When it comes to modernising payment infrastructure, financial institutions have traditionally relied on three strategic approaches: build, buy, or partner. Each option has its advantages and limitations. Building in-house demands specialist talent and time that many banks don’t have. Buying software has become less viable as vendors increasingly transition to software-as-a-service (SaaS) models. Partnering, while common, can lead to dependency on external providers and integration complexity.

Despite their differences, these three approaches typically aim to achieve the same result: modernising legacy systems without carrying out a complete overhaul. That’s because an estimated 70% of bank IT budgets are allocated to maintaining outdated infrastructure. In most cases, institutions favour incremental improvements rather than taking on the risk of a full-scale replacement.

However, in an era of rapid technological evolution, the “build, buy, or partner” framework is beginning to show its limitations. Emerging strategies such as artificial intelligence (AI) enabled payment orchestration provides a more flexible, intelligent, and data-driven alternative—one that enhances existing infrastructure without replacing it.

Understanding the Complexity Behind Every Payment

To the end user, payments may appear instantaneous and straightforward. But behind the scenes, they involve a highly complex and fragmented series of steps. A single transaction may pass through multiple intermediaries—banks, processors, card networks, fraud detection systems, and compliance checkpoints—all within fractions of a second.

Payment orchestration refers to the intelligent coordination of these elements. It routes each transaction through the most effective path based on a range of factors: location, payment method, processing cost, success probability, and regulatory compliance. Like a conductor unifying a group of musicians, a payment orchestrator ensures the various components of the payment ecosystem operate in harmony.

This technology gives merchants access to multiple payment providers through one central platform. That flexibility allows them to optimise acceptance rates, adapt to local regulations, and meet regional customer preferences—all without restructuring their core systems.

Crucially, orchestration also offers top-down visibility across the entire payments operation. These insights enable merchants and financial institutions to streamline operations, reduce risk, and extract meaningful intelligence from transactional data that would otherwise go to waste.

AI’s Role

Although much of the public discourse around AI has centred on generative models such as ChatGPT, the true value of AI in financial services lies elsewhere. In the payments space, AI isn’t about generating content—it’s about making sense of real-time, high-volume data.

Banks and merchants process vast quantities of transactional data each day. Most of it sits unused, occupying costly cloud storage. Machine learning and AI algorithms can analyse this data at speed and scale, generating insights that go far beyond human capabilities. These insights inform everything from strategic shifts (‘customers are gravitating towards alternative payment methods’) to micro-level decisions (‘provider X yields a 0.043% higher approval rate on Sundays than provider Y’).

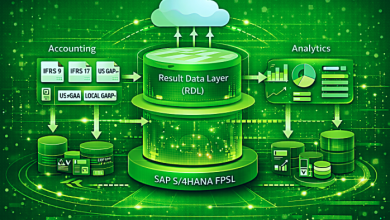

AI-enabled payment orchestration takes this a step further. It connects fragmented systems—card management, reconciliation, third-party services, compliance tools—into a single intelligent hub. The result is a more responsive and efficient payments engine capable of adjusting in real time to maximise transaction success, reduce costs, and fight fraud.

Connecting the Dots: What the Orchestration Layer Really Does

Picture an orchestra with a blend of seasoned musicians and eager newcomers. While each can play their part, what they need is a conductor to bring it all together. The same applies to payment infrastructure composed of legacy and modern systems. Left unmanaged, even the most sophisticated tools can underperform.

An AI-enabled orchestration layer acts as that conductor. Rather than requiring a full rebuild or new vendor relationship for every improvement, it unifies and enhances the systems already in place.

These orchestration layers bring several key capabilities:

- Real-time fraud detection, with dynamic risk scoring and escalation steps such as biometric prompts

- Smart decline recovery, through retry mechanisms or alternative payment methods

- Automated compliance tools, including AML and KYC screening, suspicious activity monitoring, and audit-ready reporting

- Centralised oversight, enabling faster decision-making and more agile operations

By streamlining how systems communicate and respond, orchestration layers improve both the security and speed of transactions—while simultaneously enhancing the customer experience.

AI-Orchestration: The Fourth Way Forward for Financial Institutions

AI-enabled orchestration represents more than just another tool—it offers a fourth strategic path beyond build, buy, or partner. As outlined in research by RS2, this approach allows institutions to evolve their payment systems without taking on the risks of replacing core infrastructure.

Deploying orchestration in secure Virtual Private Clouds gives banks full control over data and architecture, addressing concerns around security and compliance. These platforms are also designed to support interoperability with emerging standards such as ISO 20022, ensuring long-term compatibility.

The benefits of this model are already clear:

- Increased transaction approval rates through intelligent routing.

- Lower operational and fraud-related costs via smarter automation.

- Simplified regulatory compliance with fewer manual processes.

- Improved customer satisfaction through faster, more consistent payment flows.

Unlike the traditional trio of strategies, AI orchestration allows financial institutions to modernise at their own pace, without disrupting existing services.

Orchestrating the Future of Banking – Intelligently

Banks and financial institutions face a balancing act between innovation and risk. Legacy systems are costly and cumbersome, but the risks of total replacement are often too great to justify. AI-enabled orchestration presents an elegant solution: a way to modernise intelligently, build resilience, and unlock the full value of transaction data.

As technology advances, the institutions that succeed will be those that not only adopt new tools—but orchestrate them with intelligence, adaptability, and purpose.