LONDON, Oct. 27, 2025 /PRNewswire/ — BrokerListings.com has published its Broker Complaints Report 2025 – an analysis of approximately 1,000 one- and two-star user reviews for 10 well-known brokerages.

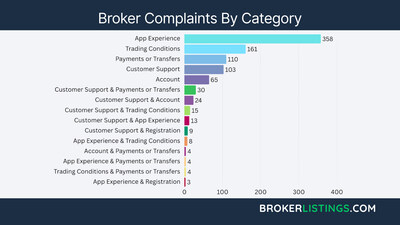

The study found 911 individual issues and categorized them into 15 categories for a 12-month period spanning September 2024 to September 2025.

Poor app experiences featured the most in dissatisfied reviews, accounting for 386 issue mentions, while problems relating to trading conditions were cited 190 times.

“The real eye opener was how customer support, which could be used to mitigate other problems, is often adding to frustrations, showing up in 21% of the issue mentions we recorded, as more brokers lean on automated chatbots,” said Jemma Grist, the report’s lead author.

Scope

Researchers focused on 10 widely known brokers. They recorded around 100 one- and two-star reviews for each brand split across Trustpilot, Google Reviews, App Store, and Google Play.

Each review was read and coded for one or more issues, including crossovers where one review may complain about withdrawal problems as well as customer support.

Key Findings

- 42% of issue mentions cited app issues: Users often complained of unstable apps and cluttered screens that bury key actions. Criticism especially targeted legacy firms sometimes seen as “tacking on ancient features without any consideration of… how people today use mobile investment apps.” Several reviewers stated they plan to switch to modern, more intuitive apps.

- 21% of issue mentions complained about trading conditions: Slippage, rejected or partial orders, margin rules, and fees aren’t living up to everyone’s expectations. Some reviewers even cited missed market moves as a result.

- 21% of issue mentions noted support failures: Slow replies, inaccessible channels, getting stuck with a chatbot, and unhelpful escalation processes compounded issues. Reviewers complained of ticket loops lasting days and stock replies that failed to address specifics, with support complaints peaking during critical moments like pending withdrawals.

- 17% of issue mentions related to payments and transfers: Withdrawal delays, unclear transfer timelines, opaque status updates, and challenges with broker-to-broker transfers frustrated users. Some reviewers went further – linking fund delays to missed trading opportunities.

- Legacy brokers were the most criticized for their UX and support: In contrast, more mobile-centric brokers, such as Capital.com and Trading 212, stood out for their helpful responses to complaints on the platforms analyzed.

Practical Takeaways

For Traders

- Test the broker before you commit: Over 90% of brokers offer a demo account where traders can explore the app, platform, and features before depositing funds. It’s an easy way to try before you buy.

- Read reviews across multiple sources: Look for patterns rather one-offs. And remember, reviews can be extreme – sometimes attracting either particularly unhappy (or happy) users. Also, some negative reviews aren’t always the fault of a broker – it can be that a novice investor may not fully understand a financial concept or trading conditions like margin requirements.

- Check withdrawal timelines, stipulations, and fees: Many brokers have strict know your customer (KYC) requirements that must be satisfied before you can access funds, a legal requirement in many regions. Understanding what needs to be provided, such as copies of ID documents, may save delays later.

For Brokers

- Continue to invest in the mobile user performance: Shorter load times, easier navigation, reliable live data, and integrated features are common frustrations. With individual investors spending more time managing portfolios from their palms, this must remain a priority.

- Ensure you’re providing reliable support, with access to human agents: 24-hour assistance is sought after by active traders, while getting through to a person quickly is key when dealing with issues like withdrawal delays or account freezes.

- Communicate during incidents: Publish status updates to keep traders in the loop and reply publicly to negative reviews with resolutions tailored to the user’s problem. This will help minimize the frustration caused and show prospective traders you take complaints seriously.

“The fastest path to fewer one-star reviews is transparency around trading conditions, communication when things go wrong, and getting the mobile investment experience right. And while it can be tempting to turn to chatbots for costs and efficiency purposes, make sure human support is still readily available when traders encounter serious problems”, added Jemma Grist.

Users can read the Broker Complaints Report for 2025.

Disclosures

The report summarizes user-reported experiences on public platforms, with brands and examples only referenced to help illustrate themes.

The appearance or order of brands is not a rating or endorsement – no brands paid or didn’t pay to be included in the study.

About BrokerListings.com

BrokerListings.com publishes easy-to-use broker comparisons and reviews to help individual traders make informed choices about where to open an investment account.

Contact

Head of Research

James Barra

BrokerListings

[email protected]

Photo – https://mma.prnewswire.com/media/2805827/Complaints_Report.jpg

View original content to download multimedia:https://www.prnewswire.com/news-releases/brokerlistings-publishes-new-analysis-of-1-000-broker-complaints-and-reveals-key-pain-points-amongst-traders-302595356.html

SOURCE BrokerListings