In the fast-paced world of venture capital, where timing, insight and precision are everything, artificial intelligence is rapidly transforming how investors discover, evaluate and support startups. From sourcing deals through predictive analytics, to streamlining due diligence with natural language processing, AI provides a competitive edge that should not be left on the sidelines. As firms grapple with increasing volumes of data and heightened pressure to make smarter bets faster, AI stands to redefine the VC landscape, turning gut instinct into data-driven strategy.

Venture’s resource reallocation and network bias predicament make it impossible to thoroughly evaluate startup potential. Far too often, exceptional startups with suboptimal pitches are overlooked for mediocre startups with polished presentations. AI can be a powerful tool for process optimization by supporting the evaluation process as an intelligent filter, screening pitches against objective, established criteria and reserving human judgment for quality pitches that pass initial AI screening.

It’s important to strategically leverage artificial and human intelligence to address a venture’s opportunities and setbacks. Combining domain expertise, independent review and a commitment to assessment quality will transform the evaluation process.

Here are a few ways AI is rewiring the age-old (some would say broken) VC ecosystem:

Time is Money – Optimizing Pitch Assessment with AI

There is no shortage of visionaries seeking to change the world with the latest product. However, there is a limitation to time dedicated to thoroughly assessing the business potential of these ideas. Evaluating 100 deals requires approximately 1,000 hours of human review, and the lack of manpower and standardization results in rushed, incomplete evaluation of startups. This rewards polished pitches over business fundamentals, obscuring qualified startups from the investment pool.

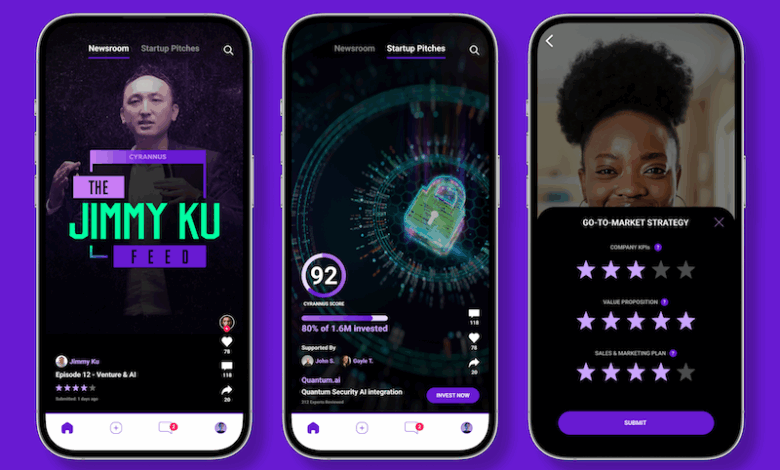

Leveraging AI can amend this systemic flaw by screening pitches through specific criteria that prioritize product feasibility and market potential before reaching the human intelligence stage. Reducing human expenditure and time investment in the initial stages of evaluation ensures product fundamentals are at the forefront for assessors, not superficial claims.

Bias Reduction

Because of time limitations, firms are often influenced by network biases to make decisions about startup pitches. This can result in an overreliance on familiarity and intuition to determine potential—not the idea itself. Founders who aren’t as well-connected risk being overlooked, regardless of the startup’s strengths or potential. A meritocratic screening process will eliminate this issue by prioritizing core product features instead of founder personalities, ensuring investment criteria are applied consistently across a broader candidate pool.

Once past the preliminary screening stage, independent evaluation is key to reducing bias through the funding stage. In the same way that blind academic peer review focuses on merit, AI can match startups to domain experts for independent review based on area of expertise. As startups become more technical, independent review by field experts will ensure the product is feasible before it reaches investors. A startup that manufactures robots to clean aircraft tarmacs, for example, would be best evaluated by someone familiar with robotics or ground operators.

Higher Quality Opportunities

To maintain a synergy between investors, founders and experts, experts must be equally invested in startup quality as investors. One solution is to offer experts equity on the platform, incentivizing the network to uncover startups with the most potential. The intention is not to identify unicorns, which is impossible, but to use AI to optimize the collective intelligence of specialists to review startups. This assures investors that funding is allocated to opportunities that show true business potential.

With AI screening and expert review in venture, the baseline quality of the opportunities available is raised for investors. Failure rates would decrease, as specialists look out for red flags in pitches. The feedback provided by specialists would be accessible to investors, offering a clearer picture of what they’re funding. There is no need to gamble blindly when objective evaluation is streamlined to uncover the strongest startups.

Striking a Balance Between Artificial and Human Intelligence

AI is a powerful information transformation system that can assist with evaluating structured elements such as market validation or technical feasibility. It enhances information flow and synthesis that supplements decision-making processes. However, AI’s limited reasoning capabilities make it inadequate in providing investment recommendations, preserving the irreplaceable value of domain expertise. Without sufficient expert insight, AI-generated recommendations may perpetuate industry biases.

While AI has its limitations and should not function as an autonomous decision-making system, it remains a valuable tool for addressing time and labor constraints. Human expertise delivers a thorough analysis of startups, ensuring investors can meet personal investment objectives.

Out with the Old, in with the New

As new technology is uncovered, it is essential that venture evolves alongside it. What may have worked in the past has created an inefficiency where volume is prioritized over quality, increasing risk for investors and limited founder access to capital. Leveraging AI to execute preliminary screening of pitches and matching prescreened startups to specialized evaluators are two ways to implement AI in venture, addressing time constraints and limiting bias.