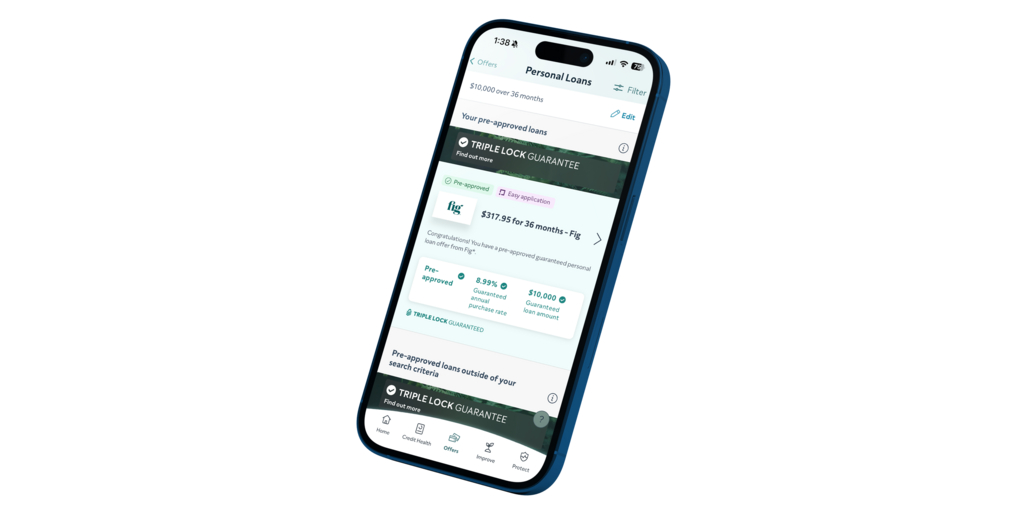

TORONTO–(BUSINESS WIRE)–ClearScore, a leading global credit marketplace, today announced its pre-approval feature in Canada. The new offering shows users which loans or credit cards they’ve been pre-approved for before they apply, helping them avoid unnecessary declines and uncertainty.

According to a TransUnion study, 87 per cent of Canadians believe access to credit is crucial for achieving their financial goals, but over half (52%) feel they don’t have sufficient access to these products. For many Canadians, the credit application process can feel overwhelming due to detailed forms, lengthy approval timelines, and the possibility of a declined application, as each application leaves a mark on credit reports. Through direct integrations with lenders, ClearScore’s marketplace features pre-approved credit offers, giving users certainty with guaranteed rates, credit limits and loan amounts, without harming credit scores. As long as the individual passes standard fraud and affordability checks, and the details they provided match, they’ll receive the loan or credit card.

“When you’re applying for credit, the fear of rejection can be overwhelming, especially when one application could affect your ability to borrow again,” said Justin Basini, Co-Founder and CEO of ClearScore. “By giving Canadians pre-approved offer details upfront, we’re putting control back in the hands of the consumer. Our Pre-Approved Marketplace delivers more transparency, more certainty, and a better, less stressful way to borrow.”

Lenders such as Fig and Karoo are taking the lead by partnering with ClearScore to offer these pre-approved products. This innovation sets a new industry standard that competitors are beginning to follow and reinforces ClearScore’s commitment to building a financial ecosystem that prioritizes user needs.

About ClearScore

ClearScore, part of The ClearScore Group, is dedicated to making personal finance clearer, calmer, and easier to understand for 25 million people worldwide. Launched in the UK in 2015, ClearScore has grown to become the #1 platform for accessing financial data, including credit reports, scores, and Open Banking information. Operating across four continents, ClearScore combines user-permissioned data at scale with cutting-edge technology to match consumers with the right financial products at the right time. With over 200 financial services partnerships globally, ClearScore helps partners source customers, boost revenue, and manage risk while empowering users with transparency, fairness, and control over their financial decisions.

Contacts

Media

Ashley McFarlane

[email protected]

(647) 522-0660