Private markets still run on data rooms stuffed with Excel, PDFs, and decks. Every deal means hours of copy-paste, reconciling versions, checking formulas, and stitching together a model that an investment committee can actually audit. It’s slow, it’s brittle, and filled with blindspots.

This week, a new startup promises to change that. F2, an AI platform built inside Arc Technologies, this week spun out to build the AI-native Bloomberg terminal for private market investors.

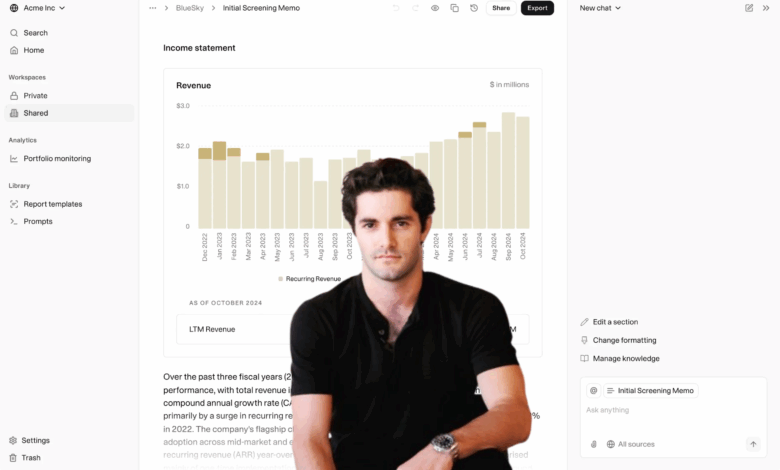

The platform ingests these messy workflows and files to create traceable analysis built for underwriting, diligence, and monitoring. The company says investors can move from diligence to decision up to 60% faster.

To accomplish this mission, the company raised $10 million funding led by NFX, Left Lane Capital, and Y Combinator.

From internal tool to independent platform

F2 started as infrastructure for Arc Capital Markets, which says it has handled roughly $10 billion in debt placement. The job: pull messy data-room files, Excel, PDFs, PowerPoints, into a structured, auditable model fast enough for real deal cycles. That internal tool found outside demand. Dozens of private credit funds, commercial banks, and PE teams now use F2, the company says, which drove the decision to spin out.

“Just as Bloomberg changed how public markets work, F2 is changing how private investors underwrite and execute,” said Don Muir, Arc’s co-founder and CEO. “It doesn’t only automate. It reasons and executes.”

What F2 actually does

F2 ingests common deal artifacts and turns them into full-fidelity financials with traceability. The pitch is speed plus auditability:

- Ingest & normalize: Read Excel, PDF, and deck formats from data rooms. Preserve formulas and line-item detail.

- Structure & reason: Build consistent models, highlight gaps, and reconcile conflicting sources.

- Agentic workflows: Use an LLM-agnostic setup to run tasks across underwriting, diligence, and monitoring.

- Evidence trails: Keep links back to the source, so reviewers can check every number.

F2 claims teams move from diligence to decision up to 60% faster on the platform. The company positions this as “AI-native infrastructure” for private markets rather than a point tool.

Why a spin-out now

Selling horizontal AI to regulated finance buyers is hard if you look like a captive tool. Independence helps on procurement, data governance, and roadmap credibility. It also lets F2 chase customers Arc doesn’t serve, while keeping commercial ties: F2 users get preferred access to Arc’s capital markets platform; Arc’s lender network benefits from F2’s AI-assisted underwriting.

“We’re already using F2 to streamline underwriting and go deeper on diligence,” said Scott Peters, founding partner at RevTek Capital. “This isn’t hype. It’s happening now.”

Dan Ahrens, managing partner at Left Lane Capital and a board member at both companies, said the product grew out of real pain at Arc before broadening to the market: “It became clear the platform could serve a much larger base.”

Massive demand in private credit

Private credit has grown into a multi-trillion-dollar asset class, with PE dry powder still high and banks tightening. That mix pushes more underwriting onto smaller teams with tighter timelines. Most of that work lives in spreadsheets, VDRs, email threads, and bespoke macros. AI that can read, structure, and reason over those inputs is appealing—if it is accurate, explainable, and quick to review.

F2’s advantage, if it holds, is format coverage plus deal-grade context. Many LLM tools handle text summaries. Far fewer keep formula integrity, reconcile tabs across workbooks, and maintain audit trails that a committee will sign off on.

What’s next for the new capital

F2 says it will spend on model speed, accuracy, and stability; forward-deployed engineering for large customers; and enterprise sales. Expect deeper connectors into data rooms, banks’ internal systems, and portfolio monitoring tools, plus knobs for firm-specific accounting quirks and policies.

Firms can try the platform today at: https://www.f2.ai/.