The rise of AI-driven workloads is reshaping the digital infrastructure landscape, and data center investors and developers can no longer rely on past assumptions about demand, growth, and risk. While the emergence of lighter AI models like DeepSeek could make AI more efficient, it doesn’t mean data center growth will slow. Instead, it adds new layers of uncertainty. The challenge for investors is twofold: understanding how AI-driven demand shifts will play out and ensuring that data center infrastructure is ready for AI’s increasing power and cooling requirements.

Growth will be unpredictable

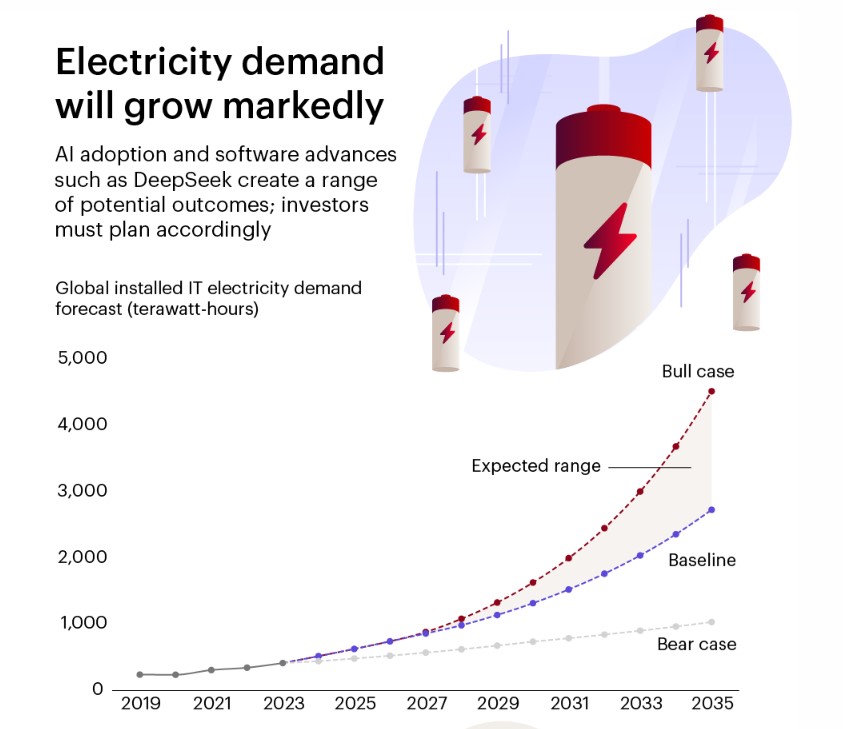

For the past five years, data center development has followed a steady, predictable demand trajectory, driven by traditional enterprise and cloud computing growth. But the AI boom is introducing a new level of volatility. The early-stage nature of generative AI means demand projections vary widely, with estimates ranging from 10% to 20%+ CAGR through 2024–2030.

Several factors contribute to this uncertainty. First, AI adoption rates will depend on enterprise readiness, regulatory considerations, and the pace of AI model evolution. Second, infrastructure bottlenecks—such as power availability and supply chain constraints for GPUs—could slow deployment.

Lastly, different AI applications (training vs. inference) have vastly different infrastructure needs, making it harder to forecast demand patterns. For investors, this means agility is key. Fixed strategies based on historical growth rates won’t hold up in this evolving landscape.

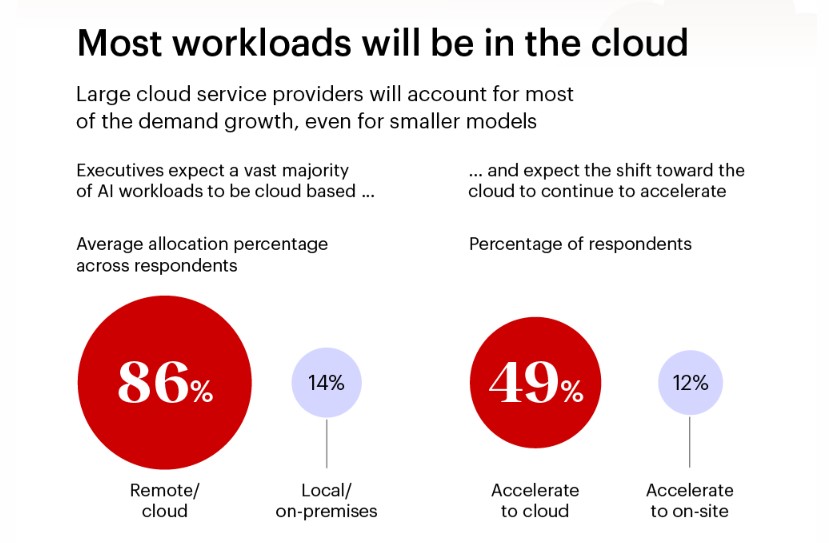

Demand will be concentrated among hyperscalers

AI workloads are increasingly consolidating in the public cloud, creating a winner-takes-most dynamic for data center demand. Approximately 85% of generative AI workloads are expected to run in cloud environments, and public cloud demand is projected to grow 1.5 to 2 times faster than private cloud.

This trend has major implications for data center investment:

- Hyperscalers will dominate new demand. A small group of cloud giants will account for the bulk of AI-driven growth, concentrating market power in their hands.

- Build-to-suit developers will be the biggest winners. Developers that can meet hyperscalers’ specialized requirements—especially for high-density, AI-ready infrastructure—will see the most upside.

- Retail colocation will capture a much smaller share of AI-driven growth. Traditional colocation providers, which serve a broader mix of enterprise customers, are less positioned to benefit from AI’s infrastructure shift. Investors should be wary of overexposure to these players.

Retrofits won’t be enough for AI training demand

While some older data centers may be able to support AI inference workloads, AI training requires entirely different infrastructure—and retrofitting may not be a viable solution. The primary constraints include:

- Power and cooling: Many existing facilities lack the space or infrastructure to support upgraded power distribution and liquid cooling, both of which are critical for AI training.

- Structural capacity: AI workloads push rack power from 10 to 15 kW to more than 100 kW. Some older data centers simply weren’t built to handle this kind of floor plate weight and power density.

- Networking: Large GPU clusters require substantial networking reconfiguration to enable high-speed, low-latency connections.

- Power availability: The power requirements for AI workloads are on an entirely different scale. Large AI data centers are moving from 20 to 50 megawatts per facility to 100 to 200 megawatts or more —a jump that many existing locations can’t accommodate.

For investors, this means that not all brownfield opportunities are worth pursuing. Retrofits should only be considered if there’s clear, tenant-driven demand and/or a realistic path to meeting AI infrastructure needs.

Strategic implications for digital infrastructure investors

Given these shifts, investors need to rethink their strategies to align with the new AI-driven landscape. Key considerations include:

- Build flexibility into new projects. Given the uncertainty of AI growth, investors should design projects with the ability to pause or delay construction if demand slows, or to support a range of general compute, AI training & inference workloads. This minimizes the risk of stranded assets.

- Prioritize build-to-suit developers. Developers that cater to hyperscalers and large wholesale colocation operators—especially those offering value-added services like AI workload migration support and managed services—will be best positioned for long-term growth.

- Reduce exposure to retail colocation providers. Traditional colocation operators that lack AI-ready infrastructure will struggle to capture meaningful AI-driven demand. Investors should carefully evaluate their exposure to these assets.

- Retrofit with caution. Brownfield projects should only move forward where there is clear tenant demand and a viable path to supporting AI’s unique infrastructure needs. Otherwise, these investments could become obsolete before they generate returns.

The AI datacenter boom presents immense opportunities—but also significant risks. Investors and developers who rethink their approach now—focusing on flexibility, scalability, and AI-specific requirements—will be best positioned to thrive. The key to success will be staying ahead of demand shifts, aligning with hyperscaler-driven growth, and ensuring that infrastructure can meet AI’s evolving needs.