Key Facts:

- Revolutionary AI-enabled solution helps address operations capacity gap as firms across banking, capital markets, insurance and payments struggle with growing data volumes

- AutoRek ARIA marks a shift in to the “agentic reconciliation” era, moving from programmed automation to intelligent automation

- Solution’s capabilities include dynamic learning, intelligent exception management, real-time coworking and assisted solution development

NEW YORK–(BUSINESS WIRE)–AutoRek, a leading provider of automated reconciliation and financial controls solutions, today announced the launch of AutoRek ARIA, a multi-skilled intelligent AI agent designed specifically for reconciliation operations.

Built within the AutoRek reconciliations platform and leveraging Microsoft Azure infrastructure, AutoRek ARIA marks a new era of “agentic reconciliation” for financial services operations. The development represents a breakthrough evolution from rules-based process automation to AI-powered intelligent automation that analyzes, learns, optimizes and extends reconciliation processes in collaboration with users. For operations teams it promises significant time savings while empowering them with new ways to add strategic value to their firms.

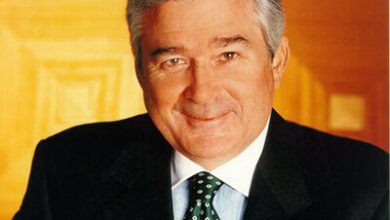

“The surge in transaction volumes and data hasn’t just created a gap in what the human professional can handle—it’s a chasm. The convergence of AutoRek’s 30 years of reconciliation expertise with cutting-edge agentic AI technology represents exactly the kind of innovation financial institutions need to address what is increasingly becoming an operational crisis,” said Chris Livesey, CEO of AutoRek. “AutoRek ARIA doesn’t just automate processes – it creates intelligent systems that reason, learn, and adapt while maintaining the control and compliance frameworks our clients expect from their AutoRek solution.”

How AutoRek ARIA Addresses Financial Services’ Operations Capacity Gap

The financial services industry faces a pervasive “capacity gap” as AutoRek’s 2025 industry research revealed 79% of asset management and capital markets firms struggle to keep up with current data volumes, while daily transaction volumes are expected to surge 39% annually. This struggle is repeated across other financial services sectors including banking, insurance and payments. Despite the growth in data volume, 90% of organizations still rely on spreadsheets for critical financial operations, creating significant operational risks and compliance challenges.

“We’re witnessing a fundamental shift in financial operations – the point where human effort and rules driven software are no longer sufficient to move money, reconcile breaks, and satisfy regulators fast enough,” said Jim Sadler, Chief Product, Technology and Operations Officer at AutoRek. “AutoRek ARIA introduces intelligent AI agents within the AutoRek platform that go beyond basic automation, to provide reasoning, coworking and decisioning capabilities, and ultimately helping operations professionals do their jobs quicker and more efficiently. This is a huge step toward realizing our goal of ‘agent-operated enterprises’ in financial services.”

From Programmed Automation to AI-Powered Intelligent Automation

Unlike traditional robotic process automation (RPA) that handles rules-driven tasks, AutoRek ARIA analyzes patterns, recognizes complex contexts and surfaces actionable insights about reconciliation processes and data. Working seamlessly within the AutoRek platform, the solution enables financial institutions to transition from reactive, manual operations to predictive, intelligent workflows that scale elastically with transaction volumes without proportional increases in operational overhead.

Key capabilities of AutoRek ARIA include:

- Dynamic Learning: AI agents that continuously learn from reconciliation patterns and improve matching accuracy over time

- Intelligent Exception Management: Proactive triage and supervised resolution of breaks, with sophisticated escalation protocols for complex issues

- Real-time Coworking: Contextual help, guidance, suggestion and side-by-side operation as the user performs their role and navigates their solution.

- Assisted Solution Development: Intelligent agents that can analyse data feeds and intelligently help you build your next automated reconciliation solution within AutoRek.

Use Cases for AutoRek ARIA

AutoRek ARIA helps address unique challenges across financial services sectors:

- Capital Markets: With T+1 settlement, 24-hour trading initiatives, AutoRek ARIA helps asset managers eliminate spreadsheet dependencies and reduce reconciliation timeframes to hours while maintaining comprehensive regulatory audit trails.

- Payments: AutoRek ARIA provides the intelligent monitoring and analysis capabilities required for modern payment operations, including support for emerging FCA safeguarding regulations taking effect in 2025.

- Insurance: AutoRek ARIA accelerates settlement processes and provides transparency into the complex data flows that typically extend B2B settlement periods to 56 days.

AutoRek ARIA will be available as an add-on to the AutoRek v6.18 and AutoRek Mion v1.2 product releases. For more information go to: https://www.autorek.com/autorek-aria/

About AutoRek

AutoRek is a leading provider of automated reconciliation and financial control solutions, trusted by the world’s largest financial institutions for over 30 years. The company’s SaaS platform automates reconciliations, data management, and reporting across asset management, payments, insurance, and banking sectors. AutoRek is headquartered in Glasgow, Scotland, with offices in New York and London. For more information, visit www.autorek.com.

Contacts

Media

Jessica Cunningham

[email protected]

+44(0) 141 406 4223