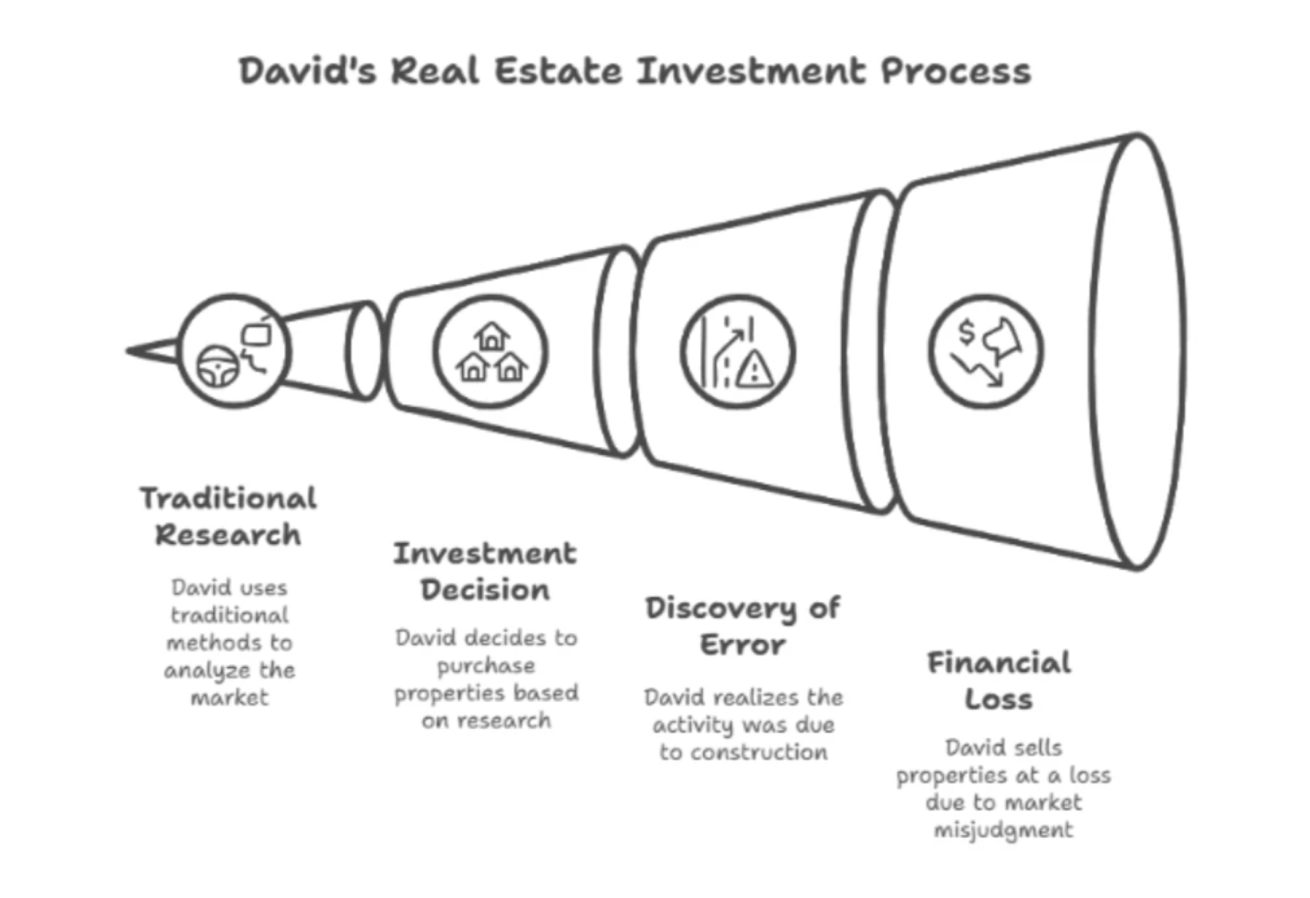

Two years ago, I watched a seasoned real estate investor named David make one of the most expensive research mistakes I’ve ever witnessed. With 20 years of experience and a portfolio worth $8 million, David considered himself an expert at identifying undervalued markets and investment opportunities.

He’d been tracking a neighborhood in Tampa, Florida where he noticed increasing foot traffic, new restaurant openings, and what appeared to be early signs of gentrification. Using traditional research methods – driving the area, talking to local brokers, and analyzing recent sales – David concluded that the neighborhood was poised for significant appreciation in the commercial properties in Texas.

Based on this analysis, David purchased four single-family homes for a total of $1.2 million, planning to renovate and either flip or rent them as the area improved. The properties seemed perfectly positioned to benefit from the neighborhood’s upward trajectory.

But six months later, David discovered his fundamental research error. The “increasing activity” he’d observed was actually temporary construction traffic related to a major infrastructure project. The new restaurants were struggling because they’d opened prematurely, expecting development that wasn’t coming. Most critically, city planning documents showed that the area was scheduled for industrial rezoning that would prevent the residential development David had anticipated.

AI-powered market analysis tools that were readily available could have revealed these factors within hours. Satellite imagery analysis would have identified the temporary nature of the construction activity. Social media sentiment analysis would have detected the restaurants’ struggles before they became obvious. Municipal data integration would have surfaced the zoning changes that traditional research had missed.

David eventually sold the properties for $850,000 – a $350,000 loss before renovation costs and carrying expenses. His total loss exceeded $500,000, all because he relied on traditional research methods in a market that demanded data-driven analysis.

That disaster taught me the most important lesson about modern real estate research: in today’s complex markets, intuition and traditional analysis aren’t enough. The investors who succeed are those who harness artificial intelligence to process information faster and more comprehensively than human analysis alone can achieve.

Why Traditional Real Estate Research Falls Short in Modern Markets

The traditional approach to real estate research – driving neighborhoods, analyzing recent sales, and relying on local broker knowledge – was adequate when markets moved slowly and information was scarce. But today’s real estate markets operate at unprecedented speed with complexity that exceeds human analytical capacity.

Modern markets are influenced by factors that traditional research methods can’t efficiently process: demographic shifts revealed through social media patterns, economic indicators that affect hyperlocal markets differently, infrastructure changes that alter traffic and development patterns, and regulatory modifications that impact property values in unexpected ways.

The volume of relevant data has exploded beyond what individual analysts can effectively evaluate. A single property investment decision now requires analyzing thousands of data points from dozens of sources, identifying patterns across multiple timeframes, and predicting interactions between factors that traditional methods treat as separate variables.

The speed of market changes has also accelerated beyond traditional research timelines. Neighborhoods can shift from emerging to peaked within months, while regulatory changes can alter investment landscapes overnight. By the time traditional research identifies these changes, investment opportunities have often disappeared or become overpriced.

Human bias also limits traditional research effectiveness. Investors naturally focus on information that confirms their preconceptions while overlooking contradictory data. Traditional research methods provide limited protection against these cognitive biases that lead to expensive mistakes.

How AI Transforms Real Estate Investment Analysis

Artificial Intelligence doesn’t replace human judgment in real estate research – it amplifies human capabilities by processing vast amounts of data to identify patterns and opportunities that traditional methods miss.

Comprehensive Data Integration and Pattern Recognition

AI systems can simultaneously analyze property records, demographic trends, economic indicators, social media activity, satellite imagery, traffic patterns, and municipal data to create comprehensive market assessments. This integrated analysis reveals connections between factors that human researchers might never consider together.

Machine learning algorithms excel at identifying subtle patterns in historical data that predict future market movements. These systems can detect early indicators of neighborhood changes, market cycles, and investment opportunities by analyzing combinations of factors too complex for traditional research methods.

AI also eliminates human limitations in data processing speed and volume. Systems can analyze years of market data across multiple variables in minutes, enabling real-time investment decisions based on current rather than outdated information.

Predictive Modeling and Risk Assessment

Advanced AI models can forecast market changes by analyzing historical patterns and current indicators to predict future conditions with measurable accuracy. These predictions help investors time purchases and sales more effectively while avoiding markets that appear promising but face hidden challenges.

Risk assessment algorithms can evaluate multiple scenarios simultaneously to identify potential problems before they impact investments. This proactive approach prevents expensive mistakes by flagging concerning trends early enough to adjust strategies.

I recently used AI analysis to evaluate a potential investment in a suburban office complex. Traditional research showed steady occupancy and reasonable rents, but AI analysis revealed concerning patterns: social media check-ins had decreased 40% over six months, traffic pattern analysis showed reduced vehicle activity, and employment data indicated major tenants were implementing permanent remote work policies. This comprehensive analysis prevented my client from making a $2.8 million investment that would likely have lost value as office demand continued declining.

AI-Powered Property Valuation: Beyond Comparable Sales

Traditional property valuation relies heavily on comparable sales analysis, which can be misleading in rapidly changing markets or for unique properties with limited comparables. AI-powered valuation models incorporate hundreds of variables to create more accurate and timely property assessments.

Automated Valuation Models (AVMs) and Advanced Analytics

Modern AVMs analyze property characteristics, neighborhood factors, market trends, and economic indicators to generate valuations that reflect current market conditions rather than historical sales that might no longer be relevant. These systems update continuously as new data becomes available, providing real-time valuation insights.

AI valuation models can assess unique properties by identifying comparable characteristics rather than requiring direct property matches. This capability enables accurate valuations for properties that traditional methods struggle to evaluate due to limited comparable sales.

Machine learning algorithms can also identify valuation trends and market shifts before they become apparent through traditional comparable sales analysis. This early detection capability helps investors identify undervalued properties and avoid overpriced markets.

Market Timing and Investment Strategy Optimization

AI systems can analyze historical patterns to identify optimal buying and selling timing based on market cycles, seasonal variations, and economic indicators. This timing optimization can significantly impact investment returns by improving entry and exit decisions.

Portfolio optimization algorithms can evaluate multiple potential investments simultaneously to identify combinations that maximize returns while managing risk exposure. This systematic approach prevents emotional decision-making and ensures investment strategies align with quantitative objectives.

Investment Opportunity Identification Through Machine Learning

The most valuable application of AI in real estate research is its ability to identify investment opportunities that traditional methods miss or discover too late to capitalize on profitably.

Emerging Market Detection and Trend Analysis

AI systems can monitor multiple indicators simultaneously to identify neighborhoods experiencing early-stage improvement before prices reflect these changes. Social media activity, business permit applications, demographic shifts, and infrastructure investments all provide early signals that AI can detect and analyze.

Machine learning algorithms can identify patterns that predict which neighborhoods will experience appreciation by analyzing successful gentrification patterns from other markets and identifying similar conditions in target areas.

Satellite imagery analysis can reveal development activity, construction progress, and land use changes that indicate market evolution before this information becomes widely available through traditional channels.

I worked with an investor who used AI analysis to identify an emerging neighborhood in Nashville six months before it became widely recognized as an investment opportunity. The AI system detected increasing social media activity, new business permit applications, and residential construction activity that traditional research hadn’t yet identified. My client purchased three properties for $180,000 each; comparable properties in the same area now sell for $280,000+.

Alternative Data Sources and Predictive Indicators

AI enables analysis of alternative data sources that traditional research methods can’t efficiently process. Mobile phone location data reveals foot traffic patterns, social media activity indicates neighborhood desirability trends, and employment data shows economic changes affecting local markets.

Sentiment analysis of online reviews, social media posts, and news coverage can predict market perception changes before they impact property values. This early warning system helps investors anticipate market shifts and adjust strategies accordingly.

Economic indicator integration allows AI systems to predict how broader economic changes will affect specific local markets, enabling investors to position portfolios for changing conditions.

Implementation Strategies for AI-Driven Real Estate Research

Successfully integrating AI into real estate research requires systematic approaches that combine technological capabilities with human expertise and market knowledge.

Data Strategy and Technology Selection

Effective AI implementation begins with identifying relevant data sources and ensuring data quality and consistency. Real estate AI systems require clean, comprehensive data to generate accurate insights and predictions.

Technology selection should focus on platforms that integrate multiple data sources rather than single-purpose tools that require manual correlation. Comprehensive AI systems provide better insights than collections of separate analytical tools.

Training and workflow integration are crucial for maximizing AI benefits. Team members need to understand both AI capabilities and limitations to use these tools effectively rather than treating them as black boxes that provide answers without context.

Validation and Risk Management

AI insights should complement rather than replace human expertise and market knowledge. The most successful implementations use AI to identify opportunities and flag risks while relying on experienced professionals to evaluate and act on these insights.

Continuous validation ensures AI models remain accurate as market conditions change. Real estate markets evolve constantly, and AI systems require regular updates and recalibration to maintain effectiveness.

Diversified analysis approaches prevent over-reliance on single AI systems or data sources. Multiple analytical methods provide cross-validation and reduce risks associated with technological limitations or data errors.

The Future of AI-Driven Real Estate Research

David’s $500,000 research disaster demonstrates that traditional analytical methods are increasingly inadequate for modern real estate markets. The investors who succeed in coming years will be those who effectively integrate AI capabilities with human expertise to make faster, more accurate investment decisions.

Key principles for successful AI implementation include:

Start with Clear Objectives: Define specific research goals and success metrics before implementing AI tools rather than adopting technology without clear purposes.

Invest in Data Quality: High-quality, comprehensive data enables accurate AI analysis, while poor data leads to misleading insights regardless of algorithmic sophistication.

Combine AI with Human Expertise: Use AI to enhance rather than replace human judgment, ensuring technological insights are validated through experienced market knowledge.

Implement Systematic Processes: Develop consistent workflows that integrate AI analysis with traditional research methods and decision-making processes.

Monitor and Adjust Continuously: AI systems require ongoing calibration and improvement as market conditions change and new data sources become available.

For real estate investors ready to embrace AI-driven research, the technology offers unprecedented opportunities to identify profitable investments while avoiding expensive mistakes. The key is understanding that AI amplifies human capabilities rather than replacing them, enabling more comprehensive analysis and better investment decisions.

David’s expensive lesson serves as a reminder that in modern real estate markets, success requires processing more information faster and more accurately than traditional methods allow. AI provides the tools necessary for this enhanced analysis, but only for investors willing to learn new approaches and integrate technology thoughtfully into their research processes.

The future belongs to investors who combine artificial intelligence with human intelligence to navigate increasingly complex real estate markets. Those who resist these technological advances risk making expensive mistakes that better-informed competitors will avoid.