Across the AI landscape, many of the assumptions that underpin current pricing models are under stress, and forward-looking companies must prepare for a sharp upward correction in the cost of AI services.

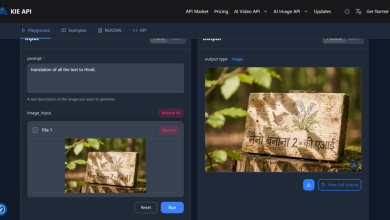

The startup pricing

Today, almost no AI startup is genuinely profitable. Most are selling model access, API calls, or integrated AI services at heavily subsidised rates, with margins often negative or razor-thin. This is not specific to AI – it’s common for all startups to focus on user acquisition rather than monetization in the early stages. What we need to keep in mind is that AI vendors are currently in the startup phase and are operating on investor capital rather than generated cash flow.

But this dynamic cannot last forever. As compute costs, model maintenance, and infrastructure demands grow, economic pressure to rationalise pricing will intensify.

The trap of vendor dependency

The most vulnerable companies are those that have deeply integrated third-party AI models into their core products and processes. They may rely on a vendors’ API for agentic decisions, text/image/video processing and creation and other tasks that now can be solved with plenty of AI models available on market.

Sometimes companies sell their solutions (which heavily rely on vendors’ models) under yearly subscriptions or long-term B2B contracts with fixed pricing. This makes them exposed to vendors’ price changes, as they wouldn’t be able to adjust their own prices for clients quickly. Legacy contracts may lack exit clauses.

If the AI vendor later raises prices – say, 2×, 5× or more – the downstream consumer (your firm) may have very few options to react and most of them wouldn’t be simple. If your operational processes heavily depend on AI, modifying them to reduce reliance on a cost-inefficient AI solution is often a complex and resource-intensive task.

If you rely on third-party AI, you must expect sharp price increases to come. The main question now: when and how steep?

What options exist?

When pricing pressure comes, companies face several strategic choices:

- Pass costs to end users. However, this is only feasible if your customers are willing to accept it. In competitive markets, raising prices may drive churn.

- Cut or eliminate AI-driven features.

- If a particular AI component becomes unviable, you may have to disable or limit it. That undermines your feature set and user experience.

- Move to open source models / self-hosting. This offers greater control over cost, flexibility, and scalability, though it inevitably comes with its own challenges.

How we do it at MD Finance

At MD Finance, from day one, we have structured our roadmap to rely heavily on open-source models. We acknowledged that, in many cases, their baseline accuracy or generalization would lag behind those of the top commercial models. However, sufficient fine-tuning allowed us to close the gap in our domain.

The downside of this approach is that it takes significant time and effort. You need strong in-house ML engineers, DevOps capacity, and ongoing maintenance. Yet, in our view, it serves as a risk hedge: if commercial model prices surge, we have a fallback without being at the mercy of external vendors.

The warning and recommendation

Any business still tied to proprietary AI should act now – prepare a contingency strategy before costs spike.

If you plan to pivot to open source, begin now. Migration is a gradual, expensive, and demanding process. Waiting until prices surge forces reactive decisions.

One caveat: open source is not “zero cost.” Deployment, scaling, and maintenance require significant investment. Subscription fees may become engineering and infrastructure costs.

Begin by identifying low-risk use cases where open-source models can be adopted. Build modular systems to enable hybrid AI deployment, combining commercial and open source models. Gradually expand usage while monitoring total cost. Prioritize regular reviews of your AI stack’s strategic resilience.

We still have time to prepare before major AI price increases. Businesses built on subsidized models risk serious disruption once prices go up to normal levels.

Act now. Analyze your dependencies. Build flexibility before rising AI prices threaten your future.