Registered Investment Advisors (RIAs) today operate in one of the most complex regulatory environments ever seen.

To succeed, firms must move beyond traditional manual compliance methods and adopt technology-driven solutions that provide automation, accuracy, and efficiency.

For RIAs, compliance for advisors is inherently linked to the smart application of compliance technology that meets evolving regulatory requirements while protecting client interests and firm reputation.

This article will explore how RIA compliance evolves via technology during 2025 and will guide RIAs that look to modernize compliance practices.

The Growing Complexity of RIA Compliance

New rules, increased regulatory scrutiny, and stronger cybersecurity requirements have only compounded the compliance burden upon RIAs, rendering it difficult for firms to keep pace.

Manual processes, spreadsheets, and disparate task management systems are generally error-prone and closely monitored by regulators.

Therefore, the SEC and other regulators expect RIAs to generate, preserve, and file massive documentation, perform timely and thorough processes, implement and supervise well-designed policies, and maintain an auditable environment across the firm.

Centralized Compliance Platforms: The Foundation

Today, compliance for RIAs is centralized in one software environment, a compliance platform that combines policy, compliance calendar, training, reporting, and recordkeeping tools into one user-friendly interface, instead of being fragmented into silos of documentation and siloed workflows.

Centralized document management capabilities include indexed archiving to respond to regulatory examination requests, automated alerts for material business events such as Form ADV renewals, trading disclosures, and employee compliance attestations, lowering the risk of missed deadlines.

One source of truth also enables improved transparency and supports firms in monitoring, managing, and evolving their own compliance ecosystem.

Automation: Reducing Risk and Driving Efficiency

Automation is critical for compliance.

Regulatory filings, employee training, and attestations of receipt of policies are examples of repetitive compliance tasks that may be automated to reduce errors and free employees for higher-value activities.

Systems continuously analyze and store electronic communications (email, text, social media posts) where the violations occur most frequently, as well as use AI algorithms to identify unusual communications that may indicate a compliance breach.

Automated trade surveillance systems can mark forbidden or high-risk trades so someone can review them.

Automation reduces risk and costs by decreasing how much companies rely on humans intervening, so companies can scale up while they control operations more tightly.

Cybersecurity Compliance: Protecting Client Data

Because data protectors are secure in 2025 as RIAs regulate with focus, tech solutions now authenticate factors, alert threats in real-time, and store data encrypted.

The burden increases.

Technology platforms can also schedule periodic risk assessments and vulnerability testing, offer automatic reminders, and provide documentation of support for audit preparation.

Staff training technology can offer cybersecurity awareness modules and track completion.

Integrating cybersecurity into a firm’s overall compliance program can show the firm’s intent to protect client information and communications.

Digital Training and Collaboration: Building a Compliance Culture

Human error is a recurring compliance issue within compliance.

Active digital training programs provide advisors and staff with personalized on-demand courses for keeping them informed about regulations and firm policies.

These platforms track training when people complete it to show they comply with the training requirements that regulators set.

Compliance software with modern collaboration tools makes communication easy.

Approvals, reporting, real-time issue escalation, and feedback loops are easier in compliance.

Compliance becomes part of the firm culture, not a disconnected afterthought.

Advanced Analytics and Real-Time Monitoring

Leading RIA firms also rely on analytics platforms and dashboards to assess compliance status in real time by leveraging structured and unstructured enterprise data to predict compliance issues and identify opportunities to improve decision-making.

In addition, predictive analytics enables firms to better test scenarios and stress their compliance programs, better allocate compliance resources, and act proactively around changes to policies, thereby converting compliance from a cost to a competitive advantage.

Emerging AI Solutions and Scalable Technologies

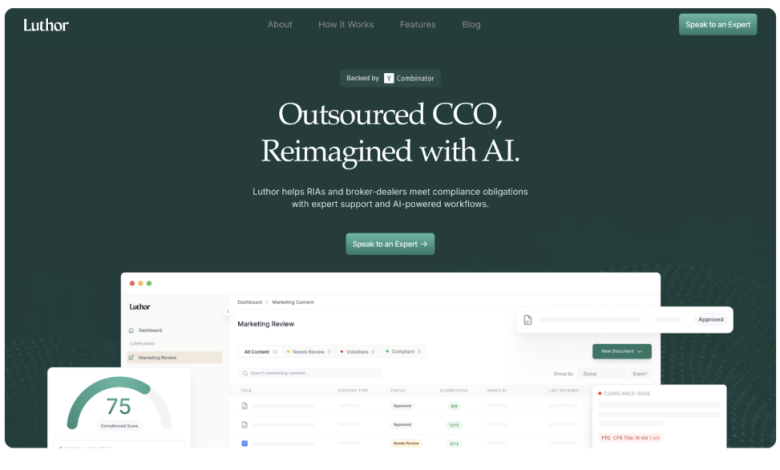

Artificial intelligence platforms, like Luthor.ai, use algorithms to automate workflows, review documents, and monitor communication, making compliance easier and more accurate.

They are scalable as firms grow and regulation increases, provide compliance and technology controls that are right-sized for the firm, and provide a layer of protection against technology misstatements or unsupported claims through transparency and auditability of processes.

In this regulatory environment, RIAs should take advantage of technology that forms the backbone of their compliance programs.

Centralized systems and automation, security, digital training and analytics, and AI tools can create a thorough, scalable ecosystem that reduces risk and the operational burden.

For RIAs, advisor compliance programs are increasingly about the trust, efficiency, and resilience derived from calculated investments in technology rather than just meeting regulatory minimums.

Legislation will continue to change, and firms with smart compliance technology will be well-positioned to thrive in 2025 and beyond.

Not only does technology drive transformation, but it turns compliance from a cost center to a confidence enabler for advisors and their clients.