reports. Model lineage becomes transparent, enabling traceable validation of every calculation.

Operational risk decreases because decisions no longer drift with server updates, sampling randomness, or contextual noise. Firms can demonstrate compliance without the need to re-run thousands of unpredictable simulations.

For institutions governed by strict reporting standards, deterministic AI simplifies oversight. It produces systems that are not only intelligent but accountable.

The Broader Economic Impact

When decision systems stabilise, markets stabilise. Predictability in models translates into confidence in valuations and pricing.

In probabilistic environments, investors price uncertainty into every interaction. They hedge against variance and model error. Deterministic AI removes that hidden cost. It transforms perception from risk to reliability.

The wider impact reaches beyond compliance. It extends to every domain where reproducibility underpins value — from insurance to logistics, from healthcare diagnostics to climate modelling. When outcomes can be verified, capital flows more freely and trust compounds.

The Financial Times recently described reproducibility as the new gold standard for algorithmic accountability. It is also becoming the foundation for economic resilience.

The Age of Drift Is Ending

Probabilistic AI will always have a role in exploration, design, and creative synthesis. But in domains where consistency defines legality, it is a liability.

Deterministic frameworks like Decision Physics represent a shift from stochastic guesswork to computational certainty. They show that intelligence can be both creative and compliant.

As regulators tighten their expectations, enterprises will have to choose between systems that imagine and systems that prove. The future of trustworthy AI will not be decided by the volume of data, but by the precision of logic.

The next era of artificial intelligence will not be about more models or larger datasets. It will be about less uncertainty.

Byline

Martin Lucas is Chief Innovation Officer at Gap in the Matrix OS and TheaHQ. He leads the development of Decision Physics, a deterministic AI framework proven to eliminate probabilistic drift. His work combines behavioural science, mathematics, and computational design to build emotionally intelligent, reproducible systems trusted by enterprise and government worldwide.