Insurance policies can seem tedious to those outside the industry. With so many clauses and specifications, policies can overwhelm customers. And some customers may miss out on critical details related to their coverage because they don’t know how to decipher the jargon. That’s where generative AI has come into play as a potential decoding assistant in the insurance landscape.

Insurers can translate policies into more understandable language with the help of this tool. But should they? Keep reading to learn about the benefits and risks associated with using generative AI in the insurance industry.

The Benefits of Using Generative AI

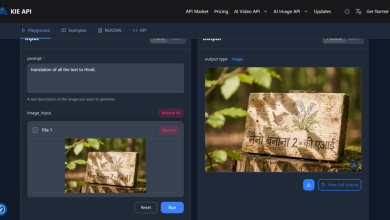

Thanks to generative AI, insurance policies can be easier to read and customized more easily. AI can convert complex phrases into simpler ones at a variety of reading levels. And it can convert policies into different languages, making them more accessible for everyone.

Perhaps most importantly, generative AI can offer succinct and clear answers to customer questions through chatbots and other mechanisms. Rather than wading through long paragraphs, customers can understand what is covered in simple terms. Even better, generative AI can contextualize customer questions, providing answers with hypothetical scenarios in mind. This alleviates stress for customers when they’re trying to understand a logical chain of events after filing a claim. And insurers can save time since they won’t be addressing as many customer questions.

Understanding the Risks

Even with so many benefits, there are risks that come with using AI to provide answers that customers will rely on. AI doesn’t always get it right and, at times, generates false information. For customers, this can lead to an inaccurate understanding of a policy that could come back to haunt them later. AI may not be trained on the latest data, too, leading to questionable reliability.

Customers won’t be happy if they notice AI-created mistakes, either. In fact, it could cause them to shop around for a reputable insurer, such as Everly Life Insurance. Insurance agencies must be mindful of these risks when deciding how or if to weave AI into their customer outreach.

How to Use AI Safely

AI can be an effective tool if insurers establish boundaries and an ongoing auditing system. For example, AI systems should be trained on the most current information and data. Insurers should test their generative AI systems, too, to see how easily they produce false answers. Noticing too many inaccuracies could mean it’s time to reroute how AI is embedded in customer interactions.

For visual guides, educational printouts, or branded policy inserts that help clarify coverage alongside AI tools, consider using Printmoz to create professional and accessible printed materials. And, ultimately, good communication is key. Insurers should seek input from customers to help with future AI training. Customers should be asked how helpful AI is through online chats. If insurers notice an uptick in policy additions and stronger satisfaction scores, generative AI may be a tool worth continuing to refine.

Investing in Generative AI

When used carefully, generative AI can help insurers elevate their customer experience and lead to more policy signups. AI can give customers quick answers to pressing policy questions. And it can ease workloads for insurers. At the same time, however, insurers will need to monitor AI’s accuracy as a tool that shares critical information for policyholders. With the right guardrails in place, AI can help clarify policies for customers.