The banking landscape, like many other industries, is undergoing rapid transformation driven by advancements in digital technology and increasing customer expectations for tailored experiences. Hyper-personalization, the ability to offer highly individualized products and services, is becoming a critical differentiator in financial services, forcing institutions to either embrace these new technologies or risk falling behind. Artificial intelligence (AI) and broader digital transformation initiatives are the fundamental forces behind this shift, providing unprecedented insights into customer needs and preferences to enable the hyper-personalized banking experience that customers demand.

Customer Expectations in the Digital Age

Today’s digital-savvy customers expect banking interactions to be relevant, timely and aligned with their unique financial situations and goals. Traditional, mass-market banking approaches are struggling to keep pace with these evolving demands, which can lead to customer dissatisfaction and attrition.

Additionally, research reveals a strong correlation between digital engagement and key performance indicators such as net profit, balance growth and transaction activity. Findings from a study conducted by Fiserv highlight that increased digital interaction leads to more meaningful customer relationships, and as a result, measurable business outcomes for banks. The proliferation of digital channels has empowered customers with more information and choice than ever before, further driving the expectation for personalized engagement.

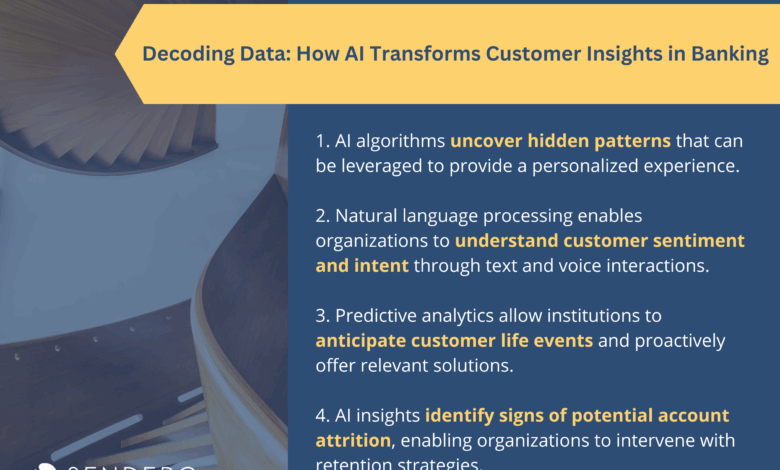

Decoding Data: How AI Transforms Customer Insights

AI algorithms are revolutionizing the way banks understand their customers by enabling advanced analysis and tools that surpass the effectiveness and capabilities of traditional methods. Through the analysis of vast and complex datasets, including transaction history, online behavior, demographics and more, AI algorithms can uncover hidden patterns that banks must leverage to provide a personalized customer experience. Machine learning (ML) algorithms can then learn from this data to predict future customer needs and preferences with increasing accuracy. Natural language processing (NLP) is another key AI capability that enables banks to understand customer sentiment and intent through text and voice interactions, facilitating more personalized communication.

Furthermore, AI-powered predictive analytics allows financial institutions to anticipate customer life events and proactively offer relevant solutions. For example, by analyzing transaction patterns and behavioral data, AI can identify a customer preparing to buy a home, allowing the bank to prompt the customer with timely mortgage offers. Additionally, AI-driven insights can flag signs of potential account attrition, enabling banks to intervene with proactive retention strategies before the customer leaves.

The Evolution of AI-Powered Hyper-Personalization

The application of AI in banking has evolved significantly, as new advancements are consistently emerging. Traditional AI enables initial steps in personalization through tailored product recommendations and basic chatbot interactions, whereas more advanced AI facilitates proactive financial advice by anticipating customer needs and offering guidance in real-time.

Agentic AI represents the next stage of evolution, allowing AI systems to autonomously perceive, decide and act to deliver highly personalized experiences.

For instance, when it comes to autonomous financial planning and advice, AI agents can analyze a customer’s financial situation and proactively create and adjust comprehensive financial plans with minimal human intervention. Beyond the generation of plans and recommendations, AI agents can autonomously identify, initiate and manage the application and onboarding process for new products, enabling banks to proactively offer the most relevant products and services for each customer’s individual, specific needs.

Additionally, AI agents can identify potential customer issues and autonomously take steps to resolve them, often before the customer is even aware of the issue. In the realm of wealth management, these agents can manage complex investment portfolios dynamically, adapting to individual investor goals and changing market conditions with greater autonomy and precision. These approaches can significantly improve customer satisfaction and loyalty through highly personalized services.

While agentic AI represents a significant advancement in digitalization, traditional AI applications, such as chatbots and virtual assistants, remain valuable. For routine inquiries and transactions, these tools offer efficient and accessible support for specific customer service needs and information delivery. However, as AI continues to advance rapidly, it’s crucial for financial institutions to leverage the new tools and resources available to stay competitive and meet evolving customer expectations.

Navigating Data Privacy and Ethical Considerations in AI-Driven Personalization

While AI and its evolution present a variety of strategic advantages, its increasing autonomy brings more responsibility. Banks must take careful consideration of data privacy regulations and customer expectations around data usage. Certain market-wide risks and biases are expected to be exacerbated with mass AI adoption, and research shows at least one in five financial service firms do not believe they are well placed to mitigate these risks. Utilizing AI to drive hyper-personalization requires transparency in how customer data is collected, analyzed and used in order to build and maintain trust. Financial institutions must implement robust security measures, such as structured decision-tracking and rigorous human oversight, to protect sensitive customer data from unauthorized access and potential breaches.

Additionally, ethical considerations, such as avoiding bias in AI algorithms and ensuring fair outcomes for all customers, are paramount in responsible AI deployment. Regulatory bodies are expected to demand greater transparency to these concerns, especially in instances where AI systems inadvertently violate compliance rules. Financial institutions must establish clear procedures that closely and accurately document all decision-making processes to maintain accountability. While AI can streamline processes and power hyper-personalization, banks will also need to invest in reasoning models and adopt quality assurance processes to ensure regulatory compliance.

Looking Ahead

AI and digital transformation are no longer optional for financial institutions; they are essential for delivering the hyper-personalized banking experiences that today’s consumers increasingly expect. AI is expected to turn into an essential business driver across the financial services industry within the next two years. This shift benefits customers through more relevant and timely offerings and financial institutions by fostering greater customer loyalty and unlocking new revenue streams. The ongoing advancements in AI will continue to shape the future of banking, making personalized experiences the cornerstone of customer engagement and a defining source of competitive advantage.