Abstract: This paper examines strategies for building and operating sustainable infrastructure for digital assets such as cryptocurrencies. It addresses the high energy consumption and carbon footprint associated with the operation of blockchain networks and data centers. The aim of the study is to systematize approaches to minimizing the environmental impact of digital asset infrastructure. The objectives include analyzing current energy consumption, exploring the potential of renewable energy sources (RES), considering technological solutions to improve energy efficiency, and assessing economic and regulatory factors. Practical strategies are presented, including choosing a data center location, using RES, optimizing cooling systems, and recovering heat. The results of the study can be applied by fintech companies, data center operators, investors, and regulators to develop and implement more environmentally friendly practices in the digital asset industry, contributing to the achievement of sustainable development goals.

Keywords: green fintech, digital assets, sustainable infrastructure, cryptocurrency mining, data centers, renewable energy, energy efficiency, ESG, carbon footprint.

The rapid development of the financial technology sector and the spread of digital assets are accompanied by a growing need for specialized computing infrastructure.

Data centers that support the operation of blockchain networks, cryptocurrency mining, and other processes are characterized by high levels of energy consumption. A significant portion of this energy is still generated from fossil fuels, which leads to substantial greenhouse gas emissions and exacerbates the issue of climate change [4]. The relevance of reducing the environmental footprint of the fintech industry is driven by the global climate agenda, tightening environmental regulations, and the growing demand from investors and consumers for compliance with ESG (Environmental, Social, Governance) principles.

The purpose of this article is to analyze and systematize scientific and practical strategies for building and managing sustainable infrastructure for digital assets.

Energy Intensity of Digital Asset Infrastructure and Its Impact

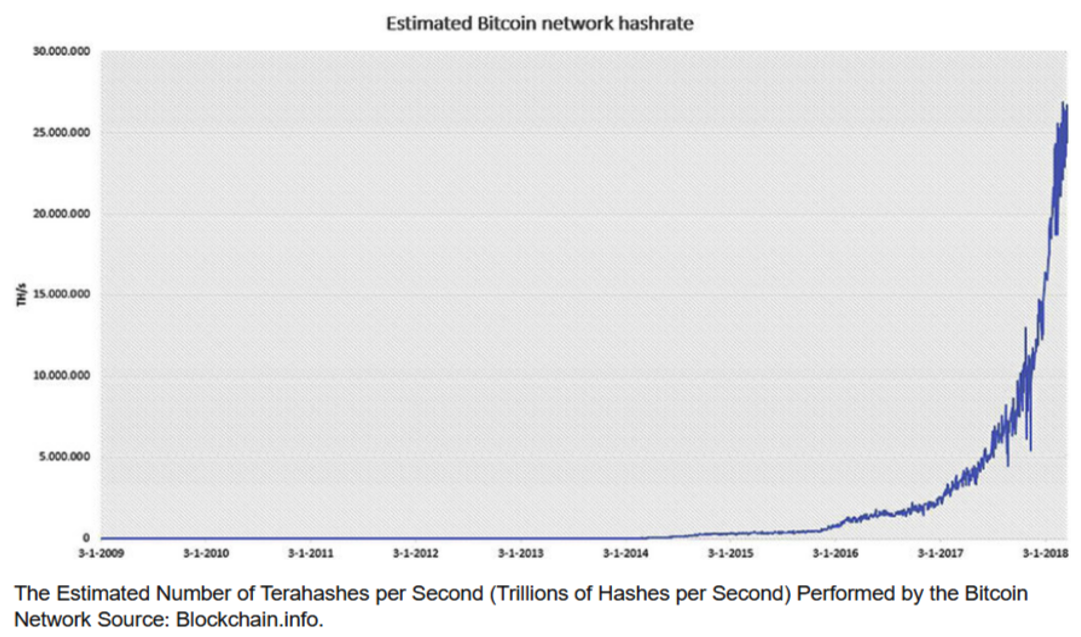

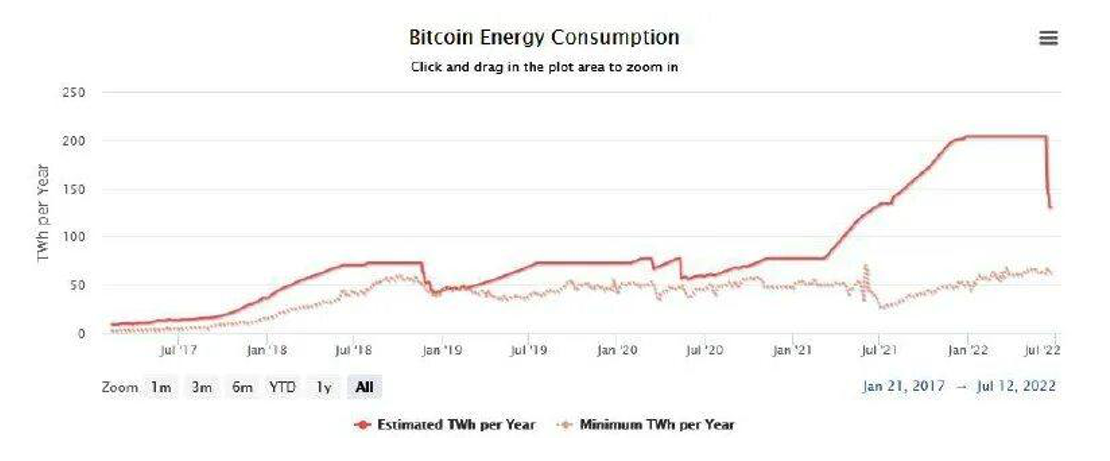

The operation of many blockchain networks—especially those using the Proof-of-Work (PoW) consensus algorithm—requires enormous computing power and, accordingly, significant electricity consumption. Studies show that the annual energy consumption of the Bitcoin network is comparable to that of entire countries [1].

Similar trends are observed for other major cryptocurrencies, albeit on a smaller scale [2].

The main sources of energy consumption are the operation of specialized computing equipment (such as ASIC miners) and cooling systems required to maintain optimal temperatures in data centers. The reliance on fossil fuels in the global energy mix results in the carbon footprint of the digital asset industry becoming a matter of serious concern [4].

High energy intensity creates not only environmental but also economic challenges for infrastructure operators, as electricity costs constitute a significant share of their operating expenses. This stimulates the search for solutions aimed at improving energy efficiency and using cheaper and more environmentally friendly energy sources.

Use of Renewable Energy Sources

One of the promising directions for reducing the carbon footprint of digital asset infrastructure is the transition to renewable energy sources. Strategically locating data centers in regions with high renewable energy potential—such as hydroelectric power (e.g., in Scandinavia, Canada), wind, or solar generation—can significantly reduce greenhouse gas emissions [3]. Operators can enter into direct electricity purchase agreements (Power Purchase Agreements, PPAs) with renewable energy producers or invest in their own generation.

However, the use of renewable energy sources is associated with certain challenges. The uneven output of solar and wind energy requires the use of energy storage systems or hybrid power supply schemes. Geographic dependence on renewable sources may limit location options for data centers. Nevertheless, the economic feasibility of using renewables is increasing as the cost of renewable energy technologies decreases and carbon pricing mechanisms are introduced [6].

Technologies for Improving Data Center Energy Efficiency

In parallel with the transition to renewable energy, the implementation of advanced technologies to reduce infrastructure energy consumption is necessary. This includes the use of more energy-efficient computing equipment, optimization of data center architecture, and the application of modern cooling systems.

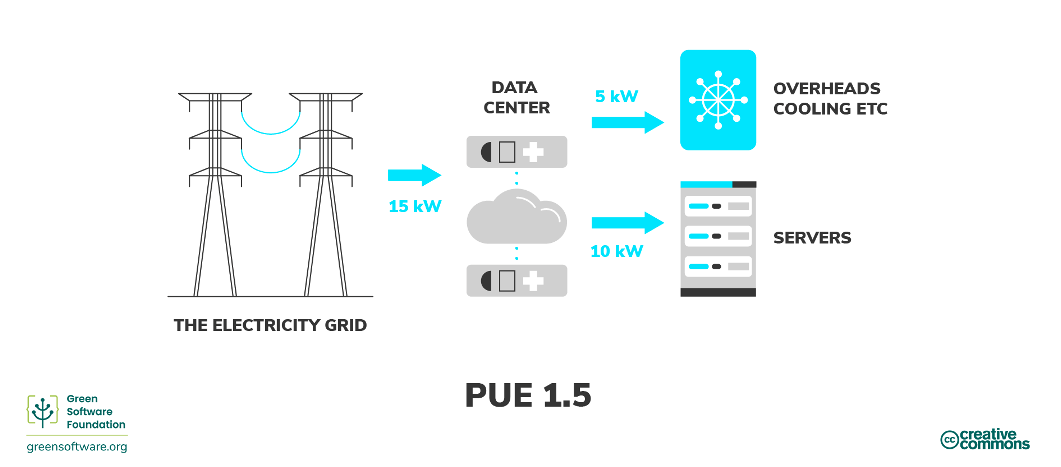

The Power Usage Effectiveness (PUE) indicator, which represents the ratio of total data center energy consumption to the energy consumption of IT equipment, is a standard measure of efficiency. Lowering PUE is achieved through technologies such as free cooling (using outside air for cooling), liquid immersion cooling, which removes heat directly from equipment components, and heat recovery systems, where excess heat from data centers is used to heat nearby buildings or greenhouses [5]. Optimization of airflow within data centers, the use of intelligent energy management systems, and resource virtualization also contribute to improving overall energy efficiency.

Economic and Regulatory Factors of Sustainability

The creation of sustainable infrastructure not only meets environmental requirements but is also economically justified. Reducing energy costs directly impacts operating profit. Companies that demonstrate a commitment to ESG principles gain advantages in attracting investments and increasing customer loyalty [6].

Regulatory pressure also stimulates the transition to “green” practices. The introduction of carbon taxes, emissions trading systems, and environmental impact disclosure requirements compel companies to revise their strategies. The development of green finance standards and the emergence of specialized “green” bonds create additional incentives for investing in sustainable infrastructure [6]. Coordination between regulators, investors, and the industry itself is essential to accelerate the transition to an environmentally responsible model for the operation of digital assets.

Thus, building and managing sustainable infrastructure for digital assets is a complex task requiring the integration of technological, economic, and strategic approaches. The analysis shows that reducing the environmental footprint is achieved through a combination of measures: transitioning to renewable energy sources, implementing advanced energy-efficient technologies in data centers, and accounting for economic and regulatory incentives.

Strategic planning of infrastructure location, the use of renewable energy through PPAs or self-generation, the application of efficient cooling systems (including immersion cooling), and heat recovery systems are practical steps for operators. From an economic standpoint, the long-term benefits of reducing energy costs and improving the ESG profile may outweigh the initial investments.

Recommendations for the industry include active implementation of energy efficiency standards, increased transparency in disclosing data on energy consumption and energy sources, and collaboration with regulators to create a favorable environment for “green” investments. These strategies are universally applicable but require adaptation to specific regional conditions, renewable energy availability, and regulatory landscapes. Further research may focus on a comparative analysis of the effectiveness of different sustainable infrastructure technologies and the development of standardized methodologies for assessing their environmental impact.

References

- De Vries A. Bitcoin’s growing energy problem // Joule. 2018. Vol. 2, No. 5. P. 801–805.

- Gallersdörfer U., Klaaßen L., Stoll C. Energy Consumption of Cryptocurrencies Beyond Bitcoin // Joule. 2020. Vol. 4, No. 9. P. 1843–1846.

- Masanet E., Shehabi A., Ramakrishnan L., Liang J., Ma X., Jones C., He J. The energy and carbon footprint of the global data center industry // Science. 2020. Vol. 367, No. 6481. P. 981–983.

- Mora C., Rollins R. L., Taladay K. [et al.]. Bitcoin emissions alone could push global warming above 2°C // Nature Climate Change. 2018. Vol. 8, No. 11. P. 931–933.

- Shehabi A., Smith S., Sartor D. [et al.]. United States Data Center Energy Usage Report / Lawrence Berkeley National Laboratory. 2016. LBNL-1005775.

- United Nations Environment Programme. Financing Climate Action: Aligning financial systems with the Paris Agreement. Nairobi: UNEP, 2021. 88 p.