If the last decade was about building AI, the next one is about measuring it. For years we’ve tried to force data platforms, machine-learning models, and “AI copilots” into a familiar box called ROI. The box keeps breaking. Not because AI has no value, but because it creates value in ways our old gauges were never designed to catch—like trying to weigh light with a bathroom scale.

Think of the economy the way a cosmologist thinks about space: not as a flat plane, but as a fabric with curves and hidden energy. AI doesn’t sit on one line of a profit-and-loss statement; it bends the fabric in several places at once. Some of its pull you can see immediately (more sales, fewer errors). Some of it reduces the chance of bad events (fines, outages). Some of it is potential energy (options for future products). And some of it is trust—traceable origins and rights—that makes an asset tradable rather than toxic. When you only ask “What’s the ROI of this tool?” you’re staring at one star and missing the constellation.

Why classic ROI keeps failing

- AI value is option-like. A model for customer support often leads to better routing, faster onboarding, smarter churn prevention. One investment, many branches. A single ROI number per tool hides the portfolio.

- Value is embedded in decisions. Models don’t print money; changed decisions do—pricing, approvals, triage. Those changes happen across teams and time, so simple before/after accounting misses them.

- Risk and rights dominate. Much of the value is avoided loss (regulatory, security, brand). It’s lumpy and probabilistic—exactly what ROI handles poorly.

- Accounting lags reality. Internally built data and models are usually expensed, not capitalized, so they vanish from the balance sheet even when they drive the business.

A simpler frame the whole company can use

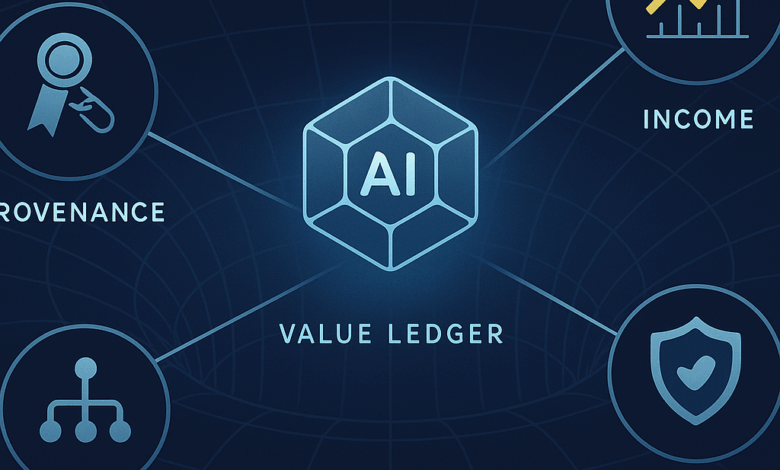

Replace the single, brittle ROI with a Value Ledger—four dials you track together. No philosophy degree required.

- Income (money today).

Did the system raise revenue or cut operating cost? Measure with experiments or matched comparisons.

Example: a pricing model lifts average order value by 2%—multiply by gross margin and volume. That’s cash. - Risk (license to operate).

What losses did we likely avoid? Fewer compliance failures; fewer fraudulent payouts; fewer SLA penalties.

Example: If a problem used to hit once a quarter with a $500k impact and now it’s once a year, you avoided about $1.5M annually. - Options (future upside).

What new use cases did this enable, and what are the odds a few win big? Treat each like a small call option.

Example: The speech-to-text stack you built for support now powers sales coaching and QA. You don’t count it twice; you admit it’s a platform and give it a banded estimate. - Provenance (transfer value).

Are the data, rights, and lineage clean and documented? Assets with clear origins trade at a premium; messy ones get discounted or blocked.

Example: A model trained on licensed data with audit logs is collateral; the same model trained on “found” data is a legal boomerang.

That’s the whole idea. Four dials, kept honest with evidence, not slogans.

Will this change how the economy values AI?

Yes—gradually, then suddenly. Expect:

- Outcome-based pricing. Buyers pay for uplift (conversion, savings) or for “risk credits” (losses avoided), not per seat or per token alone.

- Intangible collateral. Lenders and acquirers will accept governed data/models—with clear provenance—as borrowable and sellable assets.

- New audit standards. Boards will ask for experiment IDs, lineage proofs, and rights attestations right next to revenue reports.

That’s not an apocalypse. It’s a repricing of intangibles—the real assets of a software-eaten world.

What companies should do now

- Adopt the Value Ledger. Put the four dials on one page for every AI/data initiative: Income $, Risk $, Options (low/med/high band), Provenance Grade (A–C). Even rough numbers beat hand-waving.

- Instrument the counterfactual. Use A/B tests where you can; otherwise matched controls or interrupted time series. No experiment, no income claim.

- Separate capacity from savings. If automation frees “20 FTE worth of hours,” value it as throughput gained or backlog burned—not phantom layoffs.

- Monetize risk simply. Keep a small table: probability of bad event × loss if it happens. Update quarterly. You’ll be surprised how much value hides there.

- Track decay. Models drift. Give every capability a “half-life” and refresh plan. Depreciate value over expected life (often 6–24 months).

- Make provenance visible. Contracts for data rights, training logs, evaluation results. Clean lineage turns negotiations from “maybe later” into “how soon.”

How enterprising individuals can capitalize

- Become a Value Engineer. Learn enough experiment design, causal inference, and analytics to tie AI to dollars and risk. These people will run product reviews and board packs.

- Offer outcome-aligned contracts. Freelancers and boutiques can price against uplift or risk credits with a floor retainer. You’ll win deals incumbents can’t.

- Specialize in provenance. Be the person who can certify data rights, draft model cards, and assemble “ready-to-audit” evidence. It’s dull gold.

- Build small, measurable stacks. Pick a vertical (claims, lending, e-commerce ops). Ship a narrow model with clean lineage and a live dashboard of the four dials. Rinse, extend.

- Keep receipts. Document experiments, before/after metrics, and decisions you changed. Your personal portfolio becomes a miniature Value Ledger—catnip for clients and employers.

In plain terms: a story

A regional hospital buys an “AI scribe.” Old world ROI: “It costs X, do we save X in doctor time?” New world Value Ledger:

- Income: Doctors close notes during visits; follow-ups per day rise 8% → revenue up.

- Risk: Fewer documentation errors → fewer denied claims → loss avoided.

- Options: The audio pipeline now powers triage and training → future wins likely.

- Provenance: Vendor proves licensed data, shows audits → contract sails through legal.

Same tool. Different measurement. Better decision.

Summary

- Stop forcing AI into a single ROI. Use four dials: Income, Risk, Options, Provenance.

- Evidence beats eloquence. Experiments or matched controls for income; simple probability × loss for risk; banded estimates for options; real documents for provenance.

- This is the reset that matters. Not a crash—an accounting shift toward the intangibles that already run the world.

- Winners are legible. Those who can show what changed, what risk dropped, what options opened, and why the asset is clean will command better prices, better credit, and faster approvals.

In cosmology, a tiny change in early conditions shapes the whole universe. In business, a small change in how we measure value decides who gets funded, who gets copied, and who gets left behind. The firms—and the people—who adopt this new lens first won’t just argue better. They’ll own the gravity.