As artificial intelligence continues to reduce barriers to entry for technology startups, the traditional role of venture capital (VC) firms is increasingly being re-evaluated. The concept of “one-person unicorns”, startups founded and operated by a single individual that reach billion-dollar valuations despite that, is no longer speculative. Emerging technologies, particularly large language models and AI agents, are enabling unprecedented levels of productivity and autonomy for solo entrepreneurs.

This structural shift prompts several plausible scenarios for how the VC industry may evolve to maintain relevance and impact in a world where capital and labor are no longer such pressing constraints.

Scenario One: VCs Shift to Pre-Idea and Solo Founder Investing

Historically, VC investments began at the Series A stage, focusing on startups with proven traction. Over time, this shifted to earlier-stage investments (seed and pre-seed rounds). Today, some funds are investing even earlier: before there is a product, team, or even a clear idea.

This trend is evident in initiatives that back individuals rather than ideas or support emerging talent with minimal initial requirements. Other models operate as a global tournament for entrepreneurs, providing capital and mentorship pre-idea.

Such models align with a “talent-first” approach, where the VC functions more like an incubator or accelerator, offering support systems akin to those in elite sports or entertainment, identifying high-potential individuals and guiding them through the company formation process.

Scenario Two: VCs Become Educational and Coaching Platforms

As AI continues to automate operational and technical tasks, the comparative advantage of venture firms may shift toward education, coaching, and community-building. This would entail VCs developing capabilities to discover and nurture exceptional talent through structured learning and support programs.

This model is reflected in programs which create networks of potential founders, providing them with training, mentorship, and early capital. Such ecosystems resemble hybrid institutions as they are part accelerator, part business school, and part venture fund.

This evolution would parallel the transformation of sports academies or creative arts institutions, where the focus is on long-term talent cultivation rather than immediate returns.

Scenario Three: VC Shifts Toward Deeptech and Capital-Intensive Sectors

With AI reducing software development costs and time-to-market, capital may become more strategically deployed in high-barrier, capital-intensive sectors such as biotech, advanced hardware, clean energy, and robotics.

Already, many more VCs are investing in deeptech ventures that require longer time horizons and higher scientific risk. Regulatory reforms such as and growing government support for climate and quantum technology, such as the US National Quantum Initiative Act and the European Green Deal also enhance the appeal of these sectors.

These trends suggest a scenario where venture funds reorient themselves structurally, raising longer-dated funds, partnering with academic institutions, and recruiting scientific expertise to navigate regulatory and technological complexity.

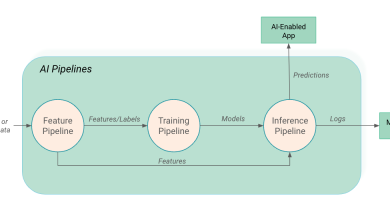

Scenario Four: VCs as AI Architects and Infrastructure Partners

In an AI-dominated startup landscape, VC firms may evolve to offer more hands-on technical support, particularly in developing, auditing, and deploying AI agents and infrastructure. Rather than purely offering capital, VCs could provide proprietary AI tooling, plug-and-play infrastructure, and in-house engineering capabilities.

More and more VCs are hiring engineers and researchers to offer more technical value-add to their skills while others are leveraging shared AI infrastructure and talent to develop startups internally.

This may lead to a model where VCs function more like “AI architects” or “agent partners,” embedding themselves deeply into the AI stack and offering founders a platform on which to scale.

A Structural Reconfiguration of Venture Capital

The rise of one-person AI unicorns therefore represents more than a novel founder archetype; it points to a deeper reconfiguration of how innovation is financed, built, and scaled. As automation displaces roles once filled by entire teams, the comparative advantage of VCs must also shift from capital deployment to talent amplification, ecosystem building, and AI co-development.

The economic rationale for this transformation is clear: in a world where the marginal cost of software development approaches zero and AI provides superhuman leverage to individuals, the scarce resources become insight, relationships, and trust. VCs that adapt by specializing in these areas instead of focusing solely on the provision of capital as their main differentiator may thrive in the new landscape.

Conclusion

From the economist’s lens, the evolution of venture capital in response to AI is not pre-determined. The rise of AI-enabled solo founders accelerates the diversification of the VC model into investor to talent scout, educator, infrastructure provider, or deeptech collaborator.

While the unicorns of the next decade may be smaller in headcount, they will still require ecosystems of support. The VCs who survive this transition will be those who understand that value creation in the AI era lies less in writing checks and more in building fertile environments for innovation.