I came down from my home office to hear our family’s nanny, “Trina,” on the phone in distress. “I think I’ve been scammed online,” Trina told me. “What should I do?”

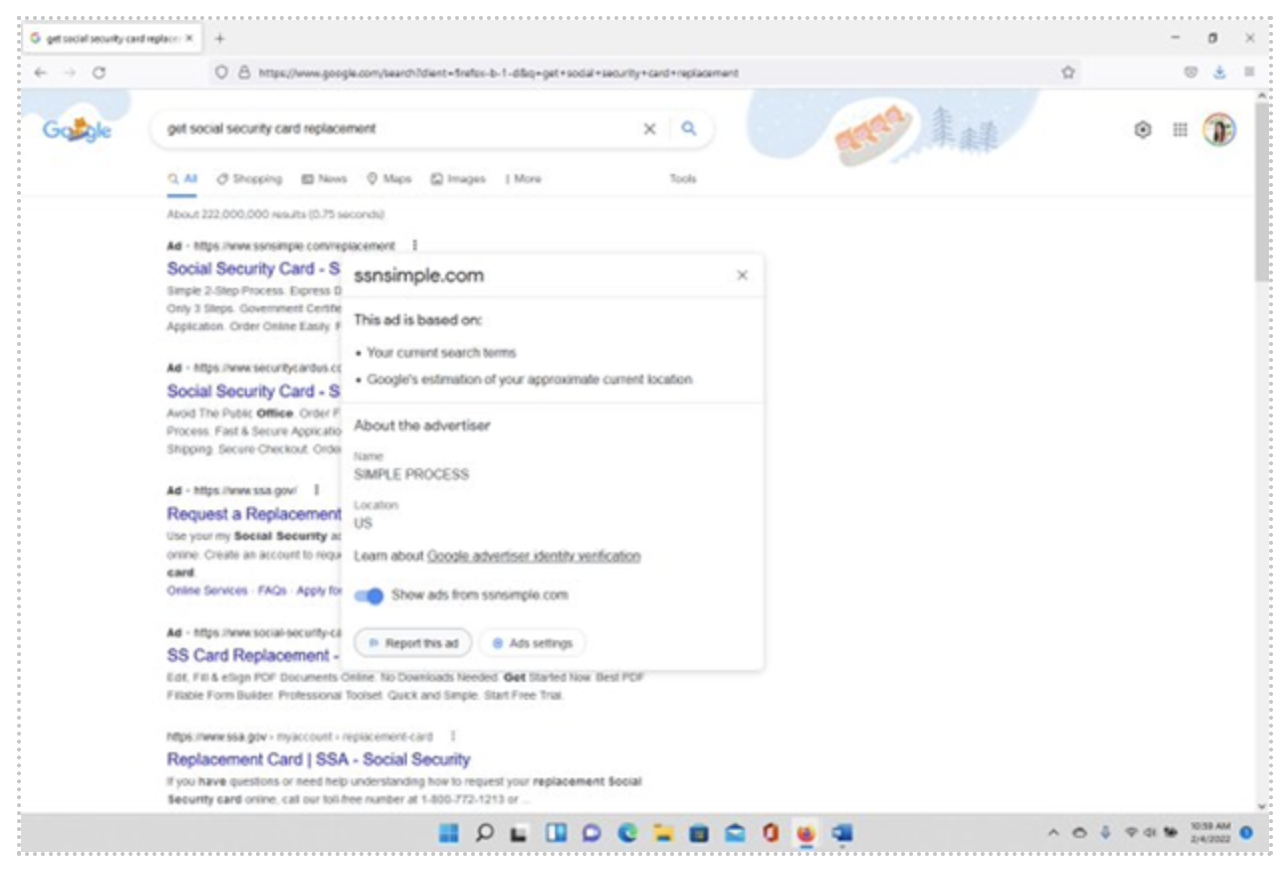

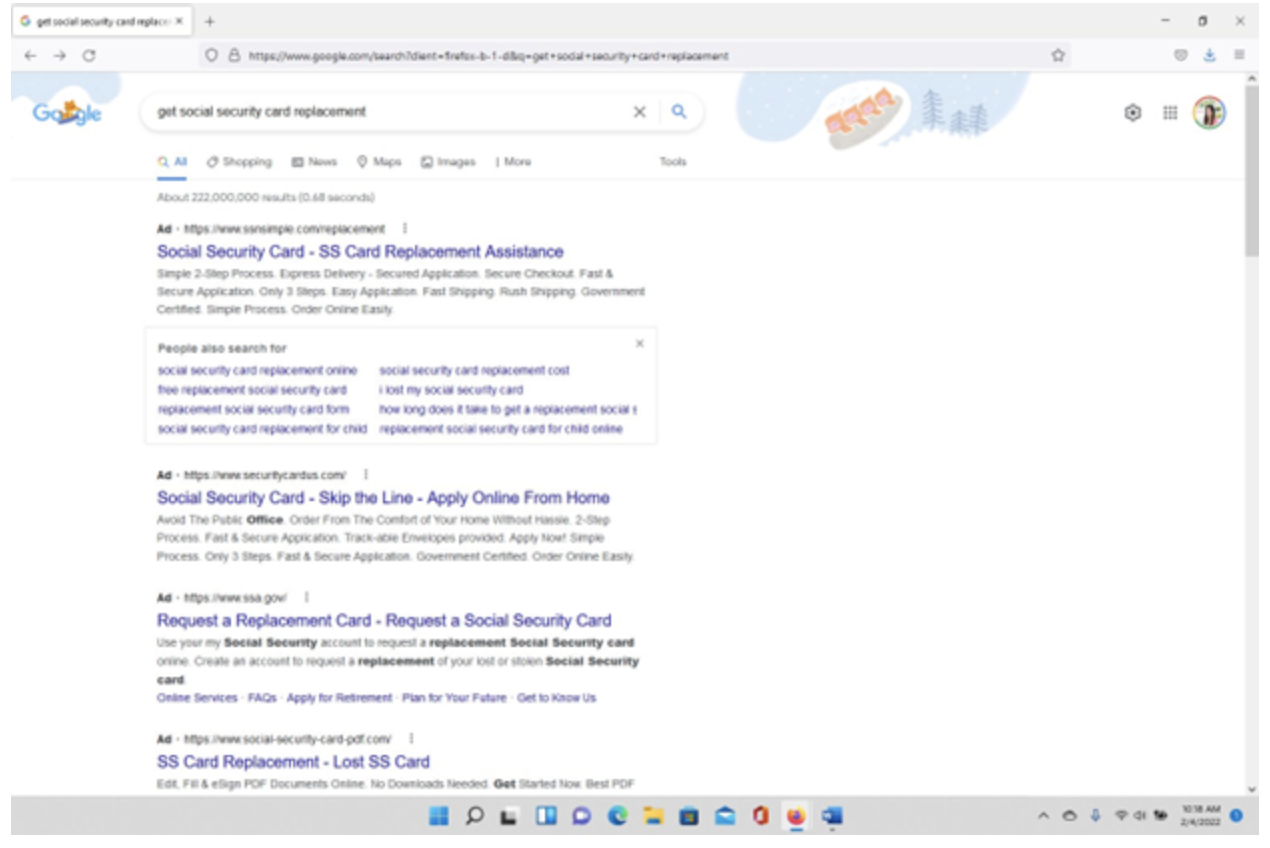

Trina explained that she had lost her social security card and was looking to get a new one. Like many of us, she had Googled the options and clicked on the first link, a website called SSNSimple.

That company had collected her personal information (including her name, address, and social security number), charged her $39, and then claimed it had filed a request on her behalf. Trina had then received a letter back in the mail saying that her application could not be processed. She then called the local Social Security Administration, who said they had no record of the transaction. Trina then learned that you can request a social security card for free from the Social Security Administration. No fee was required in the first place.

Trina was distraught. What were the risks to her personal identity? What should she do next? And I quickly joined in her anxiety. Here I was, a so-called cybersecurity professional. And while I’ve spent years advising people on simple steps that they could take to protect themselves before problems arise, I didn’t have a similar list for what to do after a scam had occurred.

With recent developments in the world of artificial intelligence (AI), it’s never been more important to know how to identify and react to scams. ML algorithms such as ChatGPT are enabling scammers to become more sophisticated in their methods, making it increasingly difficult for anyone, including cyber professionals, to determine what is credible. For instance, scams that clone your voice are on the rise. In a world where scams are becoming harder to identify, it’s valuable to know how to quickly respond to a potential fraud and ensure your information and finances are secure.

Luckily, I have great friends who gave me excellent advice about what to do when you think you’ve been scammed. I’ve compiled that information here, so that hopefully you won’t end up in a similar panic.

Put a stop on the transaction and cancel your credit cards. Before you do anything else, if finances are involved, immediately call your credit card company or bank to cancel the transaction and protect your funds. These days it is incredibly easy to get credit cards replaced, and if you’ve genuinely been scammed, the scammers are likely going to be trying to spend your money as quickly as possible. So it’s not worth waiting on.

Figure out if you’ve actually been scammed. Next, it’s worth doing a little forensic investigation. Have you actually been scammed? Sometimes transactions that seem suspicious actually turn out to be legitimate. Some things you can try:

- Check old bank statements to make sure that you haven’t seen a similar transaction before. I recently canceled a credit card due to a transaction I didn’t remember, only to realize that it was an irregular recurring transaction I hadn’t seen in a while.

- Ask questions if you are able to talk to the prospective scammers, to see if their answers add up. My grandmother had a scammer call her mobile phone pretending to be her grandson to try to get money. When she asked the grandson’s name, they hung up.

- Call the organization you engaged with electronically, to see if they have a record of the transaction. In Trina’s case, she called the local Social Security office to check on the status of her application.

- Collect as many documents as possible. Get copies of your credit card statements, letters, emails, and any other documents that might help you uncover the truth behind the transaction.

Trina’s investigation led her to go into the local Social Security branch, where she learned that the person she spoke to previously was mistaken. Her paperwork had actually been received after all. However, the scammers had not requested or submitted required identity verification documentation – such as a drivers’ license – so her application had had no chance of being positively approved. Essentially, the scammers had charged her $39 for a service that had no chance of working.

Next, assuming that you’ve been scammed, then it’s time to go into protective mode: make sure that you protect yourself, and also help others protect themselves in the future.

Change your passwords. If you signed up for a scam website with a password, make sure you are not using that password anywhere else, and change it if you are. Otherwise the scammers likely can access more information about you, compounding your problem.

Sign up for credit monitoring and/or freeze your credit. I remain skeptical of credit monitoring services, but if you have disclosed very sensitive information to scammers (your social security number, drivers’ license, etc.), you should sign up for a free, reputable service like CreditKarma.com or CreditWise from Capital One. If you are sure that scammers are trying to use your credit, you may also want to freeze your credit.

File a complaint with the search engine. If Google or another search engine led you to the scam, it likely violates their terms of service. The website Trina encountered both was problematic because it was a scam (which Google clearly disallows), and because Google’s terms of service say you cannot promote “documents and/or services that facilitate the acquisition, renewal, replacement, or lookup of official documents or information that are available directly from a government or government delegated provider.”

To report a website that violates Google’s terms of service, you can report it by right-clicking on the three vertical dots next to the URL. If you are active on social media, you can also tweet about it (as I did) which is likely to call more attention to the problem. Within hours of reporting it, the ad for the website Trina had clicked on was taken down.

File a complaint with law enforcement. Depending on the size and scale of the scam, you may also want to call law enforcement.

- Local police (non-emergency lines) can generally provide advice on how to handle a scam in your local area.

- Your state Attorney General’s office is also a great place to file complaints. A bonus of reporting to the state AG is that often materials shared with states will also be shared with the federal government, which can facilitate agencies such as the Federal Trade Commission filing lawsuits against scammers.

Notify the Better Business Bureau. Finally, if there’s a questionably legitimate company trying to scam you, you may also want to report them to the Better Business Bureau so that others who search for the company will see a record of your issues.

It’s not easy to manage when you’ve been scammed. But hopefully with a few simple steps like the above, the process of recovering from a scam can be a little less stressful.