As we stand at the threshold of the AI agent era, we are witnessing the early signs of a technological shift that promises to redefine the future of enterprise software. For more than two decades Software-as-a-Service (SaaS) has revolutionized software delivery and business operations by streamlining processes, improving access to tools, and scaling rapidly across industries.

The SaaS market as a whole is booming with projected revenue of $328.20 billion in 2024 and an impressive CAGR of 19.30% expected to drive the market to $793.10 billion by 2029 (Source- Statista). However, as impressive as these numbers are, they reflect optimization—not reinvention. The rise of Agentic AI might lead to a new era— one that could deliver 5-10x more value than traditional SaaS.

What is Agentic AI and What Can It Do?

Unlike traditional and generative artificial intelligence (AI) that responds to prompts or isolated tasks, Agentic AI systems are autonomous and goal-driven. What makes them different is their ability to set objectives, adapt to evolving circumstances, device plans and take initiatives in completing tasks. Therefore, making them more proactive collaborators who can reduce repetitive administrative tasks and allow individuals to focus on strategic decision-making.

Agentic AI represents a significant evolution in AI, characterized by self-governing agents which are often driven by large language models (LLMs) and sophisticated decision-making frameworks that can independently perform complex, goal-oriented tasks. In contrast to traditional SaaS, which primarily automates manual workflows, Agentic AI:

- Determines goals autonomously and executes multi-step tasks without human micromanagement.

- Learns and adapts continuously from new data and interactions.

- Operates 24/7, processing massive volumes of requests without fatigue.

- Integrates external knowledge — combining structured data, unstructured documents, and AI models to make governed and explainable decisions. (Source: Release.nl)

Why Agentic AI Outperforms Traditional SaaS

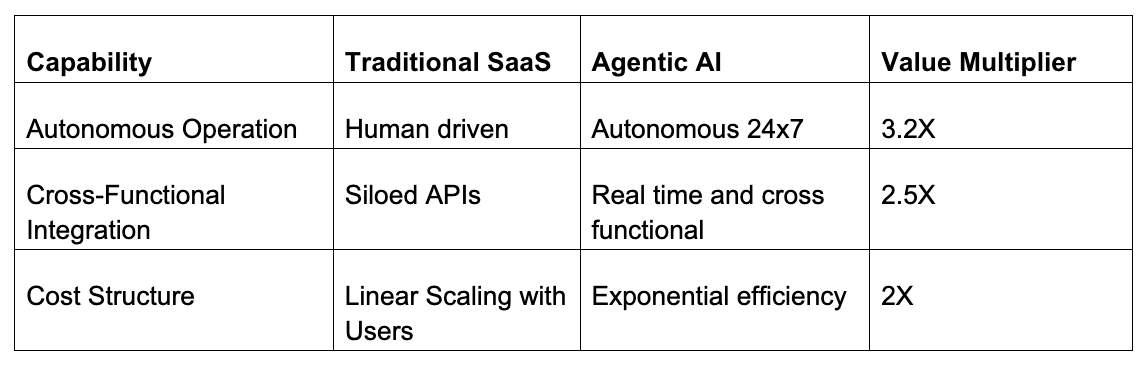

Though SaaS transformed enterprise software delivery through centralized data, automated workflows, and improved accessibility, the process of decision-making is still completely reliant on human oversight. SaaS platforms require human intervention to interpret data, initiate actions and co-ordinate across different systems and departments. Agentic AI, on the other hand, is completely independent and proactively analyzes data, executes multi-step tasks, and continuously improves its performance. This allows businesses to overcome the bottlenecks typically emerging in SaaS environments where multiple applications often operate in isolated silos, requiring manual coordination. We used the framework below to quantify the potential uplift-

Total Value Multiplier = Autonomy Multiplier × Integration Multiplier × Cost Multiplier

This framework delivers significant value multipliers:

In industries like insurance, these efficiencies, once multiplied, suggest a total impact multiplier of 7–9x for Agentic AI over conventional SaaS platforms. These estimates are based on the author’s real-world experience together with internal modeling of AI adoption business cases and logical comparison between traditional SaaS and Agentic AI. Below is the rationale behind these multipliers:

- Autonomous Operations multiplier: Agentic AI automates tasks traditionally performed by humans. For example, in customer service, AI agents can immediately analyze a customer’s issue, access relevant systems autonomously, generate personalized responses, implement solutions, and monitor outcomes. This delivers significant time and capacity savings and allows human workers to focus on more higher-level activities.

- Cross-Functional Integration multiplier: Most SaaS applications today are siloed, requiring separate logins, interfaces, and workflows. Agentic AI acts as a unified intelligence layer that interfaces with all systems in real-time, eliminating context switching and streamlining workflow integration.

- Cost Structure multiplier: SaaS licenses are often charged per employee, including training and support costs. Agentic AI reduces these expenses through license cost reduction, training elimination, and fewer support staff needs.

When considering the shift from traditional SaaS to Agentic AI, there are three interconnected risk categories that organizations must navigate carefully, namely,

- Technical risks center around the complex challenges of integration, performance scaling, and data quality. These require a methodical, phased approach with continuous testing to mitigate effectively.

- Operational risks that shift to business continuity, change management, and resource allocation — areas where hybrid approaches and progressive transitions are crucial for maintaining stability while driving transformation.

- Strategic risks encompass market timing, competitive positioning, and regulatory changes, which require adaptive planning and regular assessment to navigate successfully.

By following a comprehensive and risk-aware approach, organizations can minimize disruptions while unlocking the full potential of this agentic transformation.

Power of Agentic AI in the Insurance Sector

For industries such as insurance, which are deeply data-intensive, process-heavy, and highly regulated, the potential applications of Agentic AI in day-to-day work is considerable. By reducing manual intervention, enhancing accuracy, and enabling real-time decisions, Agentic AI can streamline operations across several core functions in the insurance sector acting as augmentation to human experts in each role:

- Claims Processing: Coordinated Intelligence for Exponential Gains: Current fragmented automation systems—computer vision for damage assessment, LLMs for document processing, and predictive models for payouts—operate in isolation, creating inefficiencies and handoff delays.

- Agentic AI could transform this landscape by deploying autonomous agents that orchestrate the entire claim flows upon First Notice of Loss (FNOL), seamlessly coordinating claims triage and priority routing, property damage assessment via imagery, document processing and classification, settlement calculations, and subrogation recovery identification.

- These AI agents could provide comprehensive adjuster decision support, automatically flagging legal, liability, and coverage anomalies while enabling near real-time resolution.

- The potential impact is substantial: up to 60-80% reduction in processing time for low complexity claims, faster adjuster cycle times with increased claim validation accuracy, and higher subrogation and salvage recovery through automated opportunity flagging.

- Risk Assessment: From Sequential to Autonomous Underwriting: Traditional underwriting workflows remain linear and fragmented, requiring manual coordination between document classification, OCR (or Optical Character Recognition enhancement, entity recognition, and risk evaluation models across five or more distinct stages.

- Agentic AI could revolutionize this approach by creating autonomous orchestration across the entire risk processing workflow—from initial risk ingestion through data digitization, risk evaluation, intelligent routing, and analytics insights.

- These systems could seamlessly coordinate document classification models and source priority systems during risk ingestion, while simultaneously deploying OCR enhancement, named entity recognition, and LLM text extraction models for comprehensive data digitization. During risk evaluation, agentic AI could autonomously integrate risk scoring models, claims prediction algorithms, industry classification systems, financial stability models, fraud detection capabilities, pricing engines, and portfolio fit assessments—all while maintaining custom-configured rules that evaluate risks against insurer appetite and criteria. Rather than requiring human intervention between each stage, intelligent routing through underwriter assignment models, priority scoring systems, workflow optimization algorithms, capacity management models, and decision path frameworks could enable qualified risks to flow seamlessly to appropriate destinations in a decision-ready format.

- The anticipated transformation includes significant up to 50-70% improvement in risk selection accuracy through continuous learning models that drive future insights and appetite refinement strategies, straight-through processing for standard risks, and significantly reduced underwriting delays while maintaining rigorous human oversight through integrated flagging models for complex cases requiring expert judgment.

- Fraud Detection: Current fraud detection systems operate reactively with modular approaches limited to pattern detection after claim submission, creating gaps that sophisticated fraudsters exploit.

- Agentic AI could establish continuous agent networks operating across all insurance functions, proactively flagging threats, validating documents, and reducing false positives through intelligent claims investigation referral routing, organized crime ring detection via advanced network analysis, comprehensive social network and behavioral pattern analysis, photo and document authenticity verification, sophisticated pattern recognition for suspicious claims, and streamlined fast-track routing for verified non-fraudulent claims.

- The potential impact includes significant reduction in fraud, particularly in organized fraud and soft fraud scenarios, faster fraud triage enabling Special Investigation Units to focus on high-impact cases, and increased trust in automated claim systems through explainable fraud alerts and transparent decision-making processes.

To summarize, the growth of Agentic AI hints at a complete redefinition of how enterprise software operates. While SaaS has already optimized existing processes by automating them, Agentic AI creates new possibilities by combining autonomy with real-time data integration, and constant learning to drive exponential growth. Importantly, Agentic AI is not intended to replace human expertise, but to augment it — by taking over repetitive, data-heavy tasks, it will empower individuals to focus on strategic decision making that requires human capabilities.

For the insurance sector, Agentic AI offers a rare prospect to enhance operational efficiency as well as improve decision-making accuracy, while allowing individual workers to focus on high-value, customer-centric innovation. As early adopters are already demonstrating, Agentic AI has the potential to deliver 5–10x greater impact than traditional SaaS models — ushering in a new era for the insurance industry and beyond.