The fintech industry is evolving at an unprecedented pace. As the lines between finance and technology continue to blur, a new trio of transformative forces—Web3, SaaS (Software as a Service), and AI (Artificial Intelligence)—is reshaping how fintech businesses operate and how professionals work. More than just disruptive technologies, these forces are converging to redefine the structure of the global workforce itself.

This convergence is giving rise to a borderless, digital-first fintech labor market, where traditional employment models are being replaced by decentralized collaboration, intelligent automation, and agile, cloud-based systems. From global startups to established financial institutions, the future of work in fintech is increasingly remote, skill-driven, and location-agnostic.

Web3: Redefining Work Through Decentralization

At its core, Web3 promotes a decentralized internet architecture—one where control and value shift away from centralized authorities and toward individuals and communities. This shift is not only transforming financial systems (think decentralized finance or DeFi) but also redefining how people contribute to and get compensated for work.

In the Web3 ecosystem, talent no longer needs to rely on traditional employment structures. Many professionals now engage in project-based, permissionless work, often facilitated by DAOs (Decentralized Autonomous Organizations). These entities enable contributors from around the world to propose, execute, and get paid for work without signing contracts or even meeting in person.

Moreover, payment infrastructure powered by blockchain enables instant, low-cost global transactions. Workers are increasingly choosing to be paid in cryptocurrencies and stablecoins, further reducing reliance on banks or national currencies.

For those looking to enter this dynamic and fast-growing space, the number of opportunities in web3 jobs is rapidly increasing, spanning technical, creative, and operational roles across the globe.

SaaS: Streamlining Collaboration and Scalability

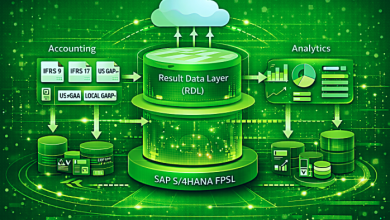

SaaS has become the operational backbone of modern fintech. These tools provide cloud-native infrastructure that supports everything from product development and customer service to compliance and payments. For fintech companies aiming to scale rapidly without a large physical footprint, SaaS is a game-changer.

SaaS empowers a globally distributed workforce in several key ways:

- Remote Collaboration: Tools like Zoom, Slack, Notion, and Trello make asynchronous work seamless, even across time zones.

- API-Driven Finance: SaaS platforms such as Stripe, Plaid, and Brex provide plug-and-play financial services that reduce the need for in-house development.

- Cost Efficiency: With subscription-based models, companies avoid large upfront costs while accessing continuously updated tools and services.

This shift has lowered the barriers to entry for fintech startups, allowing lean teams from anywhere to launch and compete on a global stage.

AI: Empowering the Fintech Workforce with Intelligence

AI is no longer just a buzzword—it’s a critical enabler of speed, accuracy, and personalization in financial services. Whether it’s underwriting loans, detecting fraud, or offering real-time investment advice, AI is deeply embedded in the modern fintech stack.

Beyond automation, AI is also reshaping roles by augmenting human decision-making. Rather than replacing jobs outright, AI tools often serve as copilots—helping professionals become more productive, strategic, and responsive.

For example, customer support agents now work alongside AI-powered chatbots that handle routine inquiries, freeing up time for complex problem-solving. Risk analysts use machine learning models to scan thousands of transactions for anomalies in seconds. Product teams leverage AI-driven A/B testing to refine user experiences more efficiently.

As generative AI tools mature, they’re also being adopted for everything from marketing content to smart contract generation—further expanding the range of skills required in fintech.

Emerging Roles and Skills at the Intersection

The convergence of Web3, SaaS, and AI is giving rise to new job titles and reshaping existing ones. Professionals who were once confined to niche specializations are now expected to operate across domains, blending financial acumen with tech fluency.

Some emerging and in-demand roles include:

- Smart Contract Developers: Engineers who build and audit decentralized applications on blockchain networks.

- Fintech Product Managers: Professionals who bridge user experience, regulatory compliance, and API integration.

- AI Risk & Compliance Analysts: Experts who monitor AI systems for bias, ethical risk, and regulatory adherence.

- Token Economists: Specialists who design and model crypto-incentive systems for sustainable growth.

The most successful professionals will be those who continuously learn—investing in upskilling and staying adaptable in a fast-changing environment.

The Rise of the Borderless Fintech Organization

With these technologies in place, fintech companies are embracing new models of employment and collaboration. Traditional, centralized offices are being replaced by distributed teams and digital-native cultures. Hiring practices have shifted to prioritize skills over location, and companies are increasingly compensating workers in crypto or offering token-based incentives.

This borderless model brings notable benefits:

- Global Talent Access: Companies are no longer limited to local candidates and can source the best talent worldwide.

- Diversity and Inclusion: A distributed workforce encourages more cultural, gender, and socio-economic diversity.

- Lower Operational Costs: No need for physical offices or relocation packages reduces overhead significantly.

- 24/7 Productivity: With teams across time zones, work can continue around the clock.

Challenges and Considerations

Despite its promise, the borderless fintech workforce faces a range of challenges:

- Regulatory Uncertainty: Governments are still defining their stance on decentralized work, crypto compensation, and remote tax implications.

- Security Risks: Distributed systems and remote devices increase the attack surface for cyber threats.

- Cultural Cohesion: Maintaining team culture and communication across borders and languages requires intentional effort and digital leadership.

- Legal Complexity: Hiring internationally may involve navigating varied labor laws, tax regimes, and compliance requirements.

Organizations that proactively address these issues will be best positioned to harness the full power of this evolving workforce.

Conclusion: The Future Is Decentralized, Intelligent, and Scalable

The fusion of Web3, SaaS, and AI is more than a trend—it’s a tectonic shift in how fintech companies build products, serve customers, and hire talent. The traditional boundaries of location, contracts, and legacy systems are dissolving, giving way to a world where work is truly global, flexible, and driven by innovation.

For professionals, this means unprecedented freedom to work on cutting-edge products, often with greater autonomy and compensation flexibility. For fintech companies, it opens the door to a more agile, diverse, and resilient workforce.

As this future unfolds, those who understand and embrace these converging technologies will be poised not just to participate—but to lead.