Four FDA-approved products strengthen portfolio and reaffirm commitment to global reach

ANDERLECHT, Belgium–(BUSINESS WIRE)–#FocusToGrow–A.forall is pleased to announce the acquisition of four FDA-approved injectable generics and two late-stage pipeline assets from Provepharm’s US portfolio. With this acquisition, A.forall considerably extends its marketed portfolio in the US, marking a significant expansion of its US footprint and a key milestone in the company’s sharpened focus on high-quality generics worldwide.

Strengthening Essential Healthcare

The acquired portfolio includes four well-established hospital products that address critical therapeutic needs:

- Dihydroergotamine Mesylate (neurology – for the treatment of migraine and cluster headaches)

- Piperacillin/Tazobactam (infectious disease – broad-spectrum antibiotic for hospital-acquired infections)

- Tranexamic Acid (hematology – to control bleeding in surgical and trauma settings)

- Phenylephrine Hydrochloride (anesthesiology – to manage hypotension during surgery)

These medicines are widely integrated in US hospital protocols and marketed via established pharmaceutical distributors and group purchasing organizations, ensuring strong clinical familiarity among healthcare professionals. The newly acquired products will be commercialized through A.forall’s US subsidiary, Milla Pharmaceuticals Inc.

The two late-stage pipeline products target complementary therapeutic areas and are expected to launch in the coming years.

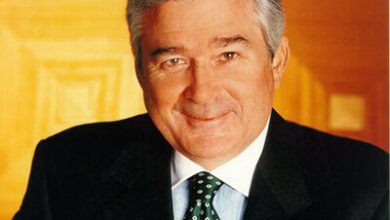

Steen Vangsgaard, CEO of A.forall, comments: “This acquisition fits perfectly with our renewed strategy to develop, commercialize and add value to medicines, increasing their availability where they matter most. These products expand our US relevance and give us immediate access to a robust portfolio that meets essential therapeutic needs. It’s a strategic investment that delivers scale, diversification and valuable cross-selling opportunities.”

Strategic US Focus

For A.forall, the US is a strategic priority. With a dedicated team on the ground, strong partnerships and a robust pipeline, the company continues to invest in one of the world’s most competitive and complex healthcare environments.

Since 2017, six products of A.forall were registered successfully in the US market, demonstrating consistent growth and commitment to American healthcare providers.

“By integrating this portfolio with our existing capabilities, we focus to reach further into markets where high-quality generic medicines make the greatest difference,” Vangsgaard adds. “This acquisition strengthens our brand recognition and significantly expands our commercial presence in the world’s largest pharmaceutical market.”

This acquisition follows the recent decision to divest A.forall’s Retail & Hospital division and focus entirely on generics: a strategy that gives the company a sharper scope, stronger momentum and a clear direction for growth.

About A.forall

A.forall is a Belgian pharmaceutical group with headquarters in Anderlecht and offices in Ireland and the United States. At current, the company employs over 144 people and distributes a wide range of pharmaceutical products to pharmacies, wholesalers, hospitals and retirement homes. A.forall is also a global player in the generics market, now with 35+ molecules on the European and U.S. market and a fully stocked pipeline of mainly injectable generics and value-added products covering various therapeutic areas.

Driven by one mission #MakingAffordableMedicinesAvailableToAll, A.forall focuses 100% on the development, licensing and commercialization of generic medicines worldwide.

A.forall is part of The Riverside Company’s portfolio, a global investment firm focused on the smaller end of the middle market that has invested in more than 220 healthcare companies since 1988.

For more information, visit: www.aforallpharma.com.

Contacts

We’re happy to provide additional context or answer any questions you may have.

For media inquiries or more information, please contact:

A.forall Group NV

Communication Department

[email protected]

+32 2 526 64 14