NEW YORK, Nov. 17, 2025 /PRNewswire/ —

Board of Directors

Priority Technology Holdings, Inc.

c/o Corporate Secretary

2001 Westside Parkway, Suite 200

Alpharetta, GA 30004

Dear Members of the Board of Directors,

Steamboat Capital Partners LLC and its affiliates (“Steamboat”) owns or advises entities owning 1.4 million shares of Priority Technology Holdings (“Priority”), making Steamboat one of the top five outside shareholders in the company based on publicly available information. We are writing to express our concerns related to the price, structure and process of the proposed “take-private” offer from Chairman and Chief Executive Officer Thomas Priore.

We became significant shareholders of Priority after meeting with Mr. Priore and Chief Financial Officer Tim O’Leary in December 2024 in your offices in New York. At that meeting, Mr. Priore shared our view that the company’s equity market valuation did not reflect its strong organic growth prospects, its diversified business model with both pro-cyclical and counter-cyclical revenue drivers, its improving balance sheet, its robust profit margins and its large insider ownership.

We were so optimistic about the future of the company that we hosted Mr. Priore for a fireside chat during an investor presentation for our investors in March 2025 where we praised the company and highlighted its undervaluation relative to its organic growth and relative to comparable publicly traded companies and historical precedent merger and acquisition transactions.

Throughout our investment in Priority, we have viewed Mr. Priore as an asset working as a fiduciary for all shareholders. It is for that reason that we were discouraged to see the preliminary, non-binding offer1 from Mr. Priore to acquire all the shares of the company he does not already own at a price of $6.00 to $6.15 per share. While we share Mr. Priore’s frustration about the public market’s consistent undervaluation of the company, we believe that this offer grossly undervalues the company, its profitable growth prospects and the long-term outlook at Mr. Priore himself has championed, both privately to us and publicly to the market.

First, the proposed acquisition is a highly opportunistic low-ball offer coming two days after the company’s share price fell by thirty percent on Thursday November 6th after a poorly received third quarter earnings release which reduced the company’s 2025 revenue guidance by two percent, yet modestly increased its 2025 EBITDA guidance2. While the offer claims to be a “23% to 26%” premium to the prior trading day’s closing price, it is a 11% to 14% discountto last Wednesday’s price, the day before third quarter results. It is also significantly lower than the average closing price over the ninety trading days before third quarter results and it is lower than the price at which the stock closed on any day during that period.

Second, the offer is a 22% to 23% discount to the price at which the company’s secondary offering was priced in January 2025, which Mr. Priore repeatedly discussed with us privately as undervaluing the company to such an extent that he himself only sold a fraction3 of the shares he was able to. Given that Mr. Priore was largely unwilling to sell his own shares at $7.75 in the January 2025 secondary offering (because the shares had declined from nearly $11 per share immediately prior), it is disheartening to see his acquisition proposal seek to exploit a similar mispricing to disadvantage minority shareholders today, even as the company’s run-rate EBITDA is higher than it was at the time of the January 2025 secondary offering.

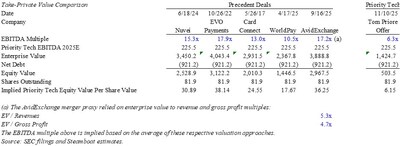

Third, the acquisition offer clearly does not provide fair value for minority shareholders. The private market for payments companies has a deep and robust history of precedent transactions, many of which we have discussed with Mr. Priore, including two recent and very relevant benchmarks in sale of WorldPay by Fidelity National Information Services and GTCR4 and the acquisition of AvidExchange5 by a consortium led by TPG and CorPay. It is important to note that both WorldPay and AvidExchange had lower growth than Priority Tech at the time of their acquisition announcements. A comparison with the valuation multiples from precedent transactions clearly shows that the $6.00 to $6.15 offer from Mr. Priore grossly undervalues the company. Priority’s fair value, based on prior valuation multiples, is far in excess of this range:

Lastly, we are particularly concerned that with a 57% ownership stake in the company, Mr. Priore will not allow a third-party investor to acquire the company at a fair value to all shareholders. We have personal and professional respect for Mr. Priore and the company he has built and led and we share his frustration with the public market’s consistent undervaluation, but we do not think that the solution is to offer minority shareholders a low-ball price at a moment of weakness. Therefore, we find it imperative that a Special Committee of disinterested board members is created with the express mandate to hire appropriate financial and legal advisors to seek strategic alternatives, including acquisition offers for the company from third party financial and strategic acquirers. We are highly confident that the fair value of the company is well in excess of the top of Mr. Priore’s $6.15 offer price but believe that this value may only be realized in an arms-length private transaction, not in the public markets6 and not through an opportunistic low-ball offer.

We also believe that a transaction can be structured to allow Mr. Priore to retain operational and voting control, similar to the position he currently has. The only difference would be to allow minority shareholders to receive the fair value of their shares.

As a fiduciary to all shareholders, the Board – particularly the Special Committee – must reject this inadequate proposal and immediately explore all strategic alternatives to maximize value, with an emphasis on a sale of the company. Shareholders deserve a fair process and a premium that reflects the long-term growth and potential of the company.

Accordingly, we urge the Board to promptly reject the inadequate proposal from Mr. Priore, immediately commence exploring strategic alternatives to maximize value, with an emphasis on a sale of the company at a fair multiple and communicate transparently with shareholders. We are prepared to join other shareholders in opposing any transaction that does not deliver full and fair value. We look forward to a prompt response from the company and its advisors, and reserve the right to share this letter publicly if we do not.

Sincerely,

Parsa Kiai

Managing Partner

Steamboat Capital Partners LLC

CC: Thomas Priore

1

https://www.sec.gov/Archives/edgar/data/1653558/000121390025107859/ea026471901ex99-1_priority.htm

2 See Priority Second Quarter 2025 Earnings guidance compared with the Third Quarter 2025 Earnings guidance:

2Q: https://www.sec.gov/Archives/edgar/data/1653558/000165355825000099/ex991-prthq22025earningsre.htm

3Q: https://www.sec.gov/Archives/edgar/data/1653558/000165355825000121/ex991-prthq32025earningsre.htm.

3 In the preliminary Form S3 for the secondary offering, Mr. Priore registered 1.0 million shares (out of existing ownership of 46.8 million shares) but only sold 294,167 shares given the disappointing offering price, which was a 28% discount to the company’s share price of $10.70 prior to the announcement of the offering.

Preliminary: https://www.sec.gov/Archives/edgar/data/1653558/000110465924123753/tm2429676d1_s3.htm

Final: https://www.sec.gov/Archives/edgar/data/1653558/000110465925004292/tm253610d2_424b5.htm

4https://www.fisglobal.com/about-us/media-room/press-release/2025/fis-sale-of-worldpay-stake-and-strategic-acquisition-of-global-payments-issuer-solutions-business: “The sale of 45% of Worldpay for $6.6 billion represents a multiple of approximately 10.5x expected 2025 EBITDA, a premium to the 9.8x valuation of FIS’ February 2024 sale of its 55% stake in Worldpay.” (emphasis added)

5https://www.sec.gov/Archives/edgar/data/1858257/000114036125031402/ny20049415x8_defm14a.htm: (see page 54 through 56 discussing the appropriate EBITDA valuation multiples ranging from 13 times to 18 times).

6 We believe that Mr. Priore’s offer may actually serve as a “ceiling” to prevent Priority’s stock from achieving its potential. For example, analysts at Keefe Bruyette & Woods reduced their price target from $9 per share to $6.00 to reflect Mr. Priore’s offer, even with higher future financial forecasts.

Media Contact:

Parsa Kiai

[email protected]

View original content to download multimedia:https://www.prnewswire.com/news-releases/letter-to-the-board-of-directors-of-priority-technology-holdings-302617413.html

SOURCE Steamboat Capital