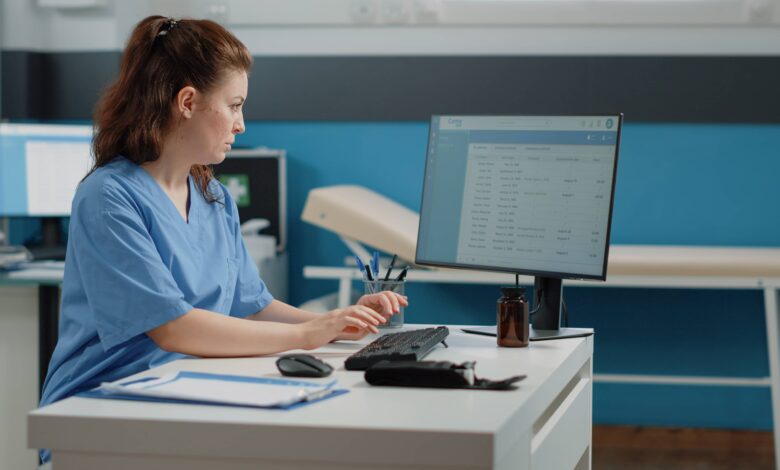

In today’s digitized environment, every healthcare organization struggles with maintaining financial viability and operations that add to staff workload or interrupt cash flow. Over time, this can impact timely patient care and the revenue cycle. Denial management is vital in keeping operations running smoothly and finances on track; it’s no longer a choice, it’s a necessity. According to Zindl, almost 65% of denied claims are not reprocessed for resubmission. What does that mean for providers, and what does this mean for the patient experience?

Denied Claims and those not resubmitted are the primary reason for losses for the provider, affecting not only revenue but also directly impacting employees. Managing these denials well is the key to improving your revenue. Identifying and rectifying issues leading to claim denials can help healthcare organizations optimize their billing processes, streamline operations, and ultimately gain patient loyalty.

Common Reasons For Denied Claims

There might be numerous reasons for claims to be denied, but administrative and coding errors are the two most common types of errors that result in denial. Documentation errors or any other irregularities can negatively impact the administrative and coding processes and appear on the claim form, causing confusion, time lost, and a poor patient experience.

Administrative errors include:

- Missing patient information

- Eligibility errors

- Duplicate claims

- Exceeding the filing time limit

- Bundle payment

Coding errors include:

- Date inconsistencies

- Invalid code pairing

- Incorrect modifiers

- Lack of medical necessity

Strategies to Reduce Claims Denials

Claim denials can lead to revenue loss in various ways, including added labor costs of claims resubmission. As it is a lengthy process, it can be time-consuming for an organization. These factors impact the operations of a healthcare organization, presenting challenges such as staff compensation and facility upkeep. Here are some Denial Management Service strategies that can help you avoid and reduce claim denials.

- Verify Insurance and Eligibility

Did you know that 24% of claims get denied due to ineligibility? A change of job might result in changes in the patient’s insurance plans. There might be instances when coverage hasn’t been terminated, their maximum benefit hasn’t been met, or their plan may or may not cover the service provided. Having a staff that understands the plans you accept, interprets policies, and possesses sufficient knowledge to discuss coverage issues with patients pays off in the long run.

- Accurate and Complete Patient Information

Leaving a required field blank on a claim form can trigger a denial. According to statistics, incomplete patient information accounts for 61% of initial medical billing denials. The most common among missed data points are the accident date, the medical emergency date, and the date of onset. Ensure that the information provided is accurate, so double-check:

- Patient name

- Date of birth

- Sex

- Insurance payer

- Policy number

- Group number

- Patient’s relationship to the insured

- Primary insurance

- Verify Referrals, Authorizations, and Pre-Approvals

18% of claims are denied due to lack of authorization and pre-approval issues. Although it might be challenging to know and learn services or procedures that require prior authorization and referrals, your staff should be trained and have expertise in identifying them. The claim must be supported by medical necessity and filed within the required timeframe. Ensure that your staff uses notes or attaches records to support the services provided.

- Accurate Coding

The best way to reduce denials is through accurate and precise coding. Using an outdated codebook or entering the wrong code can just as easily get your claim denied. Using the most current version of CPT, HCPCS, and ICD-10 codes ensures accurate and error-free data. Even small mistakes can put you at risk, which is why building staff protocols to reduce your risk and liability is a must.

- Understand Payers – And Their Rules

Understanding payer requirements is the most crucial step to accelerate payment and reduce denials. Monitoring and keeping your staff updated with the payer’s rules regarding insurance eligibility verification or calling the insurer before providing care, can eliminate rejections for procedures not covered. It might also be helpful to monitor payers’ websites and correspondence and establish relationships with them to get answers and resolve issues faster.

- Timely Submission of Claim

Commercial payers and Medicare have different guidelines, and the timeline to file a claim is different for each payer. Editing a claim can cause delays, which can extend the submission deadline. A missed deadline can cause the denial of a claim. Create streamlined processes with alert notifications about approaching deadlines for staff to ensure payers’ deadlines are met.

- Advanced Technology For Clean Claims

Automate your practice management system or Electronic Health Record Software that has built-in alerts to collect necessary data at every visit. You can use claim scrubbing tools to check the accuracy and completeness of data before it’s submitted to payers. This advanced software reduce the risk of denials, cut down payment delays, and minimize rework or resubmissions. These systems review claims before submission and flag (“scrub”) missing information or inconsistencies with set standards, ensuring proper documentation.

- Monitor, Analyze, and Audit

To reduce claim rejection in medical billing, understand the trends and patterns of your submissions. This helps identify why denials are frequent. Monitor administrative tasks closely, including documentation and claim processing. Conduct staff audits to ensure appropriate documentation and coding, and set up a process to strengthen your practices.

Conclusion

For quicker payments, reduced administrative burden, and improved financial consistency, it is essential to address repetitive errors and optimize processes. Allocate tools and education for staff for your organization to see an increase in claim resolution and a reduction in denials. While reducing claim denials isn’t about working harder, it surely is about working smarter. By leveraging technology, enhancing communication, and closely tracking denial data, providers can achieve significant improvements in their revenue cycle.