Despite years of digital transformation in banking, one critical area still lags behind: collections. It is the part of the customer journey that few talk about, but almost every customer remembers it, often for the wrong reasons. In a sector where user experience has become the battleground for loyalty, the collections process remains surprisingly disconnected. Missed EMIs trigger multiple calls from different departments, with no unified view of the customer.

What should be a moment for constructive engagement often becomes a source of irritation, damaging trust in the institution; this gap reflects a larger issue. While banks have embraced front-end digitisation, their back-end processes remain fragmented. The result is a polished interface masking broken workflows. If financial institutions are serious about delivering seamless experiences and improving outcomes, they must bring collections out of the shadows and into the centre of customer strategy, that transformation is now possible.

Debt collections management systems are expected to solve three main expectations: predictability of collections, adherence to compliance, and reputation with customers. Thanks to AI-driven debt collections management systems, these can be solved much more easily now.

Moving from Fragmentation to Intelligence

Collections have traditionally been viewed as a post-sale function focused solely on recovery. However, as credit penetration deepens and regulations tighten, this approach is outdated. The Reserve Bank of India’s March 2024 Financial Stability Report shows a gross NPA ratio of 2.7 percent, with projections suggesting a rise to 3 percent by 2026. These numbers highlight the need for smarter, more proactive customer management strategies.

Modern BFSI institutions must treat collections as a strategic lever for both risk management and customer engagement. This requires breaking down internal silos and embedding collections into the broader customer lifecycle. AI-powered Debt Collections Management Systems enable institutions to do exactly that. Rather than operating in isolation, collections teams can now work with real-time context: payment history, past service requests, and customer sentiment. This allows them to drive more informed, empathetic conversations.

Empowering Teams, Enhancing Outcomes

What were previously manual processes are quickly becoming not only automated, but increasingly personalized and outcome-oriented, thanks to the incredible speed of advances in Gen AI. It is now possible to generate personalized treatment plans for every customer based on their risk, intent, and ability to pay. Voice agents can call customers automatically, and can also provide real-time guidance to tele-collections teams. Field collectors, who are yet to fully embrace mobility, can now get an autonomous agent that can assist them with a prioritized set of cases, personalized route plans, a strategy for each customer, and even have the system fully convert their observations into precise data enrichment and next best actions.

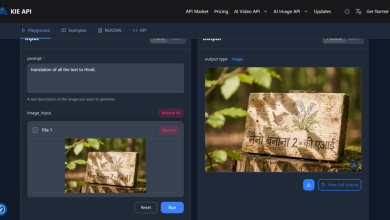

Lengthy settlement, legal, and repossession workflows can now be mostly agentic. We all read about (and use) LLMs, AI-generated documents, images, videos, etc. The technology can already be used for business, compliance, and reputation-critical debt collections management processes.

Data-Driven Insights for Continuous Optimization

The true power of an AI-led strategy shows once models ingest live repayment behaviour. Every call, click, or promise to pay becomes a fresh data point that sharpens segmentation overnight.

Models that were refreshed infrequently now update continuously, enabling organizations to test, learn, and redeploy agents within a single shift. Over time, this closed feedback loop lifts recovery rates while steadily lowering the cost of collection.

As patterns emerge in real-time, strategies evolve from static scripts to responsive playbooks. What once took weeks of analysis now happens in moments, turning complexity into clarity. AI surfaces micro-trends that human eyes might miss, driving smarter decisions at scale. The result is a self-improving ecosystem where performance gains compound over time.

Ensuring Ethical and Fair Practices

Compliance is moving from monthly audits to real-time checkpoints embedded within every workflow. Fairness monitors flag any drift that disadvantages a segment, pausing campaigns until models are retrained. Detailed decision logs give regulators a transparent trail that proves an escalation or waiver was justified by objective risk. Coupled with clear consent journeys, these controls reassure customers that digital efficiency still honours dignity.

Every model update passes through fairness and compliance checks before going live, reducing the risk of unintended harm. Instead of relying solely on post-hoc reviews, teams now act on issues as they emerge. These mechanisms support consistent outcomes across regions, demographics, and channels. Ethical safeguards are no longer separate, and they’re part of the system’s foundation.

From Transactions to Experiences

The future of financial services lies in integrated, experience-led engagement. Customers do not separate collections from service or sales. For them, every interaction is part of a single conversation with the brand. To remain competitive, financial institutions must adopt the same mindset. Collections should no longer be an afterthought.

Instead, it must be seen as an opportunity to build trust, show responsiveness, and create consistency across the entire journey. This is not just about deploying AI. It is about reframing how institutions view their most sensitive customer moments and turning them into opportunities for long-term engagement. Financial institutions have an opportunity to turn their collections agents into customers’ debt managers and eventually into their relationship managers.