Wealthsimple Ranks Highest in Investor Satisfaction

TORONTO–(BUSINESS WIRE)–Strong capital markets performance and reduced trading fees are driving increased satisfaction among do-it-yourself (DIY) investors in Canada. According to the J.D. Power 2024 Canada Self-Directed Investor Satisfaction Study,SM released today, overall satisfaction with self-directed brokerages rises to 631 (on a 1,000-point scale), a significant 33 points higher than in 2023.

The lift in overall satisfaction this year is mainly driven by the younger investors, especially Gen Y1 and to some extent Gen Z, whose scores increase an average of 71 and 24 points, respectively. While scores among Gen X also rise 21 points year over year, this generational group still has the lowest scores on average.

“The ranking draws a very distinct line among the firms that are perceived as having low fees or no fees as having significantly higher satisfaction,” says Craig Martin, executive managing director and head of wealth and lending intelligence at J.D. Power. “In 2024, low fees became the top reason given by new self-directed clients for selecting a firm, followed by personal recommendations. This has replaced the top answer in prior years: previous experience/relationship with the firm. This represents a potential threat to firms in which existing relationships with the organization are the main draw for new clients and could have broader implications about where clients choose to seek wealth management services.”

Following are additional key findings of the 2024 study:

- Unclear fees harm trust: Getting clients to understand brokerage fees remains a necessary element, with the proportion of investors saying they completely understand the fee structure declining to 52% from 59% in 2023. Trust dimension scores are 89 points lower (on a 1,000-point scale) when clients indicate they don’t completely understand fees.

- Younger investors continue to opt for fintechs: Pure DIY brokerages continue to attract the younger demographics with 66% of these firms’ clients being Gen Y or younger, while the Big 5’s client mix is the exact opposite: 66% are Gen X or older. This represents a growing risk for the Big Banks as the Gen Y and younger segment represents an increasing proportion of DIY investors.

- Testing the waters: Nearly one-fourth (24%) of self-directed investors confirmed that they have another brokerage account with a different firm. Two-thirds (67%) of these investors indicated that their other self-directed account performed about the same or better than their primary DIY account. Those who said their secondary account performed better are nearly twice as likely to say they will decrease the amount invested with their current firm in the coming year.

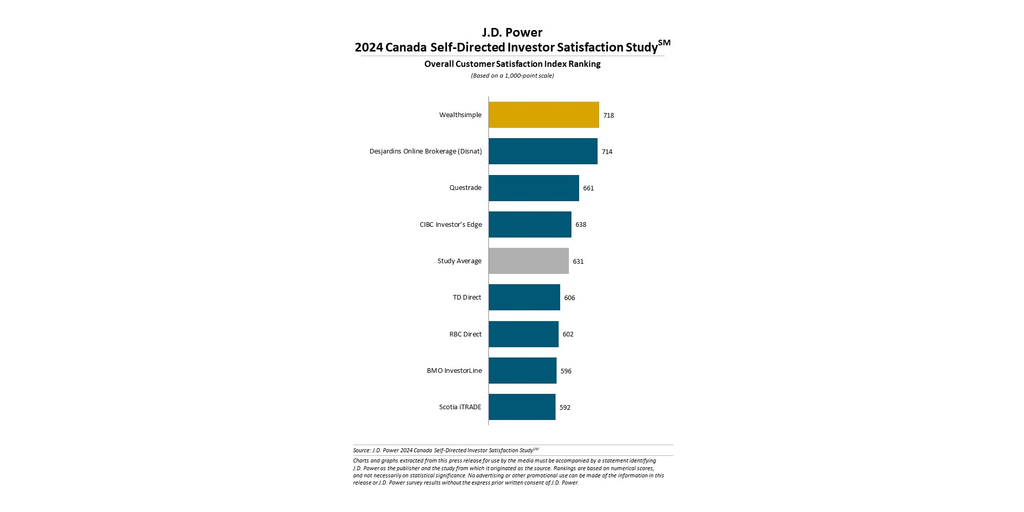

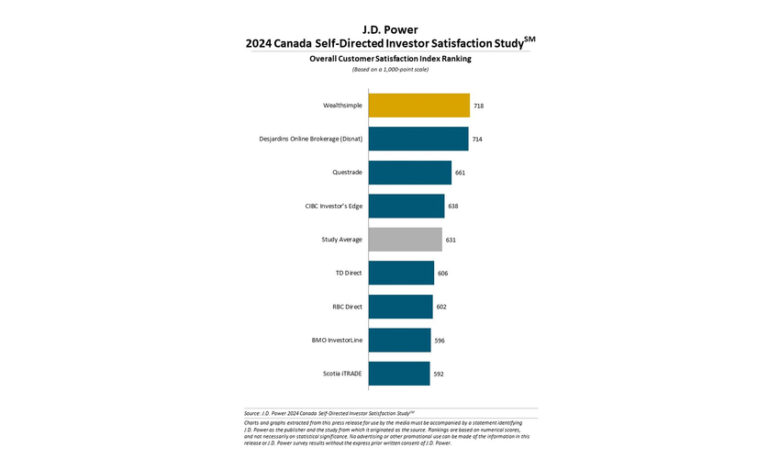

Study Ranking

Wealthsimple ranks highest among self-directed investor firms with a score of 718. Desjardins Online Brokerage (Disnat) (714) ranks second and Questrade (661) ranks third.

The Canada Self-Directed Investor Satisfaction Study, now in its 16th year, evaluates key satisfaction drivers and firm performance among true do-it-yourself investors (those who do not interact with financial advisors). The study measures satisfaction in seven factors (in order of importance): trust; digital channels; ability to manage wealth how and when I want; products and services; value for fees; people; and problem resolution.

The study is based on responses from 2,416 investors who make all their investment decisions without guidance from a financial advisor. The study was fielded from October 2023 through January 2024.

For more information about the Canada Self-Directed Investor Satisfaction Study, visit https://www.jdpower.com/business/wealth-management-platform.

See the online press release at http://www.jdpower.com/pr-id/2024039.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modelling capabilities to understand consumer behaviour, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world’s leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

___________________________

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2006). Millennials (1982-1994) are a subset of Gen Y.

Contacts

Gal Wilder, NATIONAL PR; 416-602-4092; gwilder@national.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com