Going public is one of the most defining moments a company can face. It unlocks access to large-scale capital, boosts public visibility, and accelerates growth. But the process is high-stakes and complex, with success depending on a mix of factors such as market timing, investor sentiment, regulatory readiness, and company’s financial position. Traditionally, these decisions have relied heavily on human judgment and underwriter experience.

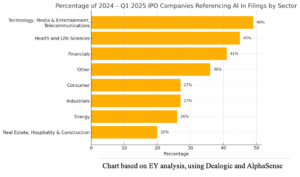

Now, artificial intelligence (AI) is beginning to transform the IPO landscape. From identifying the right moment to list to estimating investor appetite and pricing, AI has the potential to reshape how firms plan and execute their offerings. According to EY, recent IPO activity shows that companies are actively using AI to enhance their appeal to investor. Across the 2024 to Q1 2025 IPO cohort, AI was most frequently referenced by firms in the Technology, Media & Telecommunications (49%), Health and Life Sciences (45%), and Financials (41%) sectors.

Timing the Market: When to Go Public

Deciding when to go public involves a blend of market insight, strategic judgment, and timing. Market timing plays an important role in IPO outcomes, affecting both firm valuation and how the offering is received by investors. Research shows that firms often go public during periods of heightened investor optimism and favorable market conditions, creating rational IPO waves.

AI provides a powerful data-driven lens for navigating this decision. By analysing a wide range of indicators including economic indicators, industry trends, interest rate movements, and past IPO activity, machine learning models can detect patterns that humans might overlook.

Advanced tools are increasingly able to forecast short- and medium-term market trends with notable precision. For example, algorithms can identify “hot” IPO windows. They can incorporate variables such as earnings cycles, geopolitical events, and capital market dynamics to suggest favorable listing opportunities. This helps firms choose calmer periods to launch, improving visibility and investor attention.

Testing Market Conditions Through Simulation

AI can also help companies anticipate how the market might respond to an IPO before any formal steps are taken. By running simulations using historical data, peer IPO outcomes, and sentiment analysis, firms can model potential investor reactions under different scenarios. This enables decision-makers to stress-test various strategies, adjusting for changes in pricing, timing, or messaging, before committing to a final plan.

A key use case is helping determine the right price range to attract investor interest without leaving value behind. AI models can analyse data from recent IPOs, financial performance of comparable firms, investor demand signals, and broad market sentiment to generate empirically grounded pricing ranges. These tools can simulate how different price points affect investor appetite and offering outcomes. During the book-building phase, AI can also process real-time order data to help underwriters refine pricing based on actual demand.

Generative AI and predictive analytics also support broader strategic planning. By modeling demand curves and investor behaviour across varying inputs like sector classification, pricing and macroeconomic outlook, simulations can inform decisions on share allocation, investor targeting, and roadshow messaging. This helps firms tailor their approach in real time, making investor outreach more targeted and effective.

Recent advances in reasoning-based AI are pushing simulations even further. Microsoft’s collaboration with Swiss start-up Inait, which aims to build systems that mimic human-like reasoning, shows where this is headed. These models go beyond surface-level pattern recognition to make context-aware projections. Such capabilities are well suited for navigating uncertainty in market reactions and shaping IPO strategy with greater confidence.

Streamlining IPO Preparation and Compliance

Beyond strategic modeling, AI is also reshaping the behind-the-scenes work involved in getting a company ready to go public. Preparing for an IPO means producing extensive documentation, including regulatory filings, financial statements, and investor prospectuses. These documents need to be accurate, up to date, and meet evolving regulatory expectations. AI-powered tools, especially those that use natural language processing, help automate and standardise the drafting, review, and formatting of these materials.

One well-known example is Workiva, a platform that integrates generative AI into IPO workflows. Its tools help teams draft and refine key sections of SEC filings, offering smart suggestions, inline edits, and consistency checks across documents. This reduces manual effort and improves both accuracy and compliance. By handling time-consuming, rule-based work, AI allows IPO teams to focus more on strategic messaging and investor engagement, which helps accelerate preparation and reduce the risk of regulatory delays.

Enhancing Post-IPO Market Intelligence

AI continues to add value even after a company has gone public. In the post-IPO phase, AI tools help firms track investor sentiment, news coverage, social media trends, and analyst commentary in real time. This helps them spot shifts in perception early, whether it’s concern about business performance or growing interest in specific initiatives. Staying alert to these changes helps firms stay ahead of potential reputation risks.

These insights also support more targeted communications. Companies can tailor investor updates, earnings calls, and follow-up messaging with greater precision. AI-powered dashboards can highlight unusual patterns in stock performance relative to sentiment signals. This helps firms stay responsive to changing expectations from both institutional and retail investors.

Human-AI Collaboration: A Smarter Way Forward

While AI offers powerful tools, it does not replace human judgment. Its real strength is in supporting better decisions; not replacing human insight. Executives, underwriters, and legal advisors still play a vital role in interpreting data, navigating regulations, and shaping the overall IPO story. Human judgment is still crucial for weighing trade-offs and applying context that technology alone cannot provide.

The most effective IPO strategies will be those that combine human expertise with AI-driven insights. This hybrid approach allows firms to respond quickly to data while considering factors like brand identity, leadership vision, and long-term strategy. AI improves clarity and consistency, but it cannot remove all uncertainty. With the right balance, companies can enhance decision-making and improve their chances of a successful public debut.