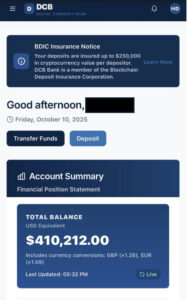

Crypto insurer Blockchain Deposit Insurance Corporation (BDIC), a global provider of blockchain-based deposit insurance, has exposed an alleged fraud scheme involving DCB Bank, which misled customers by falsely claiming their accounts were protected under BDIC insurance, despite having no partnership or affiliation with the crypto insurer and further using the logo and brand of DCB Bank in the effort.

According to BDIC Founder and CEO Jeffrey Glusman, DCB Bank falsely advertised being a crypto bank providing deposit-insurance coverage ranging from $125,000 to $250,000 for Bitcoin (₿TC), Ethereum (ETH), and USDT via a BDIC Policy, collected premiums for nonexistent policies, and issued forged policy coverage certificates bearing a falsified version of his personal electronic signature. The elaborate scam goes as far as telling the victim being contacted by the insurance “adjuster” to submit the info and a claim number for the account hack to a third-party insurance adjuster.

The deception surfaced after a customer, whose account had been compromised, contacted the BDIC Founder/CEO directly, looking for a payout on their insurance. The reason they went with this account in the first place, as explained to Glusman over email, text and conversation,, was that they had been contacted by bank and adjuster representatives (both bad actors), who, through email communication, said that the loss was covered under BDIC insurance. Therefore, to submit the claim to the “adjuster” who would confirm the hack and coverage status in concert with the DCB Bank account. When the victim did just that, they got the confirmation they had been hacked (DCB Fraud Bank being the hacker) and then the adjuster demanded payment of a deductible fee before the BDIC “policy” would activate releasing funds into the DCB Bank account. This is a practice BDIC confirmed does not exist in its legitimate procedures, and one that adds insult to injury for the victim.

Further investigation revealed additional evidence of the phishing activity coordinated with the third-party company, Monarch Limited of the Cayman Islands, and misrepresentations of FATCA, GDPR, and Basel III compliance on DCB’s website and client correspondence.

“This type of fraud undermines the trust that the digital currency ecosystem depends on,” said Glusman. “Consumers deserve verifiable protection, not false promises. As we announce our affiliate wallet and crypto-exchange partnerships during our rollout in Q4, the integration and cross pollination will provide for fluid onboarding and communication with their users leaving no doubt of their coverage using multi levels of authentication, OTP and other methods, to protect their assets”

Glusman continued “In the meanwhile, rest assured we will cooperate on all levels with authorities so those responsible are held accountable.”

Reinforcing Integrity and Consumer Protection

BDIC has engaged multiple international lawyers in response to this fraud, as well as authorities in countries where they are currently operating. Additionally, other global resources in crime prevention, including the FBI, as is standard operating procedure, to pursue civil and criminal actions against the fraudsters. Glusman has communicated with the CEO of DCB BANK, Praveen Kutty, as well so their team can protect clients and update authorities of the corporate identify theft in the regions they operate so more victims are not defrauded of their deposits and add on premiums for accounts and policies that do not exist.

While the incident highlights vulnerabilities in the market, BDIC emphasizes it is also a pivotal moment to strengthen standards and rebuild trust across the digital-asset ecosystem.

Adriano Raimondi, Chief Risk & Compliance Officer of BDIC, stated:

“While the effects of fraud can be disruptive, our commitment to industry-leading compliance not only safeguards our business but also contributes to raising standards for the crypto and financial community at large. Compliance is not a checkbox for us at BDIC – it’s a core value. We are always committed to continuous improvement, working closely with authorities, regulators, and our partners to ensure that our controls not only meet, but exceed, industry standards.”

Paving the Way for a Safer Crypto Economy

The revelations come as BDIC prepares for one of the most anticipated token offerings in the industry, designed to expand blockchain-verified deposit-insurance coverage across centralized and decentralized platforms worldwide.

The initiative is part of BDIC’s mission to normalize cryptocurrency for everyday use by making it as safe, insurable, and trusted as traditional finance and taking it to the next level of integrity through education and operating procedures that embrace the adoption experience.

“Every great innovation matures when it embraces integrity and trust,” Glusman added. “We invite partners, regulators, and innovators to join us in building a financial ecosystem where protection and transparency are the norm — not the exception – and embrace the UNITY message we called for since the ByBit hack…we appreciate the recent comments from Justin Sun of Tron and HTX in this regard sincerely as we look for other leaders to step to the forefront with him.”

Call to Action – Normalization

Wallet platforms and Crypto exchanges alike have the opportunity to engage BDIC for coverage that consumers have shown, fraud or not, they desire, as tens of millions of cryptocurrencies flowed into this elaborate scam based on this safety feature offered. This social proof, identifying the consumer focus being the peace of mind and for safe keeping of current positions, or the consideration to adopt digital currency use in daily life based on safety, further confirms that BDIC Insurance offered in Q4 will result in growth of adoption for platform providers of BDIC.

Allen Sautter, Chief Information Security Officer of BDIC, stated:

“Strong compliance controls are the foundation of trust – not just within our company, but across the industry as a whole. Events like this drive all organizations to reflect, refine, and share best practices for risk mitigation so that the entire market ecosystem becomes more resilient.”

Fraud Victims

BDIC urges anyone who believes they may have been misled by DCB Bank or similar entities to contact [email protected] or reach out to local law enforcement authorities.

The company continues to collaborate with regulators and investigators across multiple jurisdictions to protect consumers and reinforce industry accountability.

Article by Tyler K Kreiling of WealthNWisdom @TylerKreil14843 on X

About Blockchain Deposit Insurance Corporation

Blockchain Deposit Insurance Corporation (BDIC) is the first decentralized cryptocurrency deposit insurer, offering cutting-edge security solutions for digital asset holders. By leveraging blockchain-powered smart contracts and risk assessment algorithms, BDIC provides institutional-grade insurance to safeguard cryptocurrency investments worldwide, with offices currently in the Central District, Hong Kong (BDIC HK LTD) and opening locations in additional jurisdictions with Insurance and Foundation Headquarters, Latin America, and European offices upon insurance regulation approval in respective markets. The TGE remains planned for Q4 and subsequent rollout of the BDIC insurance coverage, as well as before year-end on wallets and exchange platforms.

Website: www.BDICinsurance.com

Instagram: https://www.instagram.com/bdicinsurance/

Telegram: https://t.me/+chOE3jJPG40wMzkx

Twitter/X: https://x.com/bdicinsurance

Linkedin: https://www.linkedin.com/company/blockchain-deposit-insurance-corporation