Teams are beginning to use AI to access data more efficiently, improve forecasting, and support collaboration. However, especially in certain functions like finance, where managing risk is paramount, teams are understandably cautious in their approach to adoption.

But technology is continuing to evolve, and a new shift is quietly taking place: the emergence of autonomous decision-making, powered by AI agents. Though still early on their adoption curve, these agents are working behind the scenes to anticipate needs, adapt to changing conditions, and take action. Business teams that seize this opportunity will find themselves on their front-foot compared to those who wait.

Let’s explore how.

From reactive to proactive

Historically, AI has been a somewhat reactive participant in business operations – responding to prompts to parse data, surface trends, and forecast. Agentic AI takes us beyond simple automation.

These systems don’t wait for a string of prompts to tackle complex tasks. Once given a single instruction, they run autonomously in the background – proactively executing sophisticated workflows with minimal human input. What’s more, they collaborate and learn from each outcome, establishing a continuous feedback loop of self-improvement.

From real-time forecasting and dynamic scenario planning to risk management and anomaly detection, their impact is already visible and tangible.

Spotlighting the finance function and the CFO

One area where agentic AI is starting to become transformative is the finance function, particularly in the context of an increasingly volatile economy.

The latest tariff developments and continued economic instability are causing financial leaders and their institutions a headache. Trade policy is notoriously complex for businesses to navigate. CFOs must assess not only the downstream impact of specific regulations on functions like their supply chain, but also how their business may be affected by the wider impact on regional and global economies.

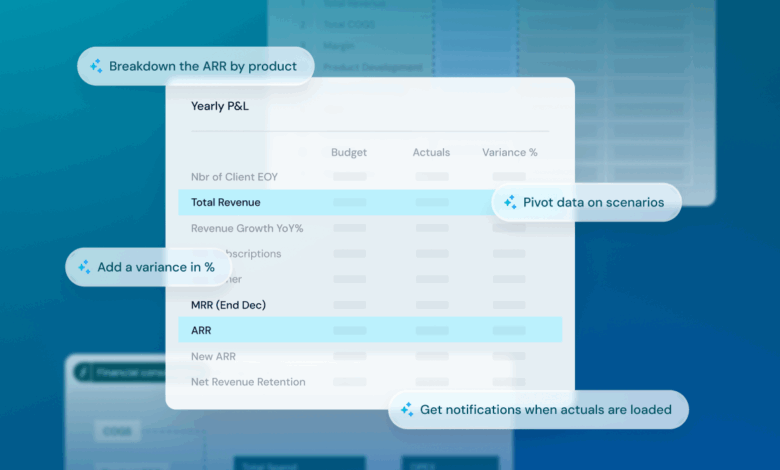

How does agentic AI fit into this? Introducing AI agents for finance teams has opened new doors to autonomous planning, real-time insights, and more proactive risk mitigation. AI agents can do more than just streamline processes like reconciliation and financial reporting – they can work independently and proactively as an extension of the team to help CFOs stay one step ahead of today’s fast-moving business environment.

Imagine a world where a forecasting model not only reacts to past trends but also continuously learns from new data, anticipates market shifts, and updates projections in real time. AI agents can simulate the financial impact of global events – from supply chain disruptions to new regulatory policies – and run thousands of scenarios to understand how these could impact the business well before the numbers show up on your financials. Once it’s run thousands of scenarios, the technology can then advise on the best ones for your business, taking into account various parameters such as your long-term company objectives.

This enables CFOs to drive more informed and strategic decision-making for their business.

Beyond the finance function

However, finance isn’t the only function that is starting to realise the benefits.

Picture yourself in an HR department of a global organisation with dozens of departments and hundreds of employees spread across offices and countries. It’s performance review season, and leadership wants a snapshot of team composition over the past quarter: Who joined? Who left? Were there any sudden departures in high-impact roles?

Normally, this would mean requesting reports from multiple teams, cross-referencing spreadsheets, and manually updating charts. With agentic AI, however, we’re already seeing how workforce movement and dynamics are becoming visible in near real-time.

These agents automatically track and synthesise data on new hires, internal transfers, and exits across departments, helping flag trends like attrition spikes in specific regions or roles. For HR and their collaboration with teams like finance, this translates into greater efficiency and more informed decisions across resourcing, organisational design, and succession planning.

Two golden rules for implementation

AI agents are poised to disrupt and redefine how a number of different business functions operate. However, there are important considerations that need to be front of mind as attention turns towards implementation.

Firstly, regardless of the primary objective for AI adoption, maximizing ROI requires having the right foundations in place. AI can only be as good as the data you feed it. If data sources are poor quality, disparate, or inaccurate, then you will get lacklustre results no matter how powerful the AI capabilities might be.

Secondly, for AI to be truly effective and seamless, it requires an organisation-wide strategy. CFOs should work alongside their CTOs and CIOs to ensure their data foundations are sound, so that when new tools or platforms are added, teams can trust the data and outputs from AI are accurate. It also helps to start small. Get clear on exactly the use case for AI and test this out before building it out further.

A strategic imperative

According to McKinsey, 78% of business leaders say AI has already improved operational efficiency and decision-making. But agentic AI offers more than marginal gains.

It promises a step-change in how decisions are made, risks are managed, and opportunities are seized. It has the power to change a business’s trajectory and results, finding new pathways to accelerate growth, drive higher margins, and identify the right opportunities to make trade-offs.

AI isn’t just about unlocking new levels of efficiency – it’s giving businesses faster, smarter access to the insights in an increasingly unpredictable world. Those who embrace this shift and harness the power of AI won’t just have a significant edge over their competition – they’ll redefine their industries.