New report reveals that while CFOs see finance as a growth driver, manual work and process inefficiencies continue to limit teams’ strategic capacity

DALLAS–(BUSINESS WIRE)–Today’s finance leaders have a clear mandate for the future: transform finance from a back-office function into a strategic growth engine. But according to new research from Yooz, the cloud-based purchase-to-pay (P2P) automation provider, that mandate is being slowed by persistent operational waste and manual work.

To understand how the relationship between CFOs and finance teams is evolving, Yooz conducted the 2025 Leaders vs. Ledger Survey in partnership with the third-party platform Pollfish. The study surveyed 600 U.S. business professionals over the age of 18, including 300 C-suite executives and 300 finance professionals, to identify where strategic alignment is strong and where operational realities are holding progress back.

The results show that while executives and finance teams are aligned on the strategic importance of finance, both groups cite manual processes, document-handling inefficiencies and outdated workflows as key barriers to achieving their goals.

Key findings include:

- Finance vision is aligned but execution lags. Executives rated finance 83% effective, up from 64% last year, while staff rated it 45%, down from 50%.

- Strategic expectations keep rising. Forty-four percent of leaders now expect finance to spend most of its time on strategic work, up from 30% in 2024.

- Manual work remains a top barrier. Sixty-three percent of staff and 59% of leaders cite manual data entry as a major challenge, and most teams spend at least four hours weekly tracking down documents.

- Technology adoption is uneven. Executive confidence in technology rose to 72%, while staff confidence fell to 54%, pointing to gaps in integration and usability.

- AI usage shows the same divide. Twenty-eight percent of staff report not using AI, compared with just 6% of leaders.

- Both sides agree on the fix. Leaders and teams rank improving processes as the best way to boost strategic value, ahead of hiring, outsourcing, or training.

“Today’s most innovative CFOs have successfully elevated finance from cost gatekeeper to growth architect, but they’re being held back by operational waste,” said Laurent Charpentier, CEO at Yooz. “Our survey reveals something powerful: executives and staff are fully aligned on the solution. Attack waste at the root through process excellence, then deploy intelligent automation. The organizations that embrace Lean Financial Operations™ will unlock the strategic capacity they’ve been fighting for.”

The findings signal a pivotal moment for finance leaders seeking to close the gap between vision and execution. Both executives and teams agree that the path forward lies not in simply adding more technology, but in choosing automation that eliminates inefficiency at the source. This process-first approach will enable finance teams to deliver the strategic partnership today’s business landscape demands.

Visit the 2025 Yooz Leaders vs. Ledger Survey Report at Yooz’s website for the complete survey results and additional insights.

About Yooz

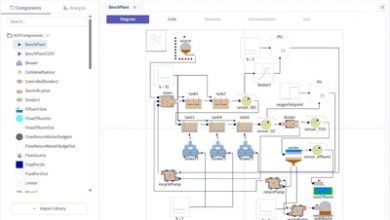

Yooz delivers Lean Financial Operations™, an AI-powered finance-automation platform that helps ambitious companies accelerate growth, fight waste, and defeat fraud. Built on proprietary document intelligence trained on more than 300 million invoices and a flexible drag-and-drop workflow engine, Yooz gives CFOs real-time cash visibility, embedded fraud detection, and the agility to scale without replacing existing ERPs. More than 7,000 customers worldwide rely on Yooz to achieve finance processes that are faster, simpler, safer, and deeper, with over 300 million invoices already processed. Yooz is headquartered in Dallas, Texas with additional offices in Europe. Learn more at www.getyooz.com.

Contacts

Media Contact

Idea Grove

[email protected]