The $14 trillion private markets industry, spanning venture capital, private equity, and private credit, runs on data. Yet far too often, this vital currency remains trapped in PDFs, Excel spreadsheets, and inboxes. Despite years of digital transformation spending, private market firms still rely heavily on manual workflows: emailing documents, updating Excel templates, interpreting scanned PDFs, and manually reconciling investor data across disconnected systems.

General Partners (GPs) and their teams face a constant uphill battle managing information across the fund management lifecycle from fundraising to deal execution, portfolio monitoring, compliance, and investor reporting. Even with investor portals, aligning and integrating disparate data sources remains a challenge. According to Gartner, over 80% of data is unstructured, locked in emails, PDFs, and other documents. McKinsey adds that data professionals spend nearly 60–80% of their time sourcing and preparing data rather than analyzing it.

This inefficiency comes at a cost. Multi-billion-dollar investment decisions hinge on spreadsheets vulnerable to human error; a single misplaced digit can cascade into compliance risks or financial misstatements. But after years of AI advancements, the industry is finally at an inflection point: leaving behind outdated Excel- and PDF-driven processes for good.

A Day in the Life: Before and After AI

To understand AI’s true potential, consider the daily rhythm of a private capital markets professional such as an associate, analyst, or operations lead navigating the fund lifecycle.

Fundraising Stage

Before AI: In the morning, you sift through a flood of prospective investor emails, manually entering subscription agreement details into your CRM. You reference multiple versions of Excel trackers, checking commitment amounts and investor status. Each capital call template must be customized, saved as a PDF, and sent manually.

With AI: AI-powered document ingestion automatically scans and extracts key data from subscription agreements, wiring instructions, and KYC forms. It validates information against internal systems, instantly updating your CRM and generating personalized capital call notices, ready to send in minutes, not hours.

Deal Execution Stage

Before AI: Midday, you’re tracking deal documents in a shared drive, struggling to locate the latest loan agreement. You copy-paste covenants into Excel for monitoring, flagging potential breaches manually.

With AI: Natural language processing (NLP) tools identify, categorize, and extract covenant details directly from legal agreements, feeding them into your covenant monitoring dashboard. AI sets automated alerts for potential breaches, so your team can act before problems escalate.

Portfolio Monitoring Stage

Before AI: Afternoons are for chasing portfolio company financials, PDF reports arrive at different times and formats. You manually key revenue, EBITDA, and debt figures into Excel models to track performance.

With AI: The system ingests quarterly reports instantly, standardizing and integrating financial data into your portfolio monitoring platform. It applies machine learning models to forecast liquidity needs, detect anomalies, and provide real-time insights across the portfolio.

Investor Reporting Stage

Before AI: Late in the week, you manually assemble data from multiple Excel files to prepare quarterly reports for LPs. Formatting errors, broken formulas, and conflicting figures send you down reconciliation rabbit holes.

With AI: AI-generated reports pull directly from reconciled, centralized data sources. LP dashboards update in real time, providing investors with transparent performance metrics and eliminating repetitive manual compilation.

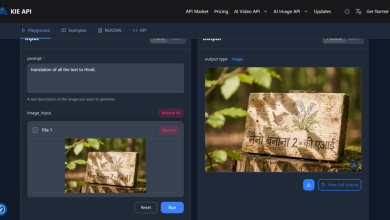

AI-Powered Document Ingestion: From Chaos to Clarity

Modern AI breakthroughs, especially in NLP and large language models, offer a path out of the manual-data quagmire. Unlike traditional optical character recognition (OCR), these tools go beyond reading text: they interpret context. AI can recognize a capital call notice, pull out payment deadlines and amounts, reconcile them against the fund’s ledger, and ensure instructions are consistent before triggering an investor notification.

Machine learning models are now capable of automatically reconciling investor data across systems, flagging discrepancies, and even predicting liquidity requirements weeks in advance. According to Pictet Alternative Advisors, 60% of fund managers reported increased portfolio company revenue due directly to AI implementation, a testament to AI’s impact beyond back-office speed.

Tangible Outcomes: Speed, Accuracy, Transparency

- Speed: Capital calls issued in minutes instead of days.

- Accuracy: Error-prone manual keying replaced by high-fidelity AI extraction.

- Transparency: Traceable data lineage from source documents to reports, satisfying both regulators and LPs.

By scaling without adding proportional headcount, firms can manage larger AUM and more investors without burning out their teams.

Beyond Automation: Redefining the Role of the Private Markets Professional

AI’s influence stretches past task automation. It’s redefining roles across the industry. Analysts and associates once buried in Excel formulas and PDF extractions are now engaging in higher-value work, evaluating investment opportunities, strengthening investor relationships, and advising on strategic portfolio moves.

The “junior analyst” role evolves into one blending data science, strategic advisory, and AI oversight skills that will become core to career advancement in the next decade.

Why Now?

Multiple pressures are accelerating AI adoption:

- Increasingly complex fund structures

- Heightened regulatory expectations for real-time, auditable reporting

- LP demand for granular, transparent data—68% now rank operational clarity above historical returns

While resistance remains, especially around data integrity, compliance, and liability, firms that take a phased approach, starting with lower-risk areas, are seeing faster wins.

The Future of the Private Markets

Tomorrow’s private markets firms will run on an AI-augmented technology where blockchain-based smart contracts automate transactions, predictive analytics anticipate risks, and NLP-driven data ingestion makes Excel and PDFs feel like relics of a slower era.

As Deloitte notes, “Collecting, curating, and analyzing both structured and unstructured datasets is the differentiator in private equity success.” Those who embrace AI now will lead on speed, accuracy, and investor trust. Those clinging to manual spreadsheets risk becoming irrelevant in a market that values precision and responsiveness.

The long goodbye to Excel and PDFs has begun, and for private capital markets professionals, it means fewer hours spent on manual data wrangling, and more on delivering insight, strategy, and value.