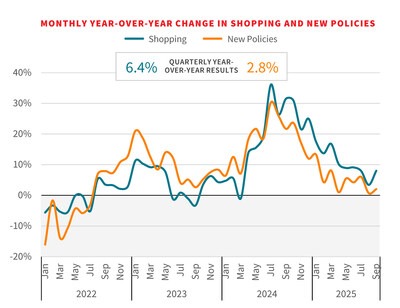

ATLANTA, Nov. 19, 2025 /PRNewswire/ — Shopping for auto insurance remained in high gear through the third quarter of 2025, according to the latest U.S. Insurance Demand Meter from LexisNexis® Risk Solutions. The quarterly year-over-year shopping growth rate registered as “Hot” at 6.4% for Q3, while new policy growth came in “Warm” at 2.8%.

Key Takeaways

- Shopping Growth Remains Hot: U.S. auto policy shopping rose to 6.4% year-over-year in Q3, maintaining a “Hot” reading, but was down from the 9.4% increase in Q2.

- New Policy Activity Still Warm: New policy growth increased 2.8% year-over-year, down from 3.6% last quarter.

- Older Shoppers Drive Growth: Policyholders aged 66 and older exhibited the highest growth rate, outpacing younger cohorts with a 10% increase in shopping growth.

- Direct Channel Maintains Momentum: Again, the direct channel posted strong shopping growth (14.1%), while exclusive and independent agency channels experienced declines compared to Q2. Exclusive channel growth slid to -0.8% but independent channel growth was 2.8%

Long-Tenured Policy Holders, Non-Standard Shoppers and Direct Channel Propel Growth

Consumers aged 66 and older, as well as non-standard and direct-channel shoppers, continued to lead Q3 auto policy shopping with the highest growth rates.

The 66 and older shoppers were the most active, achieving more than 10% growth YOY. This group consistently outshopped younger demographics. Additionally, shopping activity through the direct channel jumped 14.1%. Exclusive and independent channels experienced some decline compared to Q2, with exclusive channel growth sliding to -0.8%, and the independent channel dropping to 2.8%.

Each of these dynamics helped influence a rising annual shop rate, one that either tied with or topped the annual shop rate from the previous quarter. In Q3, like in Q2, 46.5% of policies-in-force were shopped at least once in the past 12 months.

New Analysis about Consumer Shopping Patterns Helping Drive Auto Policy Shopping

This quarter of the U.S. Insurance Demand Meter highlights a notable shift in consumer behavior. The report examines shoppers who have not shopped for auto insurance for 12 months but recently engaged in auto insurance shopping. Their shopping offered key insights into indicators of future shopping activity. These findings provide a valuable lens to evolving demand patterns and what they mean for insurers navigating a dynamic marketplace.

Geographic Rate Trends

In Q3, 15 states and the District of Columbia experienced shopping growth rates higher than the previous quarter, in contrast to Q2, which saw only Wyoming post quarter-over-quarter growth. Additionally, New Jersey (16%), California (11%) and Texas (10%) experienced double-digit increases, which helped boost shopping growth overall.

Across the market in Q3, roughly one third of all rate revisions submitted were decreases, averaging -4.2%1. By contrast, 35% of all revisions were rate increases (averaging +5.1%) and the 31% were rate-neutral filings2. This balancing act between rate adjustments and reactivated marketing campaigns helped sustain market enthusiasm.

“The third quarter reflects an evolving environment where traditional assumptions about loyalty and timing no longer hold,” said Jeff Batiste, senior vice president and general manager, U.S. auto and home insurance, LexisNexis Risk Solutions. “The persistent shopping activity of long-tenured customers and the ongoing strength of the direct channel reveal that the fundamentals of engagement have changed. Insurers now have a crucial opportunity to pair acquisition momentum with smarter retention strategies to help keep their most valuable long-term customers connected.”

|

|

Source: S&P Global Market Intelligence (and its affiliates, as applicable) |

|

|

Source: S&P Global Market Intelligence (and its affiliates, as applicable) |

Looking Ahead

In Q3, insurers increased targeted marketing, introduced new rate decreases, and capitalized on the expiration of the electric vehicle (EV) tax credit, while racing to beat impending tariffs that helped draw price-sensitive consumers into the market. Heading into the end of 2025, the auto insurance industry may experience a lull in shopping due to the holiday season, a trend that didn’t hold true in 2024.

Download the latest U.S. Insurance Demand Meter.

LexisNexis U.S. Insurance Demand Meter

The LexisNexis® U.S. Insurance Demand Meter is a quarterly analysis of shopping volume and frequency, new business volume and related data points. LexisNexis Risk Solutions offers this unique market-wide perspective of U.S. consumer shopping and switching behavior based on its analysis of consumer shopping transactions since 2009, representing nearly 90% of the universe of U.S. insurance shopping activity.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data, sophisticated analytics platforms and technology solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX), a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit www.risk.lexisnexis.com, and www.relx.com.

Media Contacts:

Annalysce Baker

LexisNexis Risk Solutions

Phone: +1 678.436.1579

[email protected]

View original content to download multimedia:https://www.prnewswire.com/news-releases/lexisnexis-us-insurance-demand-meter-us-consumer-auto-shopping-stays-strong-registers-as-hot-in-q3-302620667.html

SOURCE LexisNexis Risk Solutions