Most startup directories focus on the same highly visible companies everyone already knows about.

And even when they do list early-stage startups, the data can be outdated, incomplete, or too generic. It doesn’t present high-value investment opportunities, or you’re unable to track the key signals and metrics that matter most to you.

If you want to consistently find promising companies before they trend on Twitter, appear in pitch decks, or show up in legacy databases, you need tools designed for discovery.

Below, we’ll look at seven startup directories that help investors surface early-stage companies, evaluate signals faster, and build a sourcing edge before the market catches up.

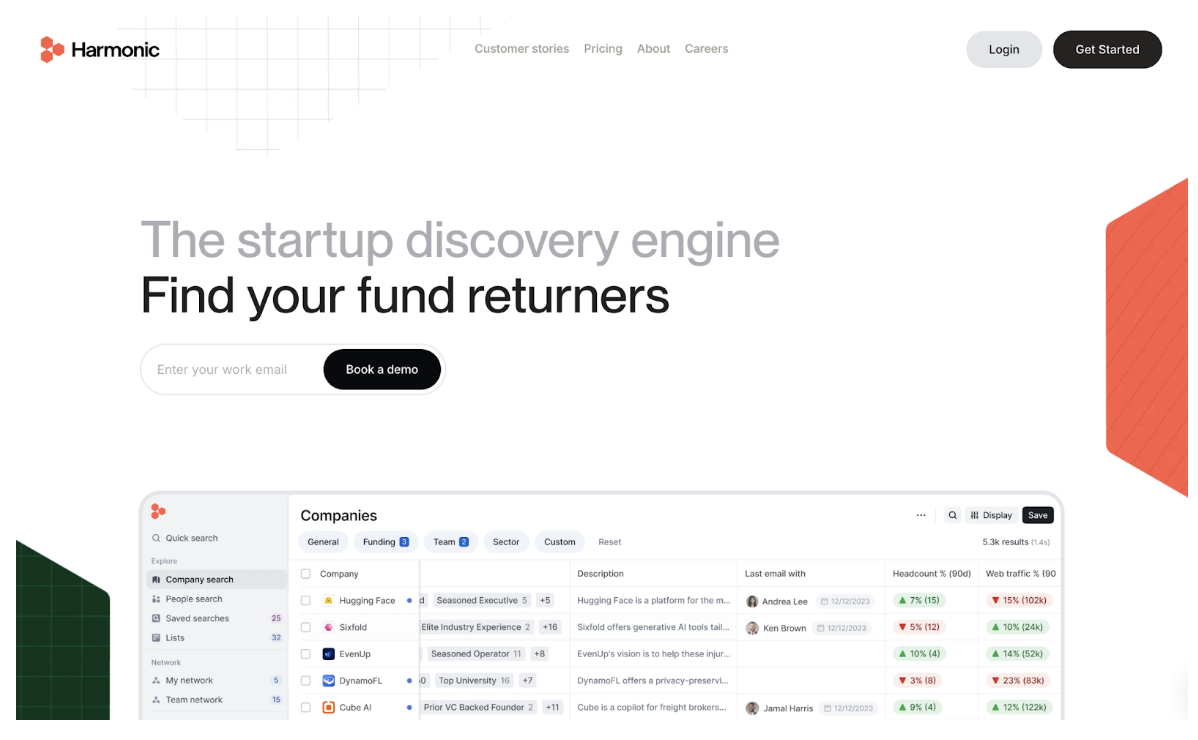

1. Harmonic

Harmonic is an AI-powered startup directory and discovery platform built for investors who prioritize early-stage deal flow.

The platform tracks 30M+ companies — including pre-seed and stealth startups that rarely appear on traditional startup lists or databases. You also get access to 190M+ founders, operators, and investors, making it easy to map networks, spot repeat entrepreneurs, and surface emerging categories before they hit mainstream attention.

With Harmonic, you can:

- Discover early-stage and under-the-radar startups, including stealth and bootstrapped teams

- Search across 190M+ founders, executives, and investors to identify talent clusters and network patterns

- Track signals like hiring spikes, domain launches, and founder movement that indicate early traction

- Use Scout, an AI sourcing agent, to deliver startup leads based on your thesis

- Collaborate with your team through shared lists, alerts, and CRM integrations — without export caps or seat limits

2. Crunchbase

Crunchbase is a startup directory that helps investors, founders, and operators quickly look up private companies across industries. It’s best for surface-level scans when you need fast access to basic company information, funding history, and key people.

Users can browse startups by industry, market, location, and funding stage, making it useful for broad market research or initial vetting. However, Crunchbase’s coverage skews toward companies that have already announced rounds or press.

Key Crunchbase features:

- Search filters for industry, funding status, location, and team size

- Company profiles with leadership, milestones, and investors

- Funding alerts and recent press updates

- Saved searches and watchlists to track companies

- Browser extension for quick lookups while researching online

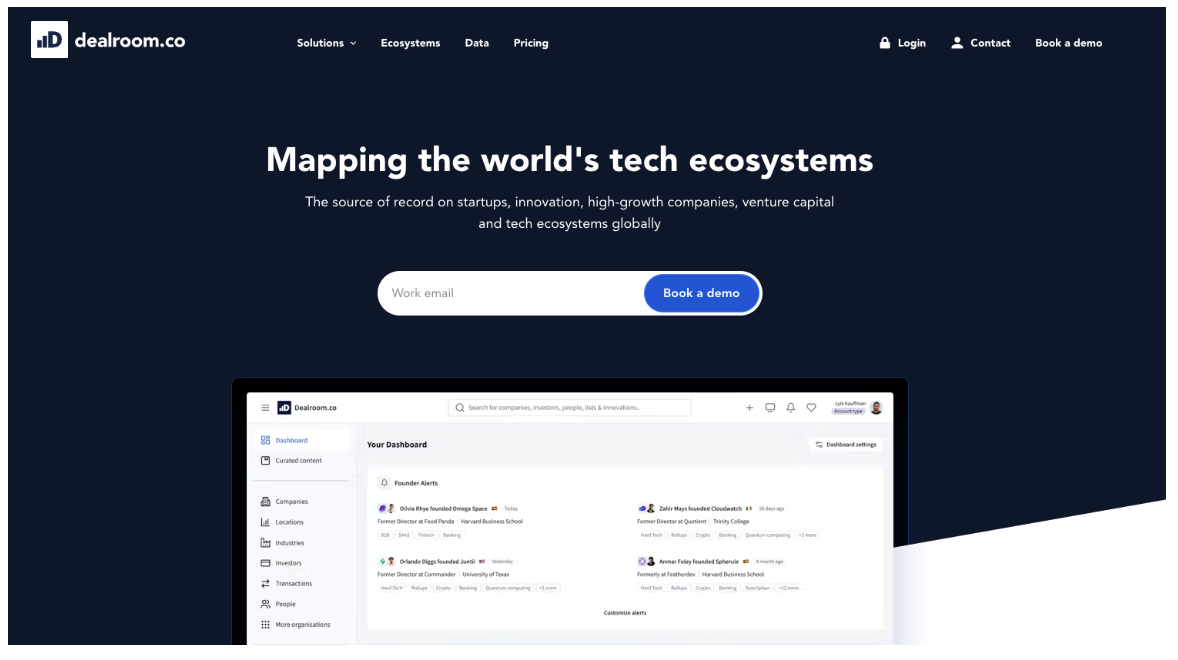

3. Dealroom

Dealroom is a startup directory and market intelligence platform with a strong focus on European tech ecosystems. It’s widely used by VCs, accelerators, and government innovation groups to explore regional startup landscapes and track emerging companies across Europe.

Its coverage is weaker in the U.S. and parts of Asia, so it’s most valuable for investors sourcing in Europe or researching cross-border opportunities.

Key Dealroom features:

- Searchable directory of European startups, investors, and funding activity

- Ecosystem maps by region, sector, and innovation category

- Filters for impact-driven and climate-tech startups

- Company benchmarking and growth indicators

- Data exports and API access for deeper research

4. Startup Stash

Startup Stash is a curated directory of startup tools, resources, and emerging companies. It’s designed for fast browsing across niche categories, making it useful for spotting new startups in specific verticals or tech stacks.

While it’s less data-driven than platforms like Harmonic or Crunchbase, its curated lists help uncover teams and products that may not yet be visible in larger databases — especially in SaaS, developer tools, and no-code ecosystems.

Key Startup Stash features:

- Curated lists of tools and early-stage products across 50+ categories

- Easy browsing for niche markets and emerging software trends

- Community-submitted startups and project links

- Great for discovering bootstrapped and indie software projects

5. AngelList

AngelList is one of the most reliable places to discover early-stage tech startups — particularly seed-stage teams hiring talent. Investors and operators use it to identify rising companies based on team growth, founder activity, and job postings.

Because AngelList skews toward young companies seeking talent or capital, it’s a strong signal source for early-stage activity. While not a traditional “database,” its startup profiles and hiring signals make it useful for scouting.

Key AngelList features:

- Directory of early-stage startups and founders

- Signal-rich hiring activity for spotting fast-growing teams

- Investor networks and founder profiles

- Talent marketplaces showing where founders are actively building

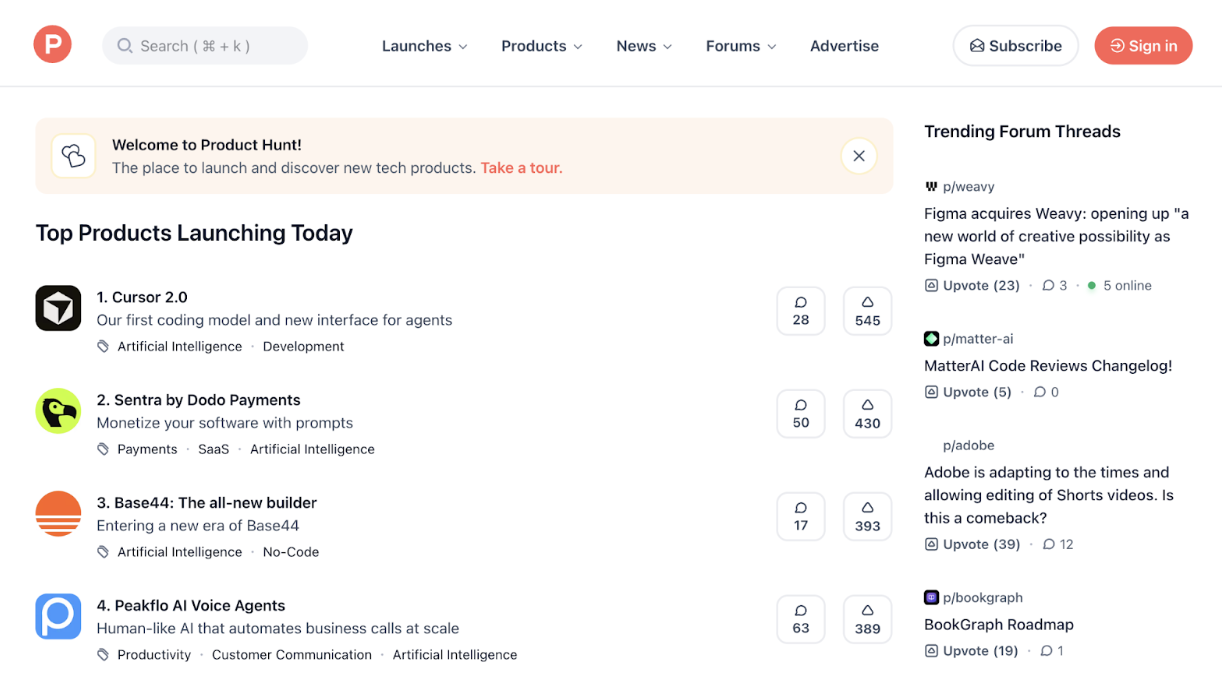

6. Product Hunt

Product Hunt surfaces brand-new startups, tools, and side projects through daily launches — making it one of the best places to discover companies at the earliest public stage.

Founders often launch here before fundraising or press coverage, so Product Hunt works well for catching emerging teams and trends ahead of mainstream visibility. Data depth is minimal, but signal quality for fresh product launches is high.

Key Product Hunt features:

- Daily startup and product launches

- Real-time voting and momentum signals

- Category pages for SaaS, AI, dev tools, and consumer apps

- Founder profiles and community commentary

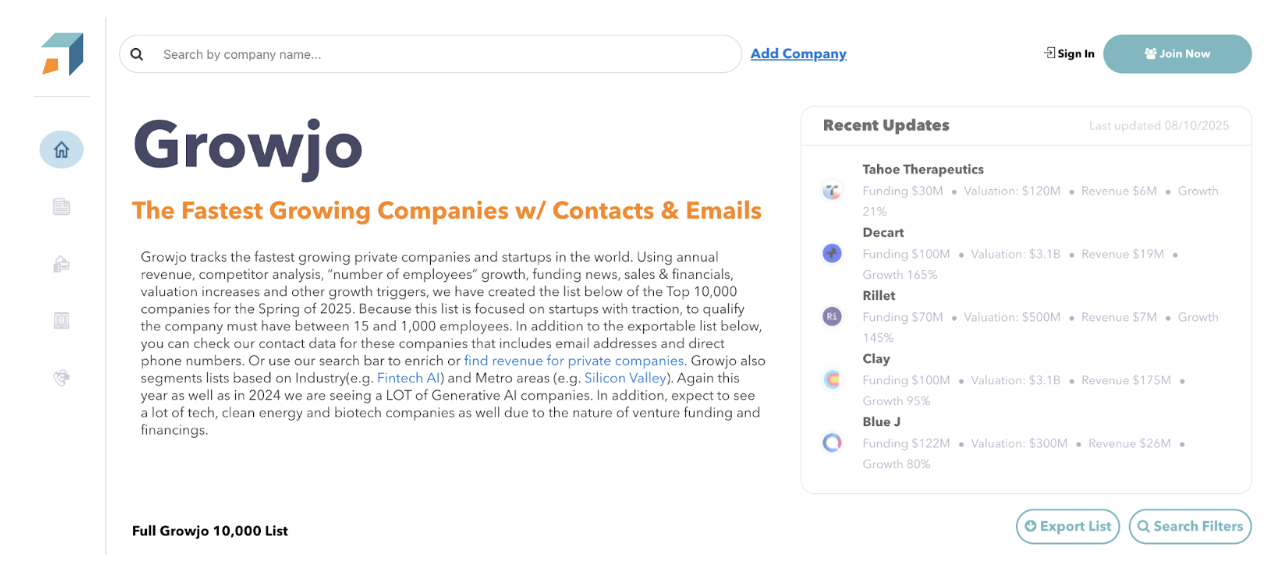

7. Growjo

Growjo curates rankings of the fastest-growing companies worldwide based on estimated revenue growth, employee expansion, and market traction. It’s a quick way to surface emerging players, though it offers less depth on financing and investor data.

Because rankings are driven by traction signals, Growjo can help spot breakout-stage startups in SaaS, B2B tech, and enterprise categories that traditional directories may miss.

Key Growjo features:

- Growth-ranked list of private companies

- Signals based on hiring, revenue estimates, and traffic momentum

- Category filters for SaaS, enterprise software, AI, and more

- Great for spotting post-MVP companies gaining traction quietly

Find Early-Stage Startups to Invest in More Efficiently

Finding early-stage startups used to rely on network luck, inbound decks, and endless manual research. Now, modern discovery platforms are making it easier to surface high-potential founders before everyone else sees them.

Tools like Harmonic give investors a data advantage — helping identify new companies at the moment they emerge, spot founder signals earlier, and build a pipeline with more conviction and less guesswork.

Use these platforms to explore markets faster, evaluate startups earlier, and stay ahead in a sourcing landscape where speed and insight matter.