When Australia’s economic growth figures come in strong, it should be good news for businesses seeking loans. That’s the logical assumption, at least. A healthy economy means more opportunities, stronger revenues, and presumably, lenders willing to back expansion plans.

But Martin Iglesias, a credit analyst at Highfield Private with over two decades of corporate banking experience, has watched this logic fail repeatedly in recent months. Strong economic growth isn’t translating to easier access to capital for Australia’s small and medium-sized enterprises. In some cases, it’s actually making lending conditions more difficult.

“Economic growth results came out, and it was really strong for Australia,” Iglesias notes. “And that’s likely going to mean no further interest rate cuts in the near term.”

It’s a counterintuitive reality that reveals the complex, and often contradictory, forces shaping Australia’s SME lending landscape in 2025.

When Good News Becomes Bad News

Recent Australian economic data painted a picture of resilience and growth. GDP figures exceeded expectations, demonstrating that the economy was expanding at a healthy clip. For most observers, this would signal positive conditions for business investment and lending.

The market’s response, however, told a different story.

“The stock market actually took a dive on the back of good economic news, because market participants always want to see interest rates going down,” Iglesias explains.

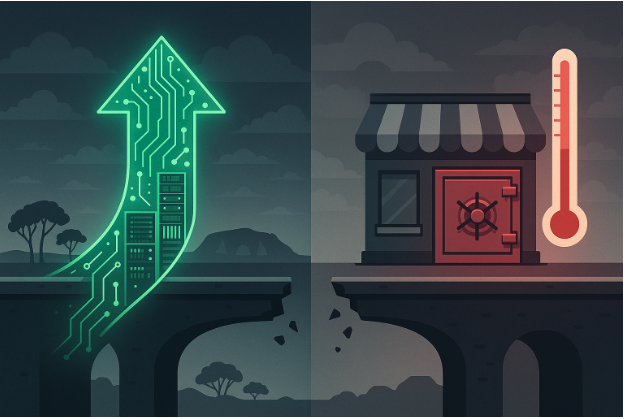

This reaction reveals how divorced economic indicators have become from the practical realities facing businesses seeking finance. Strong growth signals to the Reserve Bank of Australia that rate cuts are unnecessary, which in turn means borrowing costs remain elevated for longer. The very strength of the economy becomes an obstacle to accessing affordable capital.

For SMEs caught in this paradox, the implications are significant. They’re operating in a growing economy with expanding opportunities, yet the financial conditions needed to capitalise on that growth remain constrained.

How AI Is Driving Complicated Economic Growth in Australia

Australia is experiencing a significant surge in AI data centre investment that’s becoming a major contributor to economic growth figures. Tech giants, including Microsoft, Amazon Web Services, Google, and local players, are committing billions of dollars to build and expand data centre infrastructure across the country to support the explosive demand for AI computing power and cloud services. All together, these investments put Australia second to only the United States in terms of AI data centre investment.

However, this AI-driven economic growth creates the exact paradox that Martin Iglesias describes in the lending landscape. Whilst data centre construction and technology infrastructure spending inflate GDP numbers and make the economy appear robust, they do little to improve conditions for traditional SMEs in manufacturing, retail, wholesale, or service industries seeking business loans.

The Inflation Complication

Underpinning this paradox is persistent inflation that refuses to retreat as quickly as policymakers hoped. Iglesias points to the recent monthly inflation report showing a jump from 2.1% to 2.7%. For reference, the RBA’s target range sits between 2% and 3%.

Iglesias explains that the RBA sets rates based on the quarterly report, so the monthly report shouldn’t directly influence their decision-making. Still, “it’s a worrying trend,” he says.

“Unlikely we’re going to see them go down in the near term,” Iglesias notes, referring to interest rates. “They’ve reduced it a couple of times in the past few months. I think they’re going to probably just wait on the back of that.”

For businesses planning expansion, this creates a challenging environment. Economic growth suggests opportunities exist, but the inflationary pressures driving that growth also ensure that financing those opportunities remains expensive.

The Cost of Living Crisis Quietly Erodes Borrowing Capacity

Perhaps the most insidious challenge facing SME borrowers has nothing to do with headline economic growth figures. It’s the steadily rising cost of living that’s quietly constraining lending capacity across Australia.

“Cost of living expenses are going up in Australia a lot,” Iglesias observes.

Banks don’t assess business loan applications in isolation. They examine the complete financial picture, including household expenses for business owners and guarantors. As these costs have climbed, they’ve had a dramatic impact on serviceability assessments.

“[The Household Expenditure Measure] has gone up nearly $1,000 per month in the last few weeks,” Iglesias explains. “So that’s cutting back the borrowing capacity for customers, and it offsets the rate reductions when you’re looking at their borrowing capacity for servicing, because the cost of living expense increases are higher than what they’re saving on interest rate.”

This creates a perverse situation. Even as the RBA has implemented modest rate cuts, the benefit to borrowers has been negated by higher living costs factored into lending assessments. Businesses find their borrowing capacity stagnant or even declining, despite operating in a growing economy.

“These cost-of-living rises are being factored in by the bank on their assessments,” he says.

How SMEs Can Still Secure Funding

The gap between economic growth and lending conditions reinforces a critical lesson for Australian businesses: lenders care far more about your specific financial fundamentals than they do about headline GDP figures.

“They need to get their financials in place, and they need to show, and reflect the operating performance and reflect the need for that financing as well on the balance sheet,” Iglesias advises. “If it doesn’t, then the banks will quickly, turn them back.”

This means maintaining impeccable financial records that accurately reflect business performance. It means demonstrating clear cash flow management and sustainable business models. And critically, it means ensuring complete tax compliance.

“They cannot go to a bank with taxes in arrears,” Iglesias emphasises.

This focus on micro-level financial health over macro-level economic conditions reflects a fundamental reality: a growing economy doesn’t guarantee that any individual business is well-positioned to take on additional debt. Banks understand this, even if business owners find it frustrating.

The Real Economic Picture for SMEs

For Australia’s small and medium-sized enterprises, the broader lesson is clear: headline economic growth tells only part of the story. The factors that actually influence lending decisions—inflation trends, cost of living pressures, conservative risk management practices, and individual business fundamentals—operate largely independently of GDP figures.

Strong economic growth creates genuine business opportunities. But it doesn’t automatically create easier access to the capital needed to pursue those opportunities. In fact, by reinforcing the RBA’s reluctance to cut rates and by potentially stoking inflationary pressures, robust growth can actually complicate the financing landscape.

Business owners who understand this disconnect are better positioned to navigate it successfully. Rather than assuming positive economic headlines will smooth their path to funding, they focus on the controllable factors that lenders actually assess: clean financials, tax compliance, strong cash flow management, and realistic business projections.

“A lot of business owners just hate doing that sort of thing. It’s not the fun stuff involved in running a business,” Iglesias acknowledges. But in an environment where economic growth doesn’t guarantee lending access, this unglamorous financial housekeeping becomes more important than ever.

As Australia’s economy continues to demonstrate resilience and growth, SMEs would do well to remember that accessing capital to capitalise on that growth requires more than optimism. It requires preparation, discipline, and a clear-eyed understanding that your business fundamentals matter far more to lenders than any macroeconomic statistic.