Microsoft’s recent purchase of a £1.5bn stake – equivalent to 4% – in the London Stock Exchange Group (LSEG) was the latest deal to unite Big Tech with a business running one of the world’s most significant financial markets.

The partnership, which Microsoft says will generate $5bn in revenue over 10 years, follows hot on the heels of Google’s $1bn investment in the derivatives marketplace CME Group and a tie-up announced last year between Nasdaq and Amazon Web Services.

What is the driving force behind this series of big-money investments? The official line from Microsoft is that the LSEG deal will “empower the future of financial markets by delivering next generation data, analytics and workspace solutions”. This is just another way of saying that this is a transaction motivated almost entirely by possibilities around artificial intelligence.

Sitting on a goldmine

The London Stock Exchange Group (LSEG) has one of the most valuable and desirable datasets available anywhere in the world and the fact that Microsoft has engaged so aggressively is a testament to that value. As part of the deal, Microsoft gains a seat on LSEG’s board and has chosen its executive vice-president of Cloud and AI to fill the position. That should tell you a lot about the tech giant’s priorities.

For Microsoft, the LSEG is a new, very large customer that sits on valuable data and needs machine learning infrastructure to unlock its true value and apply it to AI. That unleashes huge potential opportunities for Microsoft using financial data it previously did not have access to. It will be fascinating to see what comes next.

However, we should also be wary of Microsoft’s plans. There is a monopoly of power that comes with AI and data accessibility – and this investment further concentrates that power among Big Tech companies. It was the same story with the recent investments in global stock market operators made by Google and Amazon – and it is a story that has been repeated across multiple industries.

Financial institutions need to embrace AI to be able to stay competitive. Leveraging their own data assets is a key part of that, as well as finding complementary data assets with other partnering institutions. It is beginning to happen already: The number of UK financial services firms that use machine learning continues to increase, according to a recent survey by the Bank of England, with 72% of firms currently using or developing ML applications.

Democratising access to data

Yet to truly break Big Tech’s monopoly on access to data, smaller companies need greater accessibility themselves.

Working with a federated data infrastructure, like the one developed by Apheris, the company I co-founded and run, ensures IP and data protection is retained. It allows AI development beyond our current level of innovation because customised solutions can be built in collaboration that address specific questions using datasets previously out of reach to small and medium sized companies.

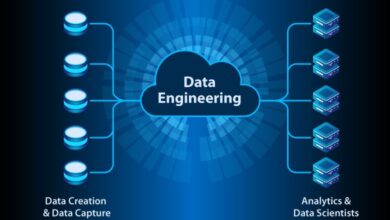

How does this work in practice? A federated data infrastructure enables multiple companies to jointly unlock value from data without ever sharing it. By bringing machine learning and analytics to where the data resides, companies can start building models that learn from all individual datasets without ever sharing the data with each other. This means they are not affected by the Big Tech data monopoly because they do not need to strike multi-billion-dollar deals to gain access to valuable data.

By joining forces, organisations can work together to build unique and differentiated datasets that allow for training and tuning high-quality models. The federated infrastructure ensures that all parties remain in control of their datasets and compliant with their local regulations and guidelines. This revolutionary technology will enable smaller businesses to participate in the AI value creation and compete with Big Tech.

Real progress in AI will be made by taking existing models and customising them to a very specific problem. This is the attraction of the LSEG for Microsoft: it provides machine learning-ready data that will be a key differentiator, allowing Microsoft to connect different data sets, including their own and others across the LSEG, to build a customised solution for complex problems affecting the global financial industry.